Answered step by step

Verified Expert Solution

Question

1 Approved Answer

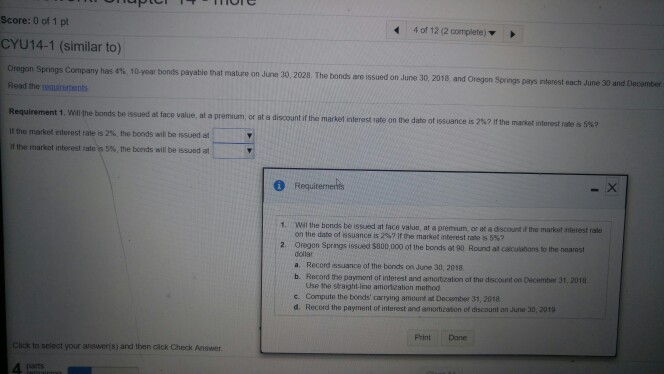

Score: 0 of 1 pt 44 of 12 (2 complete) CYU14-1 (similar to) June 30, 2028 The bonds are issued on June 30 2018 and

Score: 0 of 1 pt 44 of 12 (2 complete) CYU14-1 (similar to) June 30, 2028 The bonds are issued on June 30 2018 and Oreg Oregon Springs Company has 4, 10-year bonds payable that mature on Read the rearmens songs pas r terest each ine 30 and O arte a discountif the market Requirement 1, VWl the bonds be issued at face value, tr the market rturest rate is 2% the bonds wil be issued at it the market interest rate 5%, te bords wil be issued at at a premium, or at a discount if the market nterest rate on the date of issuance is 2%, r the market interest rate s 5%? 6 Requiremers 1. Wil the bonds be issued at face value, at a premum, or at a discount if the market nterest rate 2. Oregon Springs issued $800000 of the bonds at 90 Round al calcuilations to the nearest on the date of essuance ts 2%7 r re market nterest rate s 5%? dolat a. Record issuance of the bonds on June 30, 2018 b. Racord the paymont of interest and amortization of the discount on December 31, 201 Use the sr8ight-Iino amortzalion method e. Compute the bonds' carrying amount at Decomber 31, 2018 d. Record the payment of interest and amotizaton of discount on June 30, 2019 Print Done Click to seloct your answerts) and then cick Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started