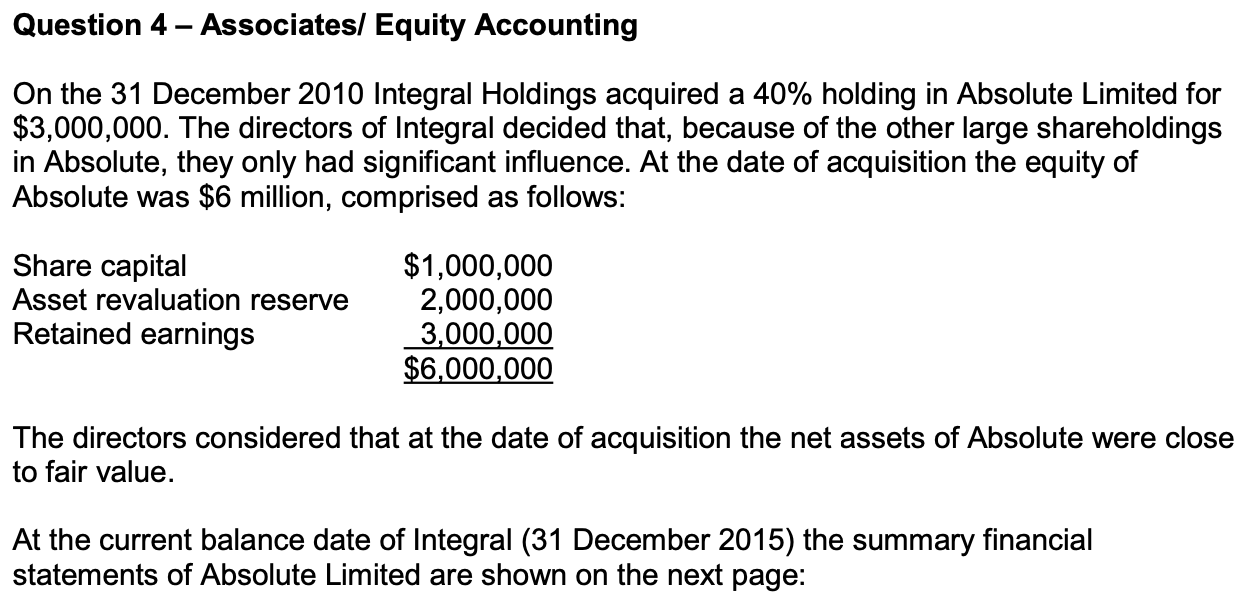

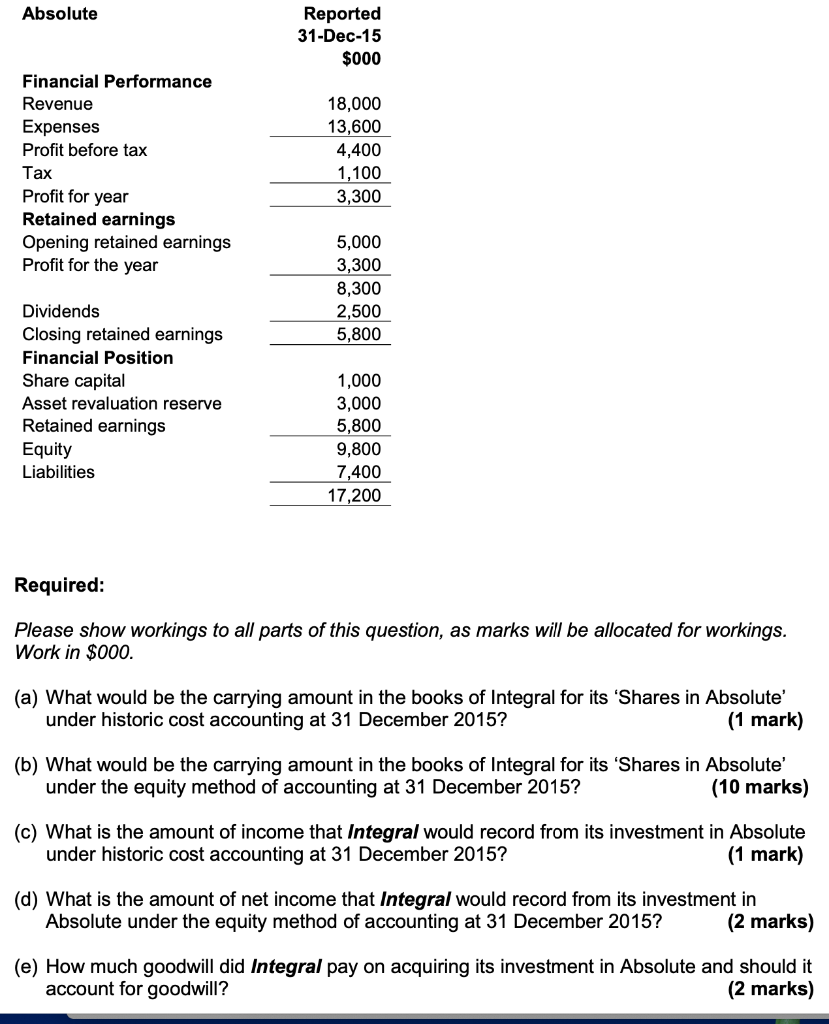

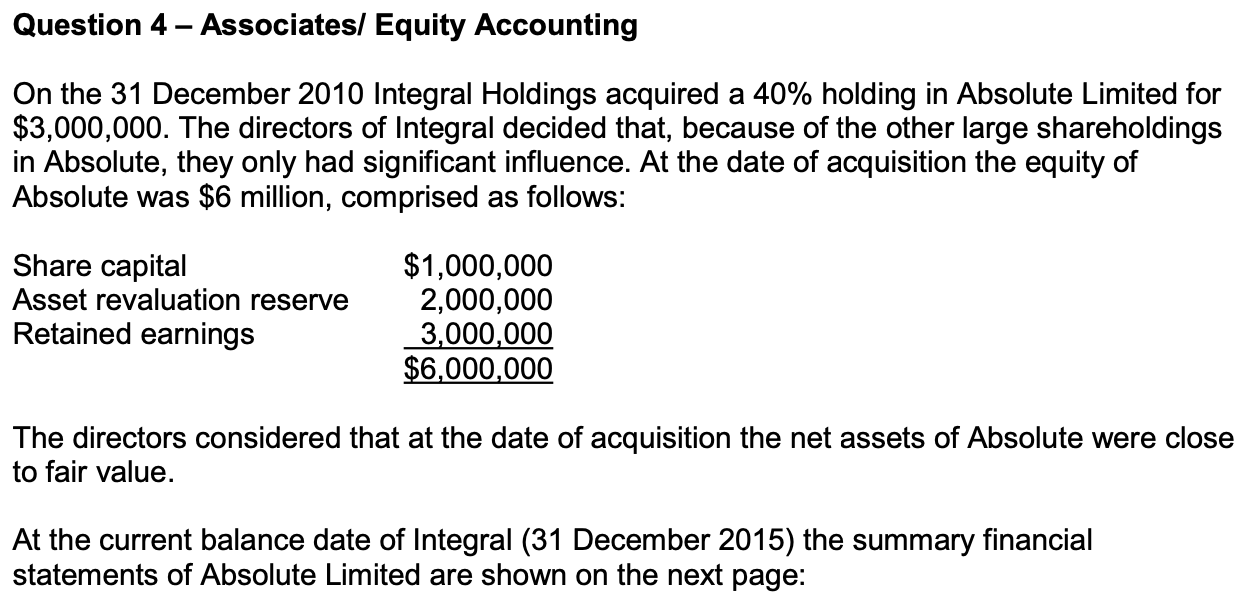

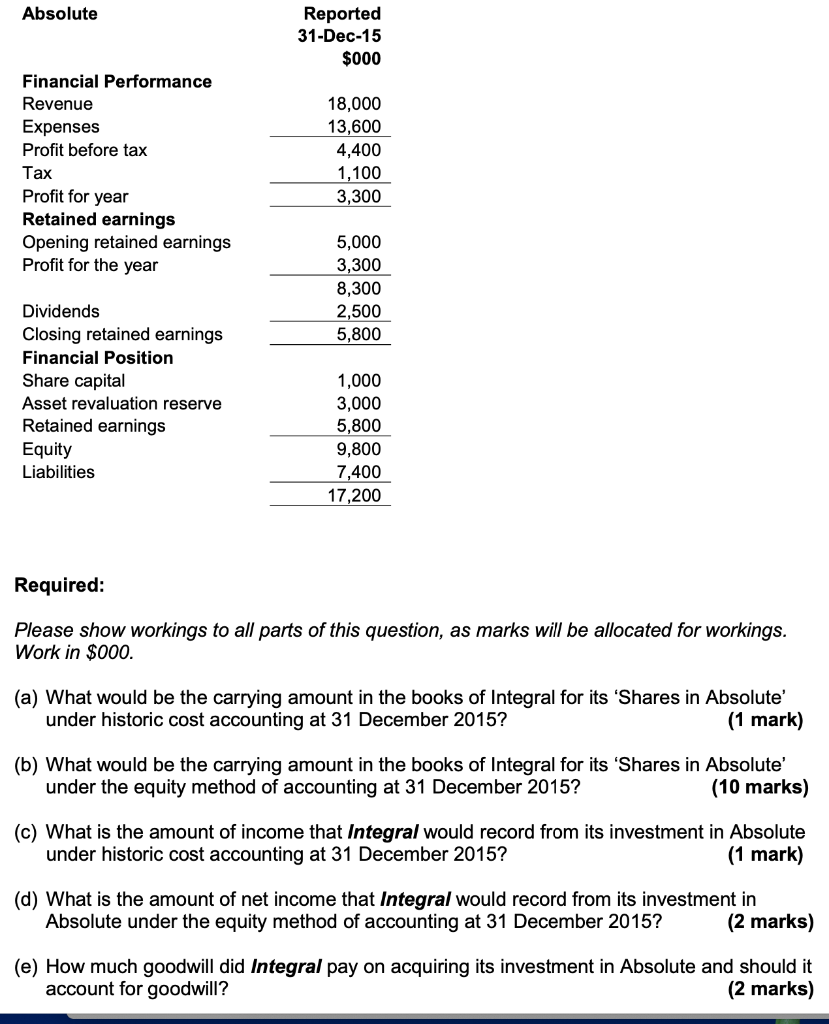

Question 4 - Associates/ Equity Accounting On the 31 December 2010 Integral Holdings acquired a 40% holding in Absolute Limited for $3,000,000. The directors of Integral decided that, because of the other large shareholdings in Absolute, they only had significant influence. At the date of acquisition the equity of Absolute was $6 million, comprised as follows: Share capital Asset revaluation reserve Retained earnings $1,000,000 2,000,000 3,000,000 $6,000,000 The directors considered that at the date of acquisition the net assets of Absolute were close to fair value. At the current balance date of Integral (31 December 2015) the summary financial statements of Absolute Limited are shown on the next page: Absolute Reported 31-Dec-15 $000 Financial Performance Revenue Expenses Profit before tax Tax Profit for year Retained earnings Opening retained earnings Profit for the year 18,000 13,600 4,400 1,100 3,300 5,000 3,300 8,300 2,500 5,800 Dividends Closing retained earnings Financial Position Share capital Asset revaluation reserve Retained earnings Equity Liabilities 1,000 3,000 5,800 9,800 7,400 17,200 Required: Please show workings to all parts of this question, as marks will be allocated for workings. Work in $000. (a) What would be the carrying amount in the books of Integral for its 'Shares in Absolute' under historic cost accounting at 31 December 2015? (1 mark) (b) What would be the carrying amount in the books of Integral for its 'Shares in Absolute' under the equity method of accounting at 31 December 2015? (10 marks) (c) What is the amount of income that Integral would record from its investment in Absolute under historic cost accounting at 31 December 2015? (1 mark) (d) What is the amount of net income that Integral would record from its investment in Absolute under the equity method of accounting at 31 December 2015? (2 marks) (e) How much goodwill did Integral pay on acquiring its investment in Absolute and should it account for goodwill? (2 marks) Question 4 - Associates/ Equity Accounting On the 31 December 2010 Integral Holdings acquired a 40% holding in Absolute Limited for $3,000,000. The directors of Integral decided that, because of the other large shareholdings in Absolute, they only had significant influence. At the date of acquisition the equity of Absolute was $6 million, comprised as follows: Share capital Asset revaluation reserve Retained earnings $1,000,000 2,000,000 3,000,000 $6,000,000 The directors considered that at the date of acquisition the net assets of Absolute were close to fair value. At the current balance date of Integral (31 December 2015) the summary financial statements of Absolute Limited are shown on the next page: Absolute Reported 31-Dec-15 $000 Financial Performance Revenue Expenses Profit before tax Tax Profit for year Retained earnings Opening retained earnings Profit for the year 18,000 13,600 4,400 1,100 3,300 5,000 3,300 8,300 2,500 5,800 Dividends Closing retained earnings Financial Position Share capital Asset revaluation reserve Retained earnings Equity Liabilities 1,000 3,000 5,800 9,800 7,400 17,200 Required: Please show workings to all parts of this question, as marks will be allocated for workings. Work in $000. (a) What would be the carrying amount in the books of Integral for its 'Shares in Absolute' under historic cost accounting at 31 December 2015? (1 mark) (b) What would be the carrying amount in the books of Integral for its 'Shares in Absolute' under the equity method of accounting at 31 December 2015? (10 marks) (c) What is the amount of income that Integral would record from its investment in Absolute under historic cost accounting at 31 December 2015? (1 mark) (d) What is the amount of net income that Integral would record from its investment in Absolute under the equity method of accounting at 31 December 2015? (2 marks) (e) How much goodwill did Integral pay on acquiring its investment in Absolute and should it account for goodwill? (2 marks)