Question

Question 4 A fast food restaurant group is considering a promotion campaign to rebuild its product brand name following an earlier crisis in food safety.

Question 4

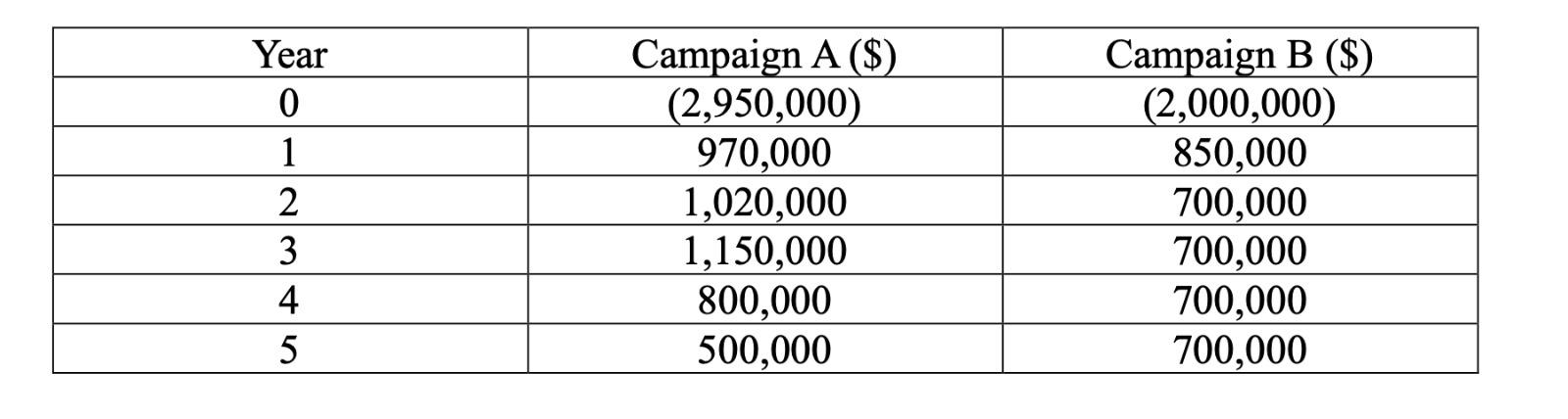

A fast food restaurant group is considering a promotion campaign to rebuild its product brand name following an earlier crisis in food safety. It receives two proposals, Campaign A and Campaign B from its public relationship consultant. The group accepts projects that can be paid back up to 3 years. Tom, the finance manager of the restaurant group has prepared estimates of the initial investment and operating cash flows associated with each campaign, which are shown in table as below. Tom believes that the two campaigns carry similar risk and that the acceptance of either of them will not change the restaurants overall risk. Tom also decides that the groups 10% cost of capital as the required rate of return.

a. Use the payback period method to determine which campaign should be adopted. (5 marks)

b. Use the NPV method to determine which campaign should be adopted. (9 marks)

c. Compare and contrast the techniques used in parts (a) and (b). Explain which criteria should be chosen? (6 marks)

d. Which campaign should be chosen if based on Profitability Index instead? Explain. (5 marks)

Year 0 1 2 3 4 5 Campaign A ($) (2,950,000) 970,000 1,020,000 1,150,000 800,000 500,000 Campaign B ($) (2,000,000) 850,000 700,000 700,000 700,000 700,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started