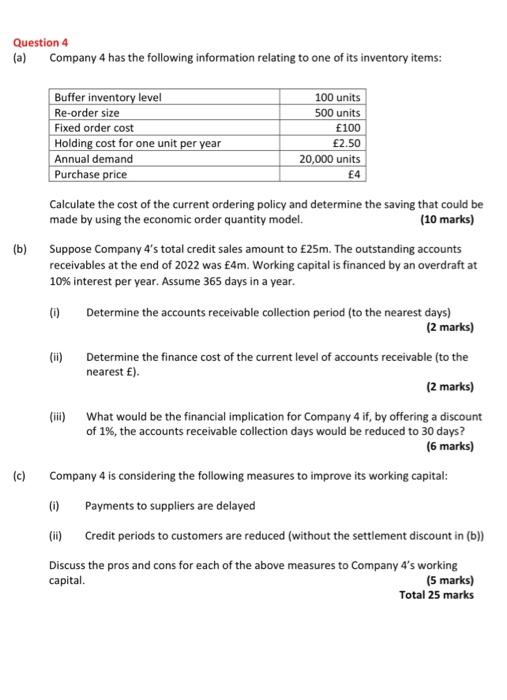

Question 4 (a) Company 4 has the following information relating to one of its inventory items: Calculate the cost of the current ordering policy and determine the saving that could be made by using the economic order quantity model. (10 marks) (b) Suppose Company 4's total credit sales amount to 25m. The outstanding accounts receivables at the end of 2022 was f4m. Working capital is financed by an overdraft at 10% interest per year. Assume 365 days in a year. (i) Determine the accounts receivable collection period (to the nearest days) ( 2 marks) (ii) Determine the finance cost of the current level of accounts receivable (to the nearest f ). (2 marks) (iii) What would be the financial implication for Company 4 if, by offering a discount of 1%, the accounts receivable collection days would be reduced to 30 days? (6 marks) (c) Company 4 is considering the following measures to improve its working capital: (i) Payments to suppliers are delayed (ii) Credit periods to customers are reduced (without the settlement discount in (b)) Discuss the pros and cons for each of the above measures to Company 4's working capital. (5 marks) Total 25 marks Question 4 (a) Company 4 has the following information relating to one of its inventory items: Calculate the cost of the current ordering policy and determine the saving that could be made by using the economic order quantity model. (10 marks) (b) Suppose Company 4's total credit sales amount to 25m. The outstanding accounts receivables at the end of 2022 was f4m. Working capital is financed by an overdraft at 10% interest per year. Assume 365 days in a year. (i) Determine the accounts receivable collection period (to the nearest days) ( 2 marks) (ii) Determine the finance cost of the current level of accounts receivable (to the nearest f ). (2 marks) (iii) What would be the financial implication for Company 4 if, by offering a discount of 1%, the accounts receivable collection days would be reduced to 30 days? (6 marks) (c) Company 4 is considering the following measures to improve its working capital: (i) Payments to suppliers are delayed (ii) Credit periods to customers are reduced (without the settlement discount in (b)) Discuss the pros and cons for each of the above measures to Company 4's working capital. (5 marks) Total 25 marks