Answered step by step

Verified Expert Solution

Question

1 Approved Answer

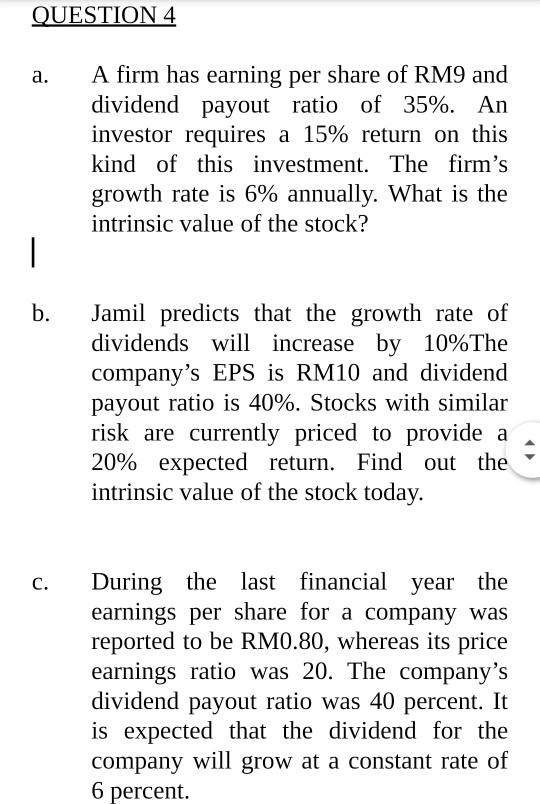

QUESTION 4 a. A firm has earning per share of RM9 and dividend payout ratio of 35%. An investor requires a 15% return on this

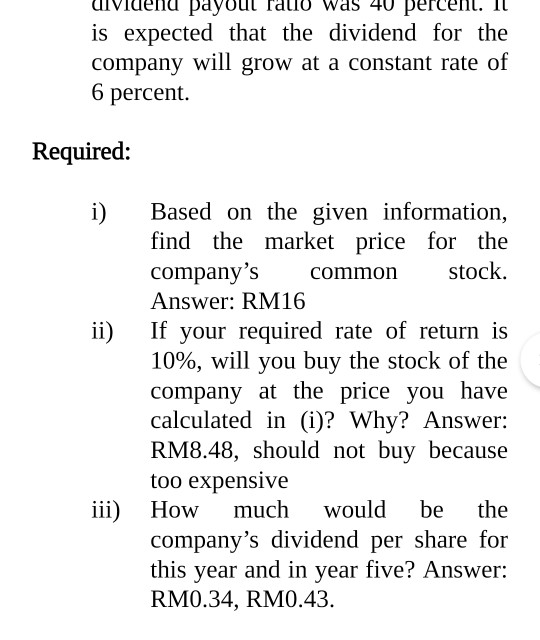

QUESTION 4 a. A firm has earning per share of RM9 and dividend payout ratio of 35%. An investor requires a 15% return on this kind of this investment. The firm's growth rate is 6% annually. What is the intrinsic value of the stock? Jamil predicts that the growth rate of dividends will increase by 10%The company's EPS is RM10 and dividend payout ratio is 40%. Stocks with similar risk are currently priced to provide a 20% expected return. Find out the intrinsic value of the stock today. During the last financial year the earnings per share for a company was reported to be RM0.80, whereas its price earnings ratio was 20. The company's dividend payout ratio was 40 percent. It is expected that the dividend for the company will grow at a constant rate of 6 percent. dividend payuul rallo Was 40 percent. Il is expected that the dividend for the company will grow at a constant rate of 6 percent. Required: ii) Based on the given information, find the market price for the company's common stock. Answer: RM16 If your required rate of return is 10%, will you buy the stock of the company at the price you have calculated in (i)? Why? Answer: RM8.48, should not buy because too expensive How much would be the company's dividend per share for this year and in year five? Answer: RM0.34, RM0.43. iii)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started