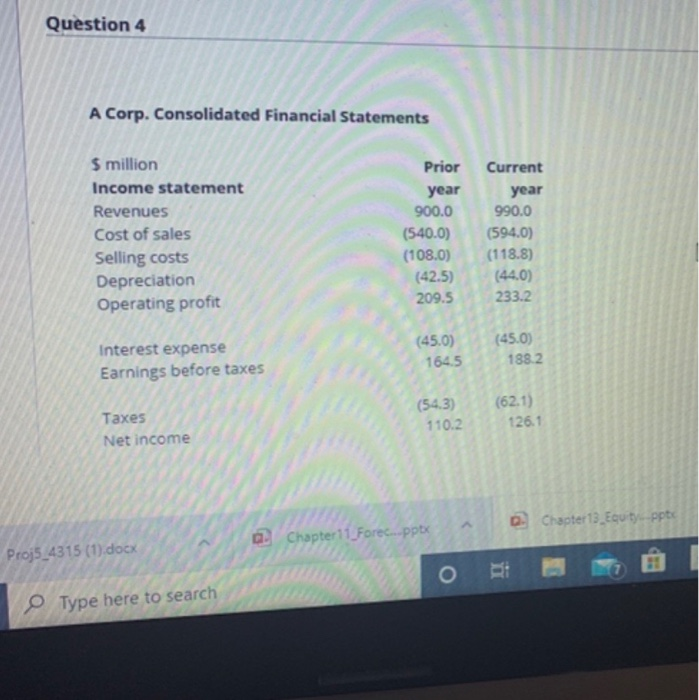

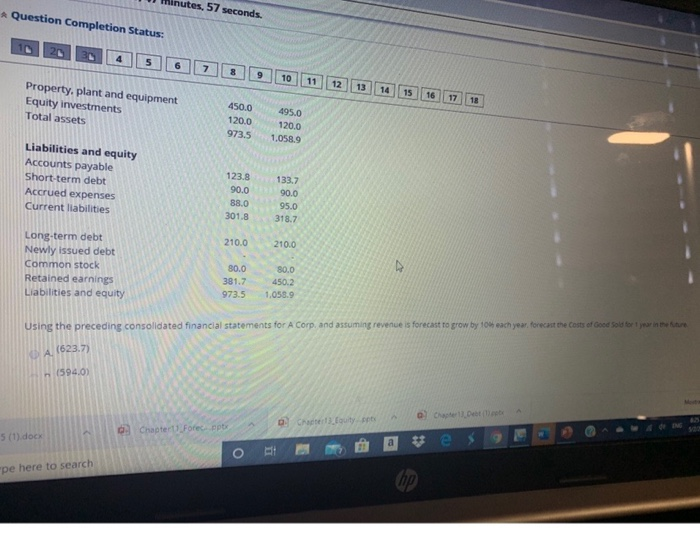

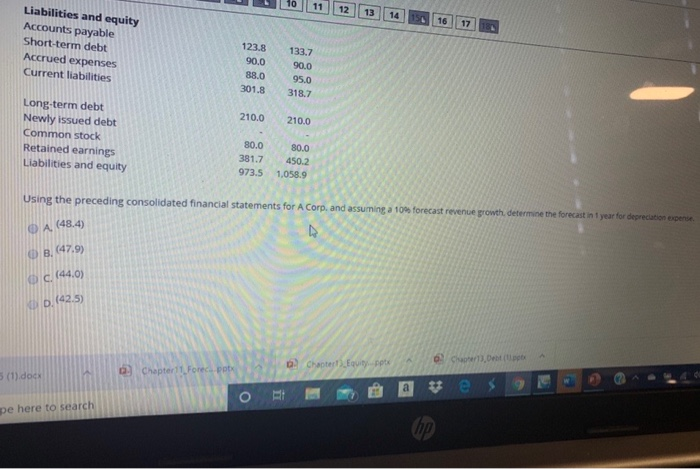

Question 4 A Corp. Consolidated Financial Statements $ million Income statement Revenues Cost of sales Selling costs Depreciation Operating profit Prior year 900.0 (540.0) (108.0) (42.5) 209.5 209.5 Current year 990.0 (594.0) (118.8) (44.0) 233.2 Interest expense Earnings before taxes (45.0) 1645 (45.0) 188 2 (54.3) 110.2 (62.1) 126.1 Taxes Net income Chapter 13 Equity ppt Proj5_4315 (1) docx WO Type here to search Minutes, 57 seconds. Question Completion Status: 1020 N 456 789 10 11 12 13 14 15 16 Property, plant and equipment Equity investments Total assets 17 18 450.0 120.0 973.5 495.0 120.0 1.058.9 Liabilities and equity Accounts payable Short-term debt Accrued expenses Current liabilities 123.8 90.0 88.0 301.8 1337 90.0 95.0 318.7 210.0 210.0 Long-term debt Newly issued debt Common stock Retained earnings Liabilities and equity 30.0 381.7 973.5 80.0 450.2 1,058.9 in the precedine consolidated financial statements for A Corp. and assuming revenue is forecast to row by each year foreca e corte A (623.7) (594.0) o per le Charter Fourty t Chapter Forec ppt 5 (1).docx pe here to search 10 11 12 13 14 15 16 17 Liabilities and equity Accounts payable Short-term debt Accrued expenses Current liabilities 123.8 90.0 88.0 301.8 133.7 90.0 95.0 318.7 210.0 210.0 Long-term debt Newly issued debt Common stock Retained earnings Liabilities and equity 80.0 381.7 973.5 80.0 450.2 1,058.9 Using the preceding consolidated financial statements for A Corp. and assuming to forecast revenue growth determine the forecasting for derechos OA (48.4) O B. (479) (44.0) Char entes Chapter Forecapot 5 (1).doc Chapter Equity pptx o es pe here to search Question 4 A Corp. Consolidated Financial Statements $ million Income statement Revenues Cost of sales Selling costs Depreciation Operating profit Prior year 900.0 (540.0) (108.0) (42.5) 209.5 209.5 Current year 990.0 (594.0) (118.8) (44.0) 233.2 Interest expense Earnings before taxes (45.0) 1645 (45.0) 188 2 (54.3) 110.2 (62.1) 126.1 Taxes Net income Chapter 13 Equity ppt Proj5_4315 (1) docx WO Type here to search Minutes, 57 seconds. Question Completion Status: 1020 N 456 789 10 11 12 13 14 15 16 Property, plant and equipment Equity investments Total assets 17 18 450.0 120.0 973.5 495.0 120.0 1.058.9 Liabilities and equity Accounts payable Short-term debt Accrued expenses Current liabilities 123.8 90.0 88.0 301.8 1337 90.0 95.0 318.7 210.0 210.0 Long-term debt Newly issued debt Common stock Retained earnings Liabilities and equity 30.0 381.7 973.5 80.0 450.2 1,058.9 in the precedine consolidated financial statements for A Corp. and assuming revenue is forecast to row by each year foreca e corte A (623.7) (594.0) o per le Charter Fourty t Chapter Forec ppt 5 (1).docx pe here to search 10 11 12 13 14 15 16 17 Liabilities and equity Accounts payable Short-term debt Accrued expenses Current liabilities 123.8 90.0 88.0 301.8 133.7 90.0 95.0 318.7 210.0 210.0 Long-term debt Newly issued debt Common stock Retained earnings Liabilities and equity 80.0 381.7 973.5 80.0 450.2 1,058.9 Using the preceding consolidated financial statements for A Corp. and assuming to forecast revenue growth determine the forecasting for derechos OA (48.4) O B. (479) (44.0) Char entes Chapter Forecapot 5 (1).doc Chapter Equity pptx o es pe here to search