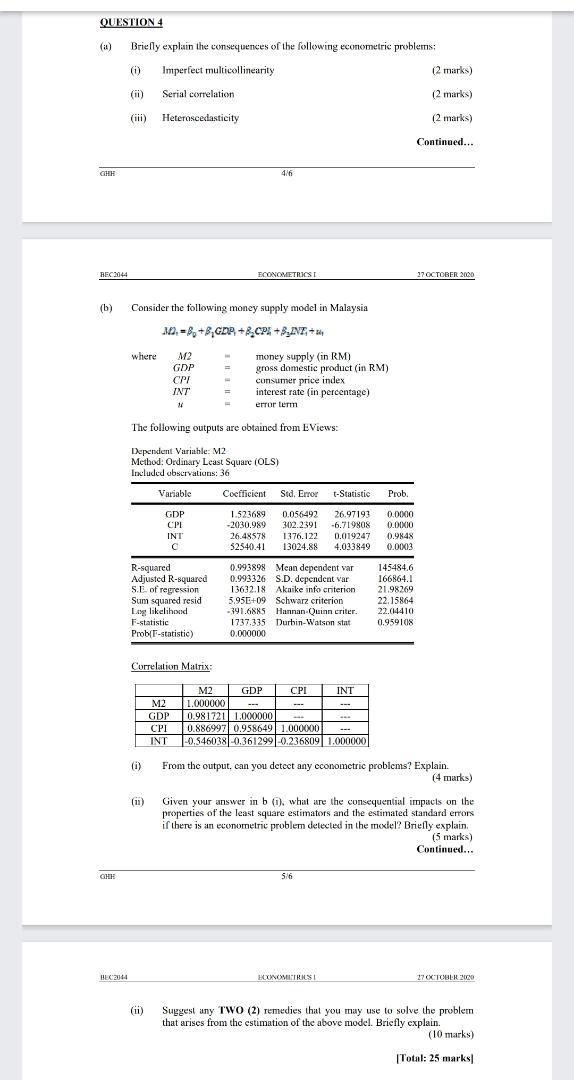

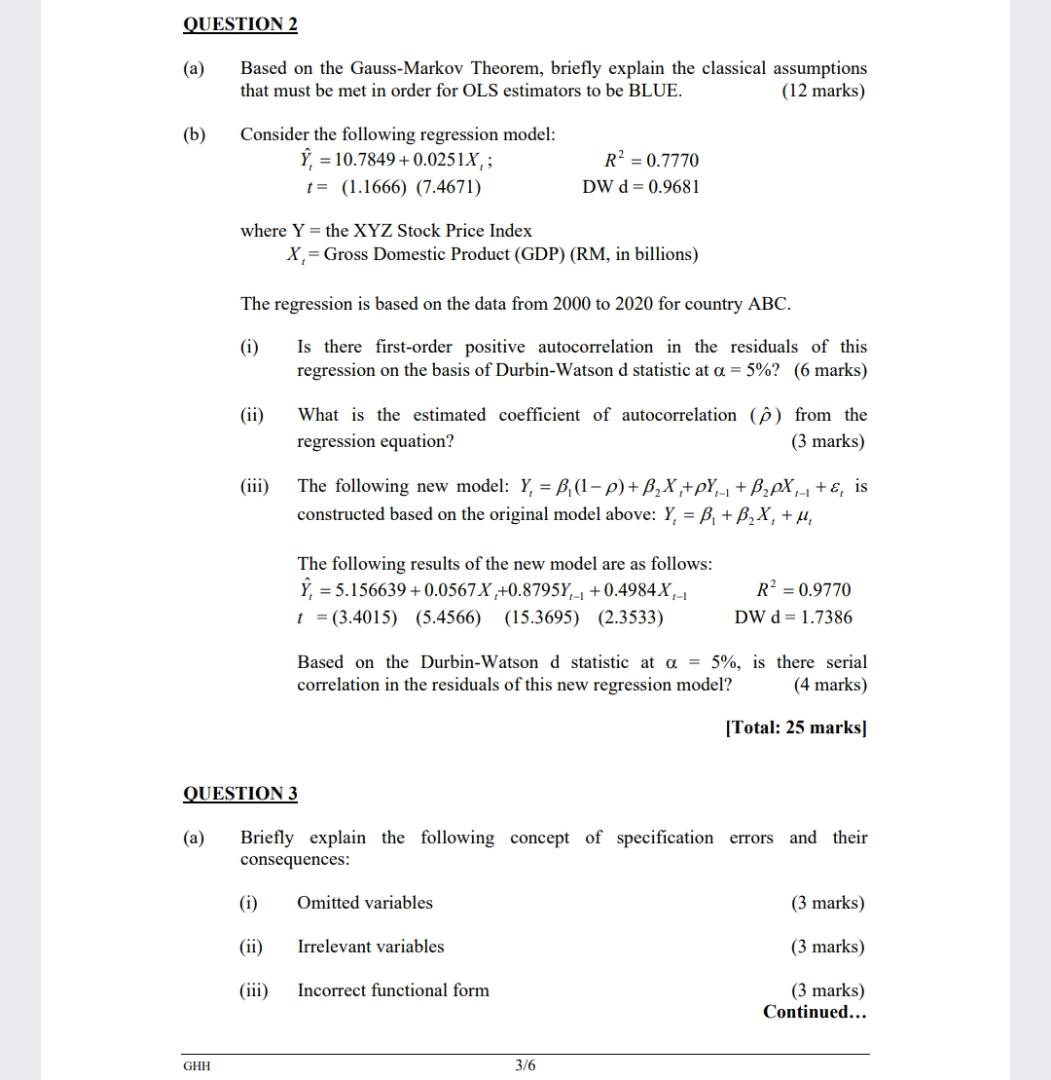

QUESTION 4 (a) Briefly explain the consequences of the following econometric problems; Imperfect multicollinearity (2 marks) (ii) Serial correlation (2 marks) (iii) Heteroscedasticity (2 marks) Continued... OHH 416 REC3044 ECONOMETRICS I 17 OCTOBER 2060 (b) Consider the following money supply model in Malaysia M. =By + 8, GDP +R.CPI +8,INE, + 4, where M2 money supply (in RM) GDP gross domestic product (in RM) CPI consumer price index INT interest rate (in percentage) error term The following outputs are obtained from E Views: Dependent Variable: M2 Method: Ordinary Least Square (OLS) Included observations: 36 Variable Coefficient Sid. Error t-Statistic Prob. GDP 1.523689 D.056492 26.97193 D.DOGG CPI 2030.989 302.2391 -6.719808 INT 26.48578 1376.122 0.019247 D.9848 52540.41 13024.88 4.033849 1.0103 R-squared 1.993898 Mean dependent var 145484.6 Adjusted R-squared 0.993326 S.D. dependent var 166864.1 S.E. of regression 13632.18 Akoike info criterion 21.98269 Sum squared resid 5.95E+09 Schwarz criterion 22.15864 Log likelihood -391.6885 Hannan-Quinn criter. 22.04410 F-statistic 1737.335 Durbin-Watson stat 0.959108 Prob(F-statistic) 0.000000 Correlation Matrix: MZ GDP CPI INT 1.000000 GDP 0.981721 1.000000 CPI 0.886997 0.958649 1.000000 INT -0.546038 -0.361299 0.236809 1.000000 (D) From the output, can you detect any econometric problems? Explain. (4 marks) Given your answer in b (i). what are the consequential impacts on the properties of the least square estimators and the estimated standard errors if there is an econometric problem detected in the model? Briefly explain. (5 marks) Continued... HEX204 BLONDMETRICS 27 OCTOBER 2060 (ii) Suggest any TWO (2) remedies that you may use to solve the problem that arises from the estimation of the above model. Briefly explain. (10 marks) [Total: 25 marks]QUESTION 2 (a) Based on the Gauss-Markov Theorem, briefly explain the classical assumptions that must be met in order for OLS estimators to be BLUE. (12 marks) ( b ) Consider the following regression model: Y, = 10.7849 + 0.0251X, ; R= = 0.7770 1= (1.1666) (7.4671) DW d = 0.9681 where Y = the XYZ Stock Price Index Y, = Gross Domestic Product (GDP) (RM, in billions) The regression is based on the data from 2000 to 2020 for country ABC. (i) Is there first-order positive autocorrelation in the residuals of this regression on the basis of Durbin-Watson d statistic at a = 5%? (6 marks) (ii) What is the estimated coefficient of autocorrelation (p ) from the regression equation? (3 marks) (iii) The following new model: Y, = B, (1-p) + B2X,+pY,_, + BypX,_ + &, is constructed based on the original model above: Y, = B, + B, X, + u, The following results of the new model are as follows: Y, = 5.156639 + 0.0567 X,+0.8795Y,_, + 0.4984X,_ R2 = 0.9770 1 = (3.4015) (5.4566) (15.3695) (2.3533) DW d = 1.7386 Based on the Durbin-Watson d statistic at a = 5%, is there serial correlation in the residuals of this new regression model? (4 marks) [Total: 25 marks] QUESTION 3 (a) Briefly explain the following concept of specification errors and their consequences: (i) Omitted variables (3 marks) (ii) Irrelevant variables (3 marks) (iii) Incorrect functional form (3 marks) Continued... GHH 3/6