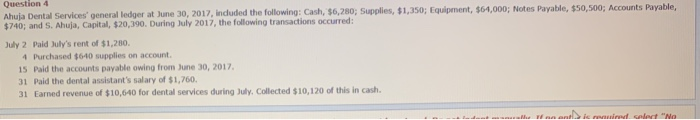

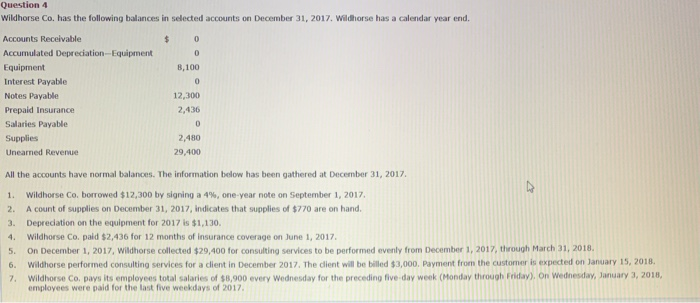

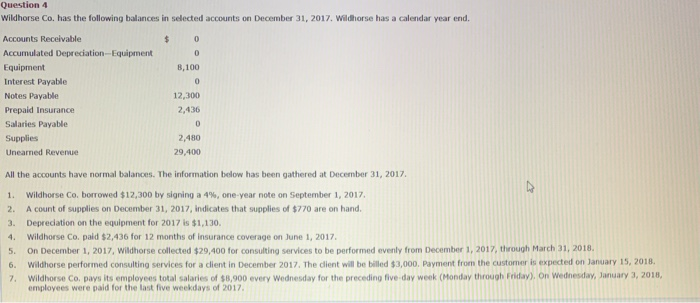

Question 4 Ahuja Dental Services general ledger at June 30, 2017, included the following: Cash, $6,280; Supplies, $1,350; Equipment, $64,000; Notes Payable, $50,500; Accounts Payable, $740; and S. Ahuja, Capital, $20,390. During July 2017, the following transactions occurred: July 2 Pald July's rent of $1,280. 4 Purchased $640 supplies on account 15 Paid the accounts payable owing from June 30, 2017 31 Paid the dental assistant's salary of $1,760 31 Earned revenue of $10,640 for dental services during July, Collected $10,120 of this in cash. Wananchi www alert "No $ Question 4 Wildhorse Co. has the following balances in selected accounts on December 31, 2017. Wildhorse has a calendar year end. Accounts Receivable 0 Accumulated Depreciation-Equipment 0 Equipment 8,100 Interest Payable 0 Notes Payable 12,300 Prepaid Insurance 2,436 Salaries Payable 0 Supplies 2,480 Unearned Revenue 29,400 All the accounts have normal balances. The information below has been gathered at December 31, 2017. 1. 2. 4. Wildhorse Co. borrowed $12,300 by signing a 4%, one-year note on September 1, 2017 A count of supplies on December 31, 2017, indicates that supplies of $770 are on hand. Depreciation on the equipment for 2017 is $1,130. Wildhorse Co, paid $2,436 for 12 months of insurance coverage on June 1, 2017 On December 1, 2017, Wildhorse collected $29,400 for consulting services to be performed evenly from December 1, 2017, through March 31, 2018. Wildhorse performed consulting services for a client in December 2017. The dient will be billed $3,000. Payment from the customer is expected on January 15, 2018, Wildhorse Co, pays its employees total salaries of $8,900 every Wednesday for the preceding five day week (Monday through Friday) on Wednesday, January 3, 2018, employees were paid for the last five weekdays of 2017. 5. 6. 7. Question 4 Ahuja Dental Services general ledger at June 30, 2017, included the following: Cash, $6,280; Supplies, $1,350; Equipment, $64,000; Notes Payable, $50,500; Accounts Payable, $740; and S. Ahuja, Capital, $20,390. During July 2017, the following transactions occurred: July 2 Pald July's rent of $1,280. 4 Purchased $640 supplies on account 15 Paid the accounts payable owing from June 30, 2017 31 Paid the dental assistant's salary of $1,760 31 Earned revenue of $10,640 for dental services during July, Collected $10,120 of this in cash. Wananchi www alert "No $ Question 4 Wildhorse Co. has the following balances in selected accounts on December 31, 2017. Wildhorse has a calendar year end. Accounts Receivable 0 Accumulated Depreciation-Equipment 0 Equipment 8,100 Interest Payable 0 Notes Payable 12,300 Prepaid Insurance 2,436 Salaries Payable 0 Supplies 2,480 Unearned Revenue 29,400 All the accounts have normal balances. The information below has been gathered at December 31, 2017. 1. 2. 4. Wildhorse Co. borrowed $12,300 by signing a 4%, one-year note on September 1, 2017 A count of supplies on December 31, 2017, indicates that supplies of $770 are on hand. Depreciation on the equipment for 2017 is $1,130. Wildhorse Co, paid $2,436 for 12 months of insurance coverage on June 1, 2017 On December 1, 2017, Wildhorse collected $29,400 for consulting services to be performed evenly from December 1, 2017, through March 31, 2018. Wildhorse performed consulting services for a client in December 2017. The dient will be billed $3,000. Payment from the customer is expected on January 15, 2018, Wildhorse Co, pays its employees total salaries of $8,900 every Wednesday for the preceding five day week (Monday through Friday) on Wednesday, January 3, 2018, employees were paid for the last five weekdays of 2017. 5. 6. 7