Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 A company is choosing between two alternative investment projects relating to the manufacture of a new product. Project A involves an initial outlay

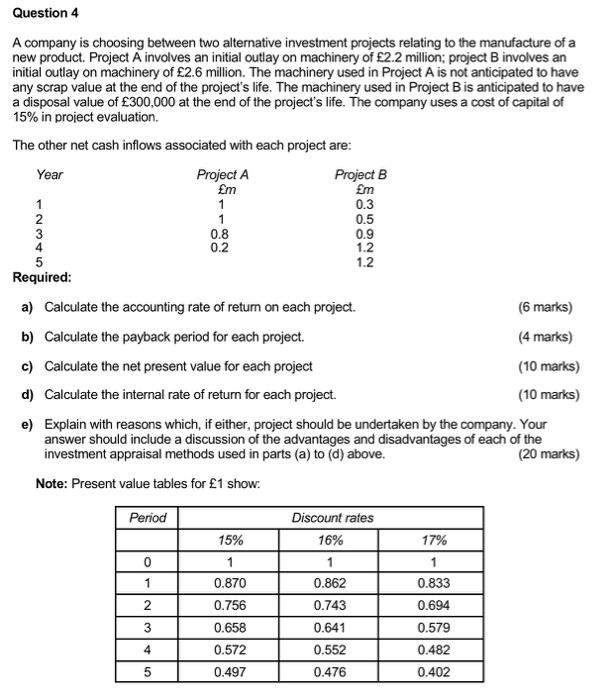

Question 4

A company is choosing between two alternative investment projects relating to the manufacture of a new product. Project A involves an initial outlay on machinery of 2.2 million; project B involves an initial outlay on machinery of 2.6 million. The machinery used in Project A is not anticipated to have any scrap value at the end of the projects life. The machinery used in Project B is anticipated to have a disposal value of 300,000 at the end of the projects life. The company uses a cost of capital of 15% in project evaluation.

The other net cash inflows associated with each project are:

Year Project A Project B

m m

1 1 0.3

2 1 0.5

3 0.8 0.9

4 0.2 1.2

5 1.2

Required:

a) Calculate the accounting rate of return on each project. (6 marks)

b) Calculate the payback period for each project. (4 marks)

c) Calculate the net present value for each project (10 marks)

d) Calculate the internal rate of return for each project. (10 marks)

e) Explain with reasons which, if either, project should be undertaken by the company. Your answer should include a discussion of the advantages and disadvantages of each of the investment appraisal methods used in parts (a) to (d) above. (20 marks)

Note: Present value tables for 1 show:

Period Discount rates

15% 16% 17%

0 1 1 1

1 0.870 0.862 0.833

2 0.756 0.743 0.694

3 0.658 0.641 0.579

4 0.572 0.552 0.482

5 0.497 0.476 0.402

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started