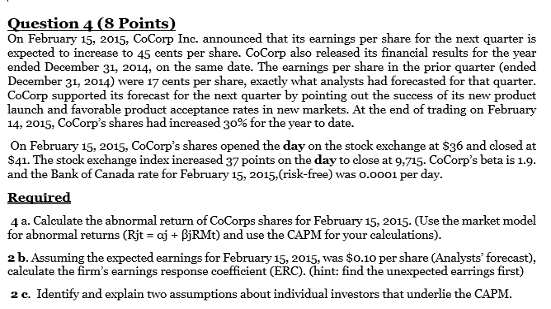

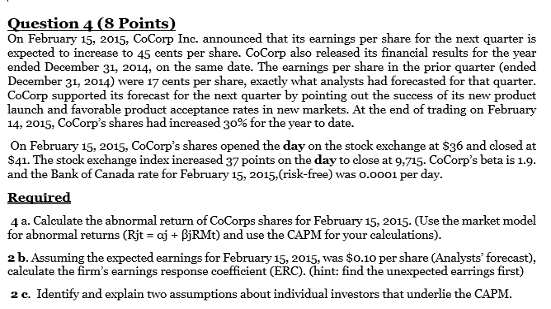

Question 4 (8 Points) On February 15, 2015, CoCorp Inc. announced that its earnings per share for the next quarter is expected to increase to 45 cents per share. CoCorp also released its financial results for the year ended December 31, 2014, on the same date. The earnings per share in the prior quarter (ended December 31, 2014) were 17 cents per share, exactly what analysts had forecasted for that quarter. CoCorp supported its forecast for the next quarter by pointing out the success of its new product launch and favorable product acceptance rates in new markets. At the end of trading on February 14, 2015, CoCorp's shares had increased 30% for the year to date. On February 15, 2015, CoCorp's shares opened the day on the stock exchange at $36 and closed at $41. The stock exchange index increased 37 points on the day to close at 9,715. CoCorp's beta is 1.9. and the Bank of Canada rate for February 15, 2015,(risk-free) was 0.0001 per day. Required 4a. Calculate the abnormal return of CoCorps shares for February 15, 2015. (Use the market model for abnormal returns (Rjt = aj + BjRMt) and use the CAPM for your calculations). 2 b. Assuming the expected earnings for February 15, 2015, was $0.10 per share (Analysts' forecast), calculate the firm's earnings response coefficient (ERC). (hint: find the unexpected earrings first) 2c. Identify and explain two assumptions about individual investors that underlie the CAPM. Question 4 (8 Points) On February 15, 2015, CoCorp Inc. announced that its earnings per share for the next quarter is expected to increase to 45 cents per share. CoCorp also released its financial results for the year ended December 31, 2014, on the same date. The earnings per share in the prior quarter (ended December 31, 2014) were 17 cents per share, exactly what analysts had forecasted for that quarter. CoCorp supported its forecast for the next quarter by pointing out the success of its new product launch and favorable product acceptance rates in new markets. At the end of trading on February 14, 2015, CoCorp's shares had increased 30% for the year to date. On February 15, 2015, CoCorp's shares opened the day on the stock exchange at $36 and closed at $41. The stock exchange index increased 37 points on the day to close at 9,715. CoCorp's beta is 1.9. and the Bank of Canada rate for February 15, 2015,(risk-free) was 0.0001 per day. Required 4a. Calculate the abnormal return of CoCorps shares for February 15, 2015. (Use the market model for abnormal returns (Rjt = aj + BjRMt) and use the CAPM for your calculations). 2 b. Assuming the expected earnings for February 15, 2015, was $0.10 per share (Analysts' forecast), calculate the firm's earnings response coefficient (ERC). (hint: find the unexpected earrings first) 2c. Identify and explain two assumptions about individual investors that underlie the CAPM