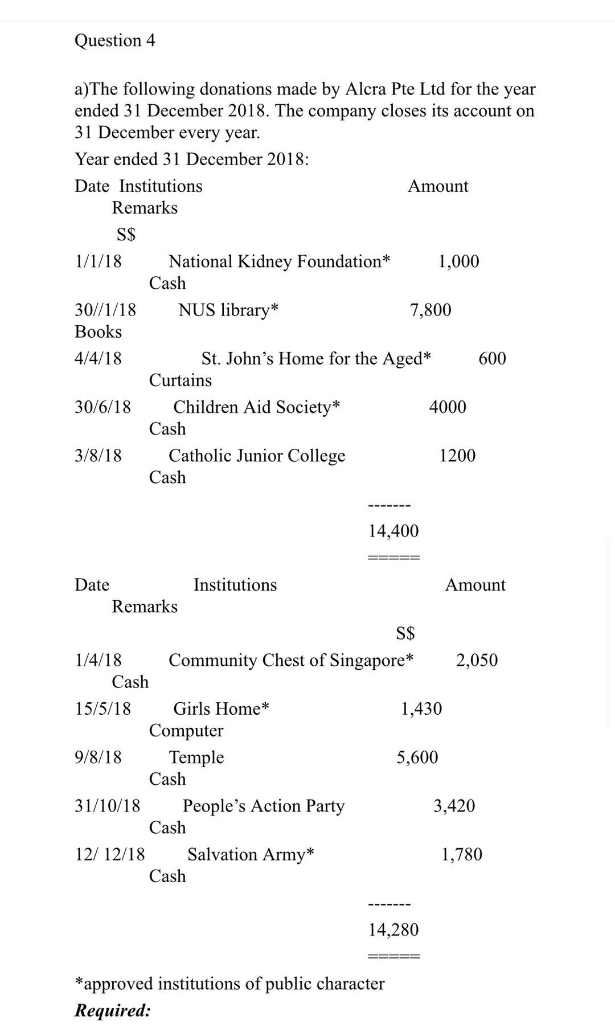

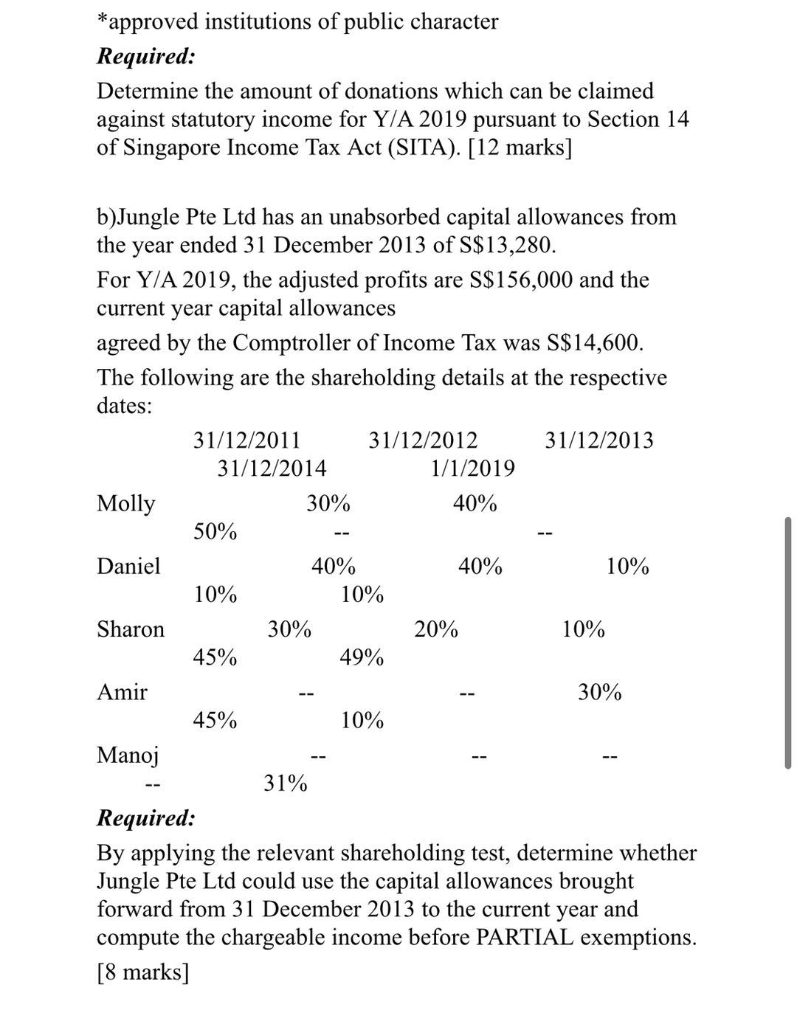

Question 4 a)The following donations made by Alcra Pte Ltd for the year ended 31 December 2018. The company closes its account on 31 December every year. Year ended 31 December 2018: Date Institutions Amount Remarks S$ 1/1/18 1,000 National Kidney Foundation* Cash NUS library* 7,800 30//1/18 Books 4/4/18 30/6/18 St. John's Home for the Aged* 600 Curtains Children Aid Society* 4000 Cash Catholic Junior College 1200 Cash 3/8/18 14,400 Date Institutions Amount Remarks S$ 1/4/18 Community Chest of Singapore* 2,050 Cash 15/5/18 Girls Home* 1,430 Computer 9/8/18 Temple 5,600 Cash 31/10/18 People's Action Party 3,420 Cash 12/ 12/18 Salvation Army* 1,780 Cash 14,280 * approved institutions of public character Required: *approved institutions of public character Required: Determine the amount of donations which can be claimed against statutory income for Y/A 2019 pursuant to Section 14 of Singapore Income Tax Act (SITA). [12 marks] b)Jungle Pte Ltd has an unabsorbed capital allowances from the year ended 31 December 2013 of S$13,280. For Y/A 2019, the adjusted profits are S$156,000 and the current year capital allowances agreed by the Comptroller of Income Tax was S$14,600. The following are the shareholding details at the respective dates: 31/12/2011 31/12/2012 31/12/2013 31/12/2014 1/1/2019 Molly 30% 40% 50% Daniel 40% 40% 10% 10% 10% Sharon 30% 20% 10% 45% 49% Amir 30% 45% 10% Manoj 31% Required: By applying the relevant shareholding test, determine whether Jungle Pte Ltd could use the capital allowances brought forward from 31 December 2013 to the current year and compute the chargeable income before PARTIAL exemptions. [8 marks] Question 4 a)The following donations made by Alcra Pte Ltd for the year ended 31 December 2018. The company closes its account on 31 December every year. Year ended 31 December 2018: Date Institutions Amount Remarks S$ 1/1/18 1,000 National Kidney Foundation* Cash NUS library* 7,800 30//1/18 Books 4/4/18 30/6/18 St. John's Home for the Aged* 600 Curtains Children Aid Society* 4000 Cash Catholic Junior College 1200 Cash 3/8/18 14,400 Date Institutions Amount Remarks S$ 1/4/18 Community Chest of Singapore* 2,050 Cash 15/5/18 Girls Home* 1,430 Computer 9/8/18 Temple 5,600 Cash 31/10/18 People's Action Party 3,420 Cash 12/ 12/18 Salvation Army* 1,780 Cash 14,280 * approved institutions of public character Required: *approved institutions of public character Required: Determine the amount of donations which can be claimed against statutory income for Y/A 2019 pursuant to Section 14 of Singapore Income Tax Act (SITA). [12 marks] b)Jungle Pte Ltd has an unabsorbed capital allowances from the year ended 31 December 2013 of S$13,280. For Y/A 2019, the adjusted profits are S$156,000 and the current year capital allowances agreed by the Comptroller of Income Tax was S$14,600. The following are the shareholding details at the respective dates: 31/12/2011 31/12/2012 31/12/2013 31/12/2014 1/1/2019 Molly 30% 40% 50% Daniel 40% 40% 10% 10% 10% Sharon 30% 20% 10% 45% 49% Amir 30% 45% 10% Manoj 31% Required: By applying the relevant shareholding test, determine whether Jungle Pte Ltd could use the capital allowances brought forward from 31 December 2013 to the current year and compute the chargeable income before PARTIAL exemptions. [8 marks]