Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4. All parts, please. Please do not copy and paste an existing answer/reponse from Chegg. expeted borrowing rate from its bate is correct in

Question 4. All parts, please.

Please do not copy and paste an existing answer/reponse from Chegg.

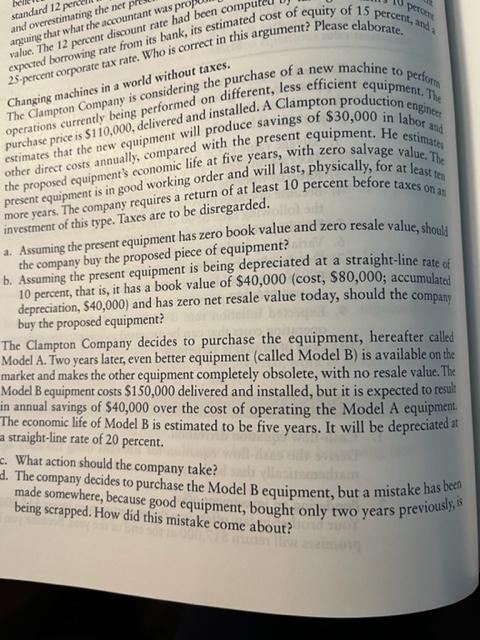

expeted borrowing rate from its bate is correct in this a taxtes. Changing machines in a world without taxes. The Clampron Company is considering the different, less efficient equipment, The operations currently being performed installed. A Clampton production enginte purchase price is 510,000 , delivered and produce savings of $30,000 in labortationt other direct costs annually, compared with the present equipment, He estimatich the proposed equipment's economic life at five years, with zero salvage valler the physically, for at least ten present equipment is in good working order and will last, physically, for at least the 10 percent before taxes at more years. The company requires a return of at leas a. Assuming the present equipment has zero book value and zero resale value, should the company buy the proposed piece of equipment? b. Assuming the present equipment is being depreciated at a straight-line rate of 10 percent, that is, it has a book value of $40,000 (cost, $80,000; accumulated depreciation, 540,000) and has zero net resale value today, should the company buy the proposed equipment? The Clampton Company decides to purchase the equipment, hereafter called Model A. Two years later, even better equipment (called Model B) is available on the market and makes the other equipment completely obsolete, with no resale value. The Model B equipment costs $150,000 delivered and installed, but it is expected to result in annual savings of $40,000 over the cost of operating the Model A equipment The economic life of Model B is estimated to be five years. It will be depreciated at a straight-line rate of 20 percent. c. What action should the company take? d. The company decides to purchase the Model B equipment, but a mistake has been made somewhere, because good equipment, bought only two years previousty, is being scrapped. How did this mistake come about? expeted borrowing rate from its bate is correct in this a taxtes. Changing machines in a world without taxes. The Clampron Company is considering the different, less efficient equipment, The operations currently being performed installed. A Clampton production enginte purchase price is 510,000 , delivered and produce savings of $30,000 in labortationt other direct costs annually, compared with the present equipment, He estimatich the proposed equipment's economic life at five years, with zero salvage valler the physically, for at least ten present equipment is in good working order and will last, physically, for at least the 10 percent before taxes at more years. The company requires a return of at leas a. Assuming the present equipment has zero book value and zero resale value, should the company buy the proposed piece of equipment? b. Assuming the present equipment is being depreciated at a straight-line rate of 10 percent, that is, it has a book value of $40,000 (cost, $80,000; accumulated depreciation, 540,000) and has zero net resale value today, should the company buy the proposed equipment? The Clampton Company decides to purchase the equipment, hereafter called Model A. Two years later, even better equipment (called Model B) is available on the market and makes the other equipment completely obsolete, with no resale value. The Model B equipment costs $150,000 delivered and installed, but it is expected to result in annual savings of $40,000 over the cost of operating the Model A equipment The economic life of Model B is estimated to be five years. It will be depreciated at a straight-line rate of 20 percent. c. What action should the company take? d. The company decides to purchase the Model B equipment, but a mistake has been made somewhere, because good equipment, bought only two years previousty, is being scrapped. How did this mistake come aboutStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started