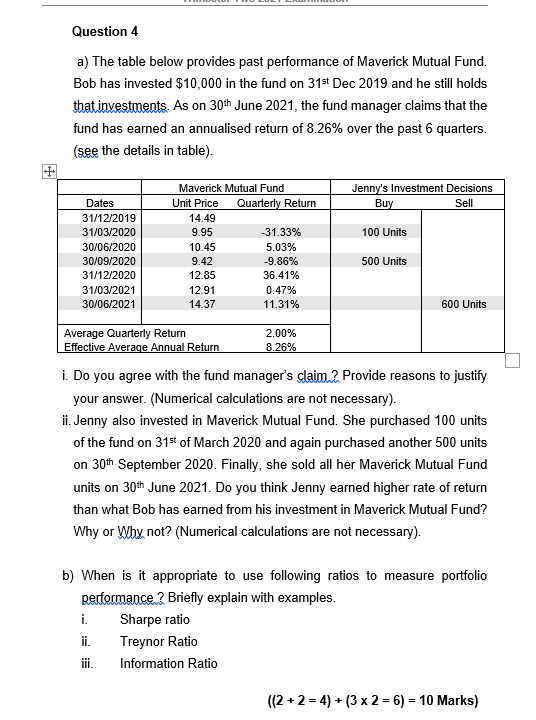

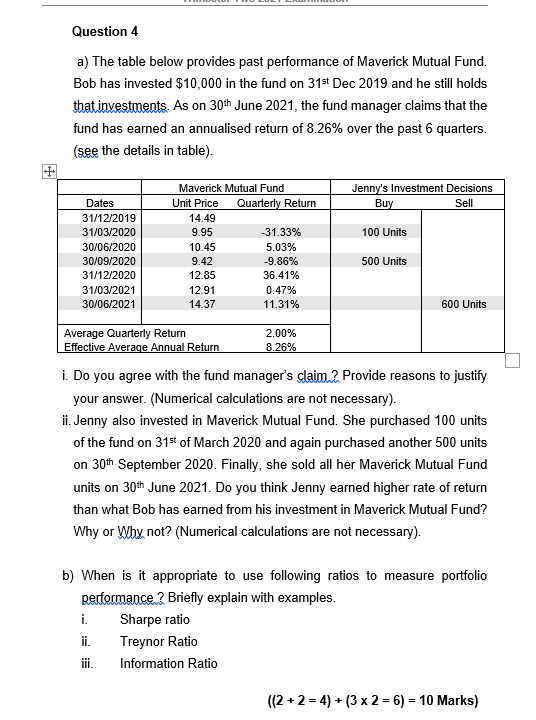

Question 4 a) The table below provides past performance of Maverick Mutual Fund. Bob has invested $10,000 in the fund on 31st Dec 2019 and he still holds that investments. As on 30th June 2021, the fund manager claims that the fund has earned an annualised return of 8.26% over the past 6 quarters. (see the details in table). + Jenny's Investment Decisions Buy Sell 100 Units Dates 31/12/2019 31/03/2020 30/06/2020 30/09/2020 31/12/2020 31/03/2021 30/06/2021 Maverick Mutual Fund Unit Price Quarterly Return 14.49 9.95 -31.33% 10.45 5.03% 9.42 -9.86% 12.85 36.41% 12.91 0.47% 14.37 11.31% 500 Units 600 Units 2.00% 8.26% Average Quarterly Return Effective Average Annual Return i. Do you agree with the fund manager's claim? Provide reasons to justify your answer. (Numerical calculations are not necessary). ii. Jenny also invested in Maverick Mutual Fund. She purchased 100 units of the fund on 31st of March 2020 and again purchased another 500 units on 30th September 2020. Finally, she sold all her Maverick Mutual Fund units on 30th June 2021. Do you think Jenny earned higher rate of return than what Bob has earned from his investment in Maverick Mutual Fund? Why or Why not? (Numerical calculations are not necessary). b) When is it appropriate to use following ratios to measure portfolio Rerformance ? Briefly explain with examples. i. Sharpe ratio ii. Treynor Ratio iii. Information Ratio ((2 + 2 = 4) + (3 x 2 = 6) = 10 Marks) = Question 4 a) The table below provides past performance of Maverick Mutual Fund. Bob has invested $10,000 in the fund on 31st Dec 2019 and he still holds that investments. As on 30th June 2021, the fund manager claims that the fund has earned an annualised return of 8.26% over the past 6 quarters. (see the details in table). + Jenny's Investment Decisions Buy Sell 100 Units Dates 31/12/2019 31/03/2020 30/06/2020 30/09/2020 31/12/2020 31/03/2021 30/06/2021 Maverick Mutual Fund Unit Price Quarterly Return 14.49 9.95 -31.33% 10.45 5.03% 9.42 -9.86% 12.85 36.41% 12.91 0.47% 14.37 11.31% 500 Units 600 Units 2.00% 8.26% Average Quarterly Return Effective Average Annual Return i. Do you agree with the fund manager's claim? Provide reasons to justify your answer. (Numerical calculations are not necessary). ii. Jenny also invested in Maverick Mutual Fund. She purchased 100 units of the fund on 31st of March 2020 and again purchased another 500 units on 30th September 2020. Finally, she sold all her Maverick Mutual Fund units on 30th June 2021. Do you think Jenny earned higher rate of return than what Bob has earned from his investment in Maverick Mutual Fund? Why or Why not? (Numerical calculations are not necessary). b) When is it appropriate to use following ratios to measure portfolio Rerformance ? Briefly explain with examples. i. Sharpe ratio ii. Treynor Ratio iii. Information Ratio ((2 + 2 = 4) + (3 x 2 = 6) = 10 Marks) =