Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Antica Ltd is a software developer. The company's summarised statement of profit or loss for the year ended 31 March 2021 is as follows:

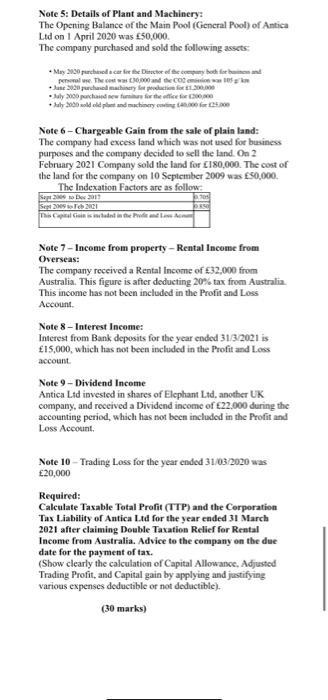

Antica Ltd is a software developer. The company's summarised statement of profit or loss for the year ended 31 March 2021 is as follows: Gross Profit 2,000,000 Add: Rental Income Interest income 20,000 10,000 130,000 2,160,000 Profit on Sale of Land (see note no.6) Less: Depreciation Entertainment Expenses Repairs Expenditure Donations and subscription (90,000) ! (7,000) 2 (20,000) 3 (14,000) Other Expenses Operating profit 4 (50,000) 1.979,000 Note 1: Entertainment Expenses: UK Customers 5,000 Staff Entertainment 2,000 Note 2: Repairs. Painting of office building 8.000 Additional room to the office building 12.000 Note 3: Donations and Subscription: onation to National Charity 10,000 Donation to Local Charity 1.000 Donation to Political party 3,000 Note 4: Other Expenses: Fine and Penalty 2,000 Trade debts are written off 3,000 Car Expense (car used by the Director for his personal Use) 5,000 Customer's loan written off 4,000 Gift of Pepsi can for 100 customers costing 10 cach 1,000 Car Lease Rent (CO2 emission of the car 125 gkm) 8,000 Balance all allowable expenses 27,000 Note 5: Details of Plant and Machinery: The Opening Balance of the Main Pool (General Pool) of Antica Ltd on 1 April 2020 was 50,000. The company purchased and sold the following assets: * May 2000 purchased acar le the Ditector of the compuny bodh fer baineand perseral use. The cot w 00 and the CO emiion wek * Jane 2020 purchased machinery le production for1.200 * Aaly 2000 purchaied new furniha for the office tar 20 + haly 2000 sold old plat and machinery cnting tan ar Note 6 - Chargeable Gain from the sale of plain land: The company had excess land which was not used for business purposes and the company decided to sell the land. On 2 February 2021 Company sold the land for E180,000. The cost of the land for the company on 10 September 2009 was 50,000. The Indexation Factors are as follow: Sap 200 o e 201 Set 2005 Feb 2CI hs Capal Cisin is nadnt in e Pdend Note 7- Income from property Rental Income from Overseas: The company received a Rental Income of 32,000 from Australia. This figure is after deducting 20% tax from Australia. This income has not been included in the Profit and Los Account. Note 8 - Interest Income: Interest from Bank deposits for the year ended 31/3/2021 is 15,000, which has not been included in the Profit and Loss account. Note 9 - Dividend Income Antica Ltd invested in shares of Elephant Ltd, another UK company, and received a Dividend income of 22.000 during the accounting period, which has not been included in the Profit and Loss Account. Note 10 - Trading Loss for the year ended 31/03 2020 was 20,000 Required: Calculate Taxable Total Profit (TTP) and the Corporation Tax Liability of Antica Ltd for the year ended 31 March 2021 after claiming Double Taxation Relief for Rental Income from Australia. Advice to the company on the due date for the payment of tax. (Show clearly the calculation of Capital Allowance, Adjusted Trading Profit, and Capital gain by applying and justifying various expenses deductible or not deductible). (30 marks)

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Calculation of Total Taxable Profit Corporation Tax Liability of Antica Ltd for the year ended 31 Ma...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started