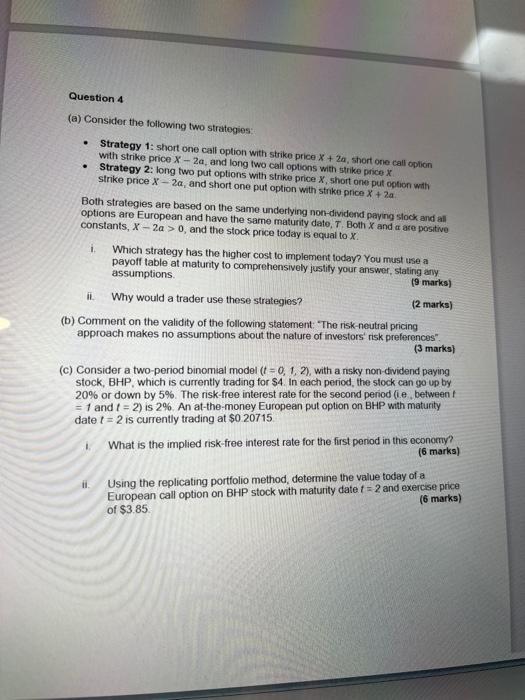

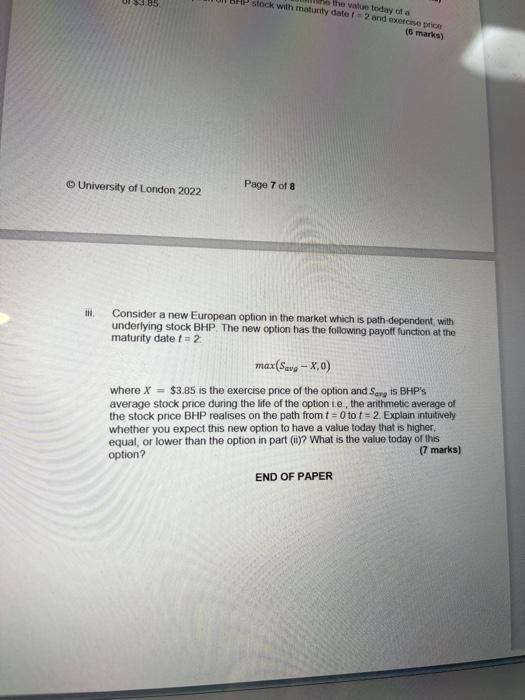

Question 4 . (a) Consider the following two strategies: Strategy 1: short one call option with strike price X + 2a, short one call option with strike price X-2, and long two call options with strike price X Strategy 2: long two put options with strike price X, short one put option with strike price X-20, and short one put option with strike price X + 2a . Both strategies are based on the same underlying non-dividend paying stock and all options are European and have the same maturity dato, T. Both X and a are positive constants, X - 2a > 0, and the stock price today is equal to X i. Which strategy has the higher cost to implement today? You must use a payoff table at maturity to comprehensively justify your answer, stating any assumptions (9 marks) Why would a trader use these strategies? (2 marks) (b) Comment on the validity of the following statement: "The risk neutral pricing approach makes no assumptions about the nature of investors' risk preferences". (3 marks) IL (c) Consider a two period binomial model t=0, 1, 2), with a risky non dividend paying stock, BHP, which is currently trading for $4 In each period, the stock can go up by 20% or down by 5%. The risk-free interest rate for the second period (ie between = 1 and I = 2) is 2% An at-the-money European put option on BHP with maturity date 1 = 2 is currently trading at $0 20715 What is the implied risk-free interest rate for the first penod in this economy (6 marks) 1 il Using the replicating portfolio method, determine the value today of a European call option on BHP stock with maturity date t = 2 and exercise price of $3.85 (6 marks) the value today ola stock with maturity date and exercise (6 marks) University of London 2022 Page 7 of 8 ill Consider a new European option in the market which is path-dependent, with underlying stock BHP The new option has the following payoff function at the maturity date 1 = 2 max(Savo 8,0) where x = $3.85 is the exercise price of the option and Sang is BHP's average stock price during the life of the option ie, the arithmetic average of the stock price BHP realises on the path from t=0 tot = 2 Explain intuitively whether you expect this new option to have a value today that is higher equal, or lower than the option in part (w)? What is the value today of this option? (7 marks) END OF PAPER