Answered step by step

Verified Expert Solution

Question

1 Approved Answer

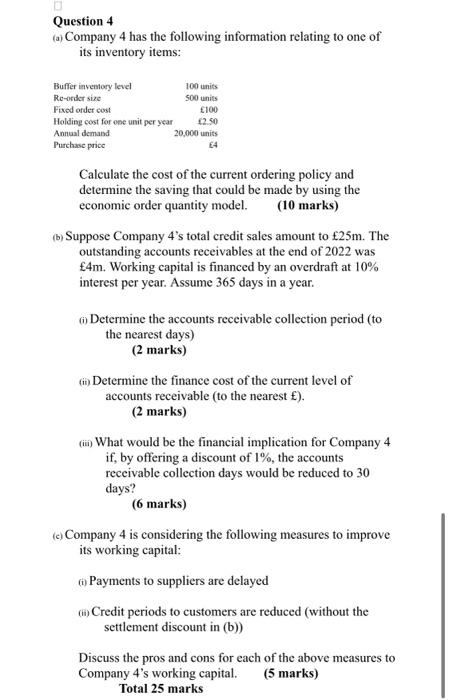

Question 4 (a) Company 4 has the following information relating to one of its inventory items: Buffer inventory level Re-order size Fixed order cost Holding

Question 4 (a) Company 4 has the following information relating to one of its inventory items: Buffer inventory level Re-order size Fixed order cost Holding cost for one unit per year Annual demand Purchase price 100 units 500 units 100 2.50 20,000 units 4 Calculate the cost of the current ordering policy and determine the saving that could be made by using the economic order quantity model. (10 marks) (b) Suppose Company 4's total credit sales amount to 25m. The outstanding accounts receivables at the end of 2022 was 4m. Working capital is financed by an overdraft at 10% interest per year. Assume 365 days in a year. (1) Determine the accounts receivable collection period (to the nearest days) (2 marks) (ii) Determine the finance cost of the current level of accounts receivable (to the nearest ). (2 marks) (iii) What would be the financial implication for Company 4 if, by offering a discount of 1%, the accounts receivable collection days would be reduced to 30 days? (6 marks) (c) Company 4 is considering the following measures to improve its working capital: (1) Payments to suppliers are delayed (ii) Credit periods to customers are reduced (without the settlement discount in (b)) Discuss the pros and cons for each of the above measures to Company 4's working capital. (5 marks) Total 25 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started