Answered step by step

Verified Expert Solution

Question

1 Approved Answer

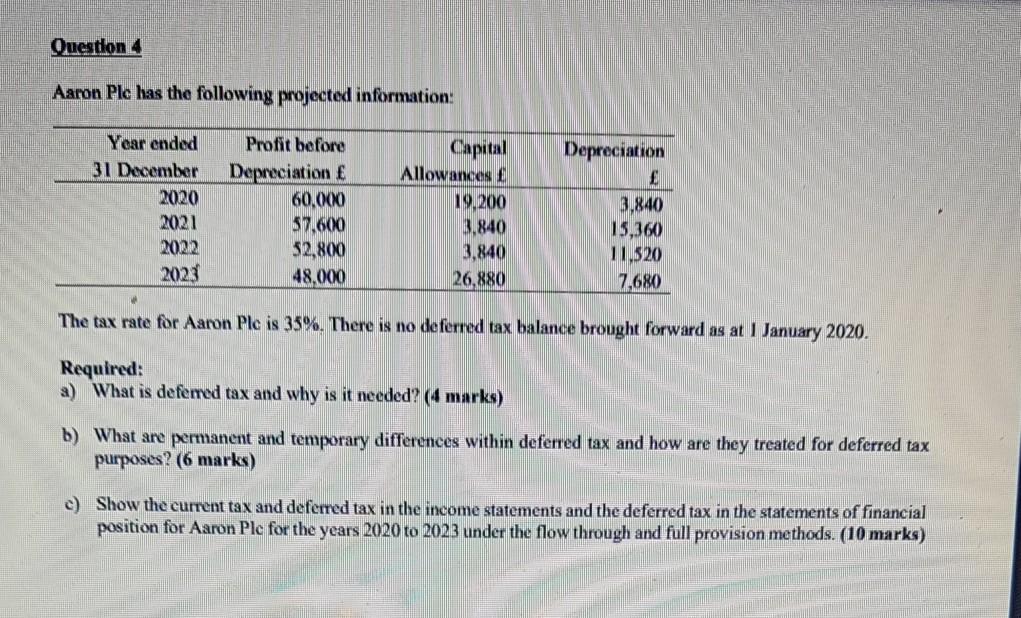

Question 4 Aaron Ple has the following projected information: Depreciation Year ended 31 December 2020 2021 2022 2023 Profit before Depreciation ! 60.000 57,600 32,800

Question 4 Aaron Ple has the following projected information: Depreciation Year ended 31 December 2020 2021 2022 2023 Profit before Depreciation ! 60.000 57,600 32,800 48,000 Capital Allowances 19,200 3,840 3.840 26,880 3,840 15,360 11,520 7,680 The tax rate for Aaron Ple is 33%. There is no deferred tax balance brought forward as at January 2020. Required: a) What is deferred tax and why is it needed? (4 marks) b) What are permanent and temporary differences within deferred tax and how are they treated for deferred tax purposes? (6 marks) c) Show the current tax and deferred tax in the income statements and the deferred tax in the statements of financial position for Aaron Ple for the years 2020 to 2023 under the flow through and full provision methods. (10 marke)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started