Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 a) A corporation which manufactures rubber gloves has been experiencing an unstable growth in the price of its common stock due to

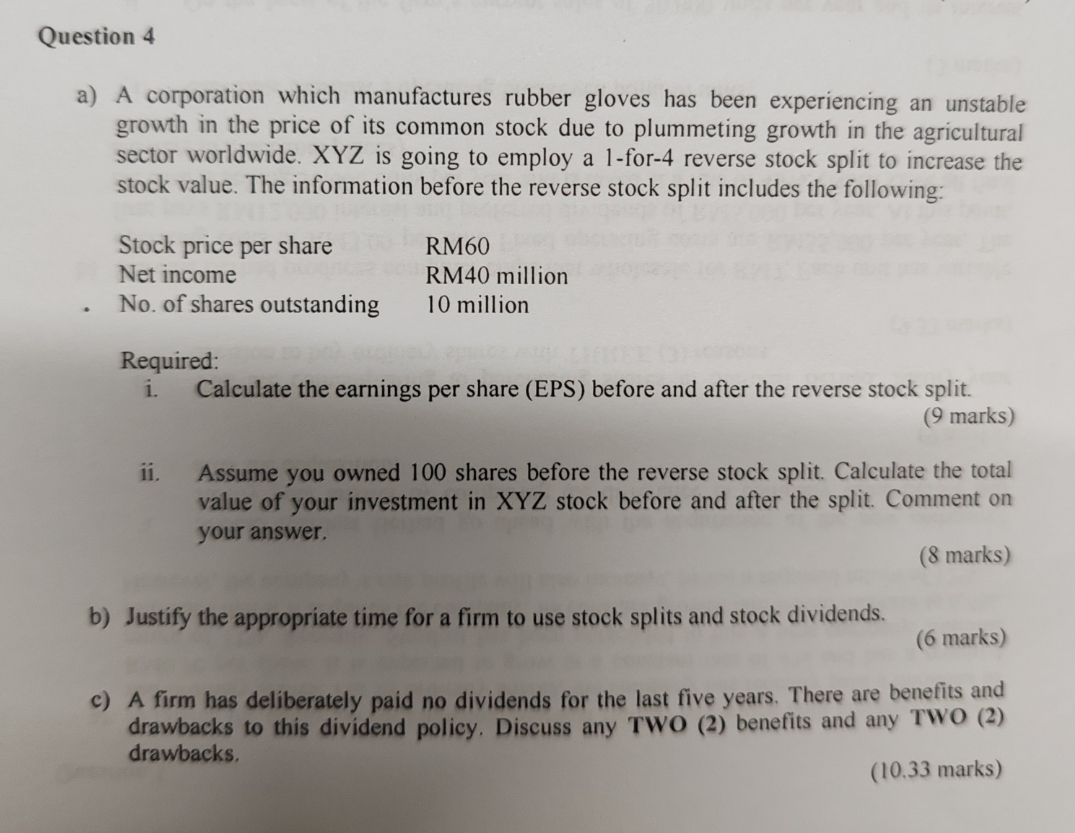

Question 4 a) A corporation which manufactures rubber gloves has been experiencing an unstable growth in the price of its common stock due to plummeting growth in the agricultural sector worldwide. XYZ is going to employ a 1-for-4 reverse stock split to increase the stock value. The information before the reverse stock split includes the following: Stock price per share Net income RM60 RM40 million 10 million No. of shares outstanding Required: i. Calculate the earnings per share (EPS) before and after the reverse stock split. ii. (9 marks) Assume you owned 100 shares before the reverse stock split. Calculate the total value of your investment in XYZ stock before and after the split. Comment on your answer. (8 marks) b) Justify the appropriate time for a firm to use stock splits and stock dividends. (6 marks) c) A firm has deliberately paid no dividends for the last five years. There are benefits and drawbacks to this dividend policy. Discuss any TWO (2) benefits and any TWO (2) drawbacks. (10.33 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a i Earnings per Share EPS Calculation Before Reverse Stock Split EPS Net Income Number of Shares Outstanding EPS RM40 million 10 million shares EPS RM4 per share After Reverse Stock Split 1for4 Numbe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started