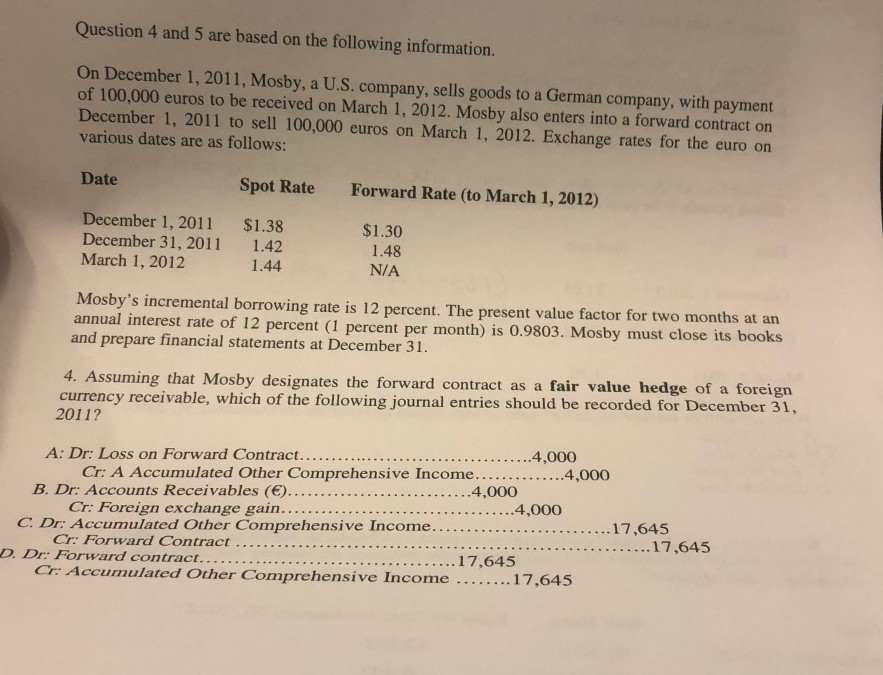

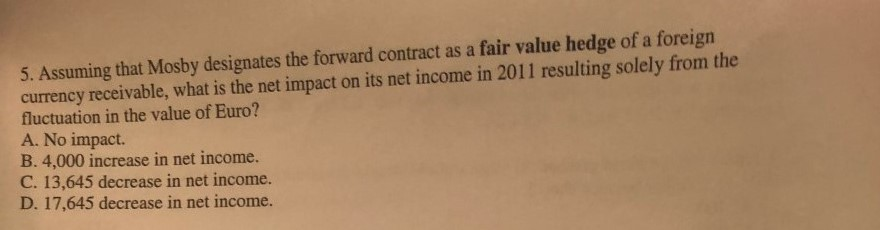

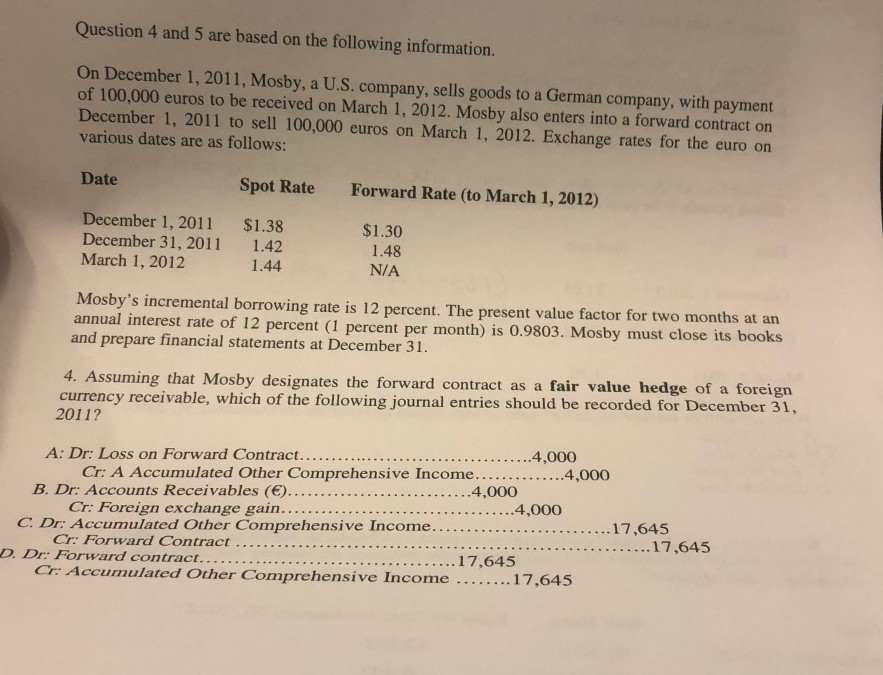

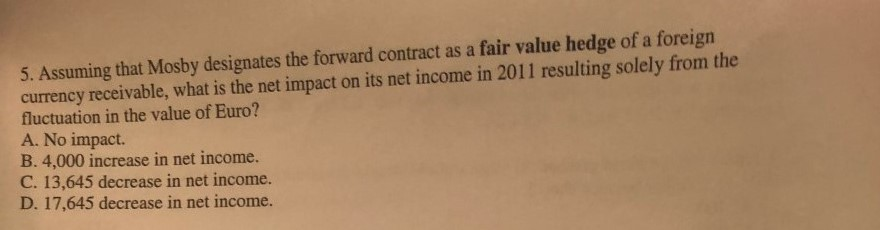

Question 4 and 5 are based on the following information. On December 1, 2011, Mosby, a U.S. company, sells goods to a German company, with payment of 100,000 euros to be received on March 1, 2012. Mosby also enters into a forward contract on December 1, 2011 to sell 100,000 euros on March 1, 2012. Exchange rates for the euro on various dates are as follows: Date Spot Rate Forward Rate (to March 1, 2012) December 1, 2011 $1.38 1.42 1.44 $1.30 1.48 N/A December 31, 2011 March 1, 2012 Mosby's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent (1 percent per month) is 0.9803. Mosby must close its books and prepare financial statements at December 31. 4. Assuming that Mosby designates the forward contract as a fair value hedge of a foreign currency receivable, which of the following journal entries should be recorded for December 31, 2011? 4,000 A: Dr: Loss on Forward Contract. Cr: A Accumulated Other Comprehensive Income.... 17,645 . . 17,645 Cr: Accumulated Other Comprehensive Income 5. Assuming that Mosby designates the forward contract as a fair value hedge of a foreign currency receivable, what is the net impact on its net income in 2011 resulting solely from the fluctuation in the value of Euro? A. No impact. B. 4,000 increase in net income. C. 13,645 decrease in net income. D. 17,645 decrease in net income. Question 4 and 5 are based on the following information. On December 1, 2011, Mosby, a U.S. company, sells goods to a German company, with payment of 100,000 euros to be received on March 1, 2012. Mosby also enters into a forward contract on December 1, 2011 to sell 100,000 euros on March 1, 2012. Exchange rates for the euro on various dates are as follows: Date Spot Rate Forward Rate (to March 1, 2012) December 1, 2011 $1.38 1.42 1.44 $1.30 1.48 N/A December 31, 2011 March 1, 2012 Mosby's incremental borrowing rate is 12 percent. The present value factor for two months at an annual interest rate of 12 percent (1 percent per month) is 0.9803. Mosby must close its books and prepare financial statements at December 31. 4. Assuming that Mosby designates the forward contract as a fair value hedge of a foreign currency receivable, which of the following journal entries should be recorded for December 31, 2011? 4,000 A: Dr: Loss on Forward Contract. Cr: A Accumulated Other Comprehensive Income.... 17,645 . . 17,645 Cr: Accumulated Other Comprehensive Income 5. Assuming that Mosby designates the forward contract as a fair value hedge of a foreign currency receivable, what is the net impact on its net income in 2011 resulting solely from the fluctuation in the value of Euro? A. No impact. B. 4,000 increase in net income. C. 13,645 decrease in net income. D. 17,645 decrease in net income