Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 - Additional question (adapted Regular exam 2019) MegaService is a large divisionalised company selling a variety of catering products. Division A, a company

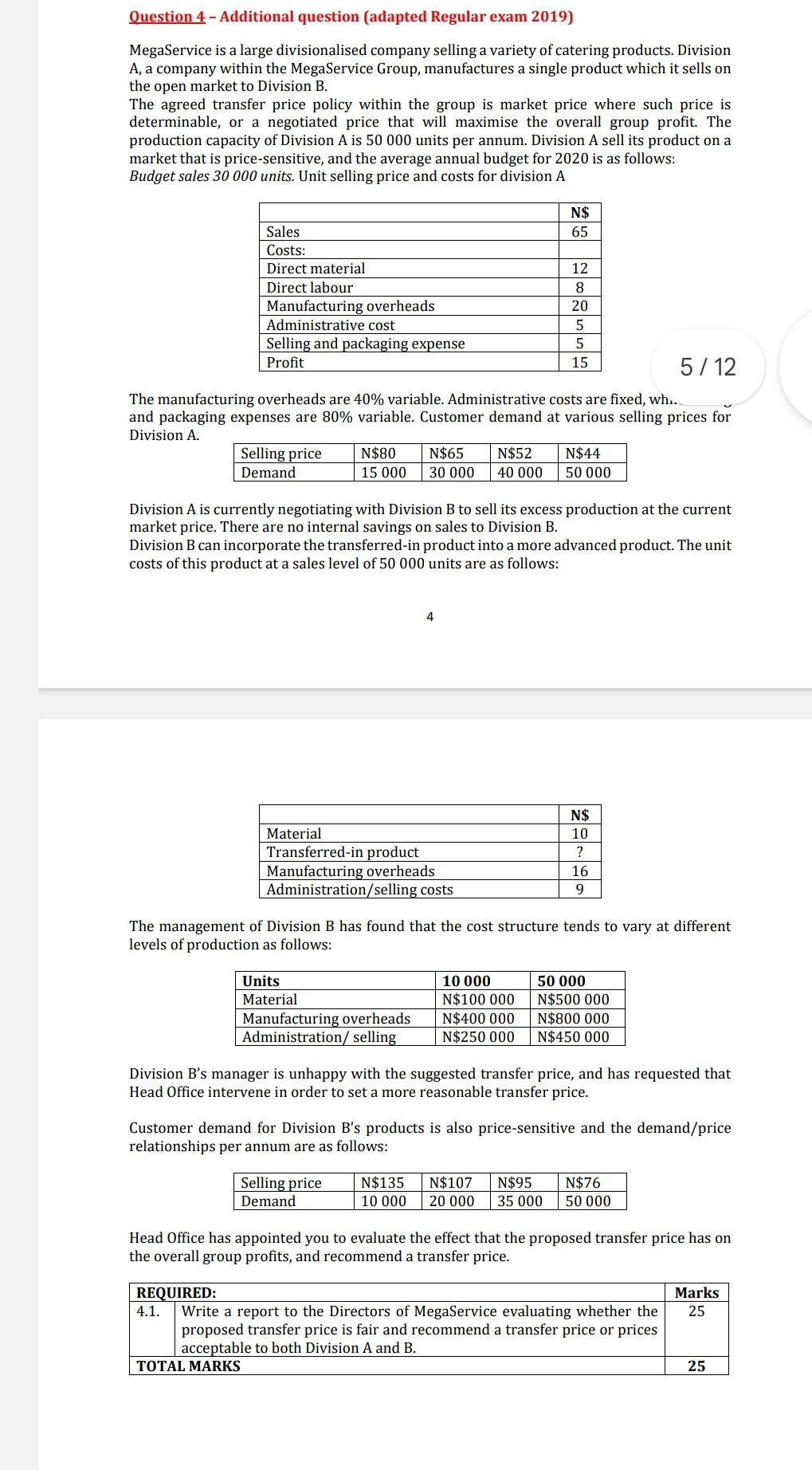

Question 4 - Additional question (adapted Regular exam 2019) MegaService is a large divisionalised company selling a variety of catering products. Division A, a company within the MegaService Group, manufactures a single product which it sells on the open market to Division B. The agreed transfer price policy within the group is market price where such price is determinable, or a negotiated price that will maximise the overall group profit. The production capacity of Division A is 50000 units per annum. Division A sell its product on a market that is price-sensitive, and the average annual budget for 2020 is as follows: Budget sales 30000 units. Unit selling price and costs for division A 5/12 The manufacturing overheads are 40% variable. Administrative costs are fixed, wh. and packaging expenses are 80% variable. Customer demand at various selling prices for Division A. Division A is currently negotiating with Division B to sell its excess production at the current market price. There are no internal savings on sales to Division B. Division B can incorporate the transferred-in product into a more advanced product. The unit costs of this product at a sales level of 50000 units are as follows: 4 The management of Division B has found that the cost structure tends to vary at different levels of production as follows: Division B's manager is unhappy with the suggested transfer price, and has requested that Head Office intervene in order to set a more reasonable transfer price. Customer demand for Division B's products is also price-sensitive and the demand/price relationships per annum are as follows: Head Office has appointed you to evaluate the effect that the proposed transfer price has on the overall group profits, and recommend a transfer price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started