Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 ABC firm approached you for advice and presented the following information to you. As the financial analyst, kindly give your opinion on the

Question 4

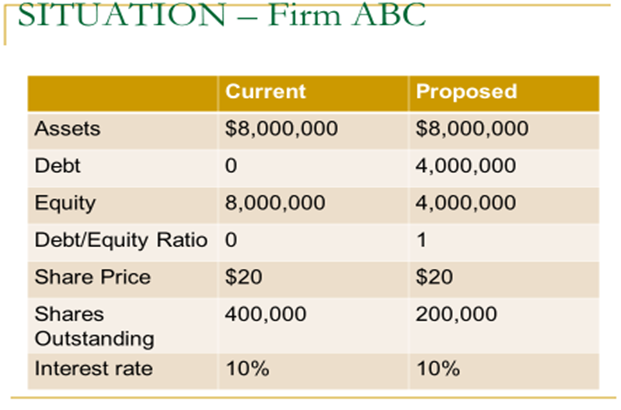

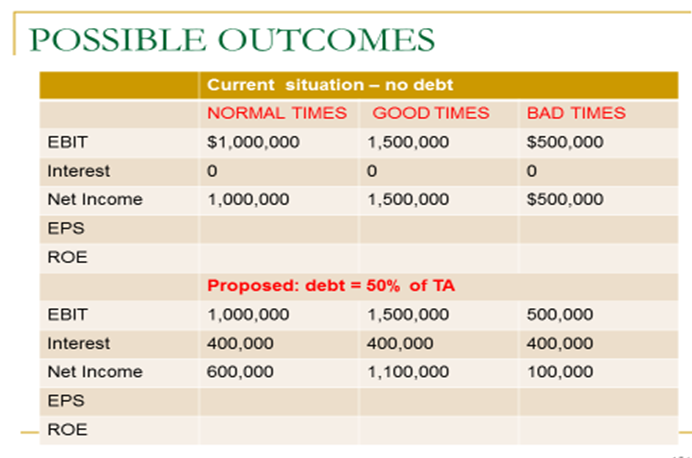

ABC firm approached you for advice and presented the following information to you.

- As the financial analyst, kindly give your opinion on the advatanges of debt utilisation under the various scenarios using Earnings Per Share (EPS), Return on Equity (ROE). Carefully interprete your results comparing the performance of these indicators under the current situation without debt and the proposed situation (with debt) using various scenarios.

- How do the Pecking Order Theory and the Trade-off Theory explain capital structure choices in Ghana?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started