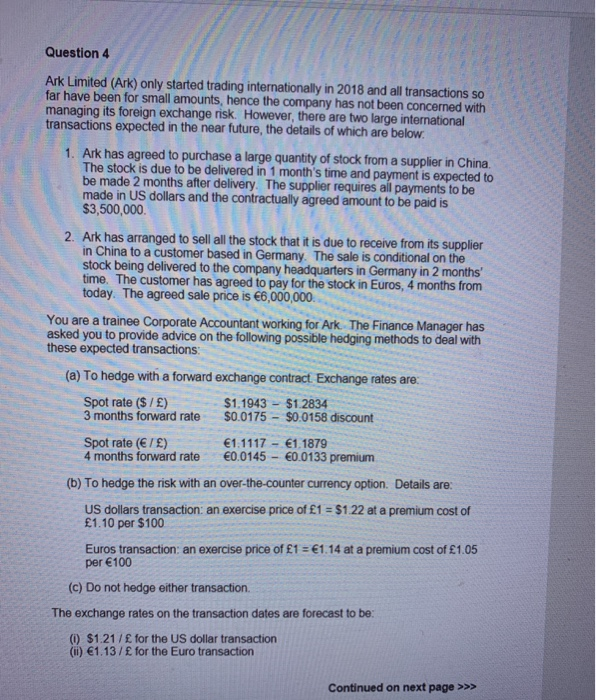

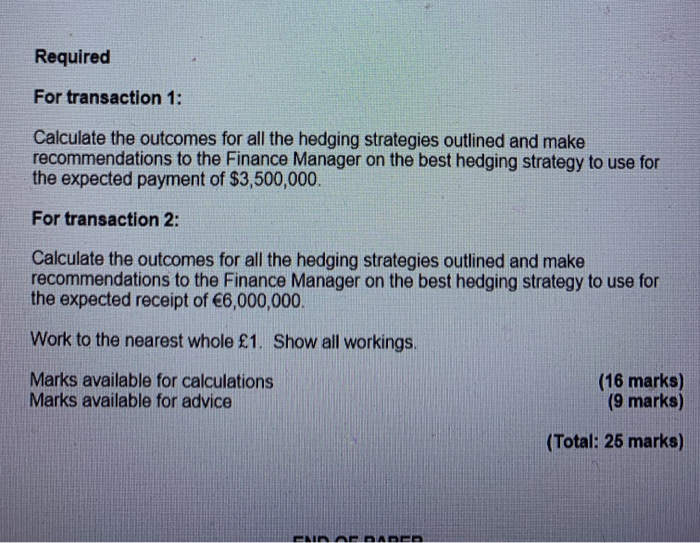

Question 4 Ark Limited (Ark) only started trading internationally in 2018 and all transactions so far have been for small amounts, hence the company has not been concerned with managing its foreign exchange risk. However, there are two large international transactions expected in the near future, the details of which are below. 1. Ark has agreed to purchase a large quantity of stock from a supplier in China. The stock is due to be delivered in 1 month's time and payment is expected to be made 2 months after delivery. The supplier requires all payments to be made in US dollars and the contractually agreed amount to be paid is $3,500,000 2. Ark has arranged to sell all the stock that it is due to receive from its supplier in China to a customer based in Germany. The sale is conditional on the stock being delivered to the company headquarters in Germany in 2 months' time. The customer has agreed to pay for the stock in Euros, 4 months from today. The agreed sale price is 6,000,000 You are a trainee Corporate Accountant working for Ark. The Finance Manager has asked you to provide advice on the following possible hedging methods to deal with these expected transactions: (a) To hedge with a forward exchange contract Exchange rates are: Spot rate ($ / ) $1.1943 $1.2834 3 months forward rate $0.0175 - $0.0158 discount Spot rate (/ ) 1.1117 - 1. 1879 4 months forward rate 0.0145 - 0.0133 premium (b) To hedge the risk with an over-the-counter currency option. Details are: US dollars transaction: an exercise price of 1 = $1.22 at a premium cost of 1.10 per $100 Euros transaction: an exercise price of 1 = 1.14 at a premium cost of 1.05 per 100 (c) Do not hedge either transaction. The exchange rates on the transaction dates are forecast to be: (0) $1.21/ for the US dollar transaction (i) 1.13/ for the Euro transaction Continued on next page >>> Required For transaction 1: Calculate the outcomes for all the hedging strategies outlined and make recommendations to the Finance Manager on the best hedging strategy to use for the expected payment of $3,500,000 For transaction 2: Calculate the outcomes for all the hedging strategies outlined and make recommendations to the Finance Manager on the best hedging strategy to use for the expected receipt of 6,000,000. Work to the nearest whole 1. Show all workings. Marks available for calculations Marks available for advice (16 marks) (9 marks) (Total: 25 marks)