Question

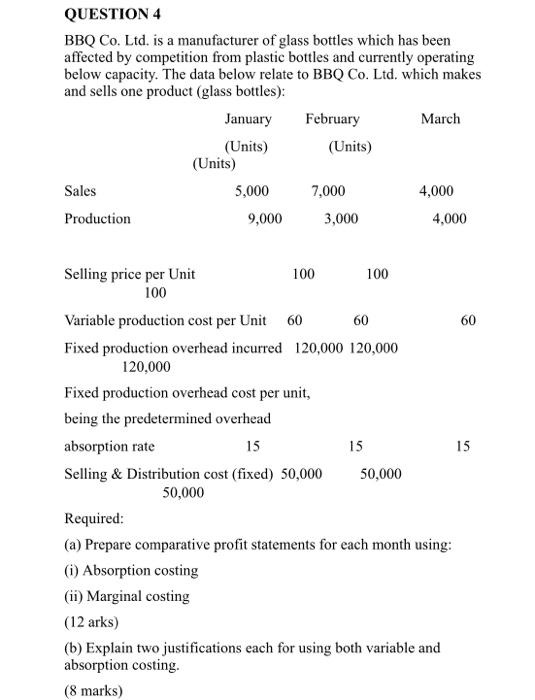

QUESTION 4 BBQ Co. Ltd. is a manufacturer of glass bottles which has been affected by competition from plastic bottles and currently operating below

QUESTION 4 BBQ Co. Ltd. is a manufacturer of glass bottles which has been affected by competition from plastic bottles and currently operating below capacity. The data below relate to BBQ Co. Ltd. which makes and sells one product (glass bottles): Sales Production January (Units) (Units) Selling price per Unit 100 5,000 9,000 February 7,000 100 (Units) Fixed production overhead cost per unit, being the predetermined overhead absorption rate 15 Selling & Distribution cost (fixed) 50,000 50,000 3,000 Variable production cost per Unit 60 60 Fixed production overhead incurred 120,000 120,000 120,000 100 15 50,000 March 4,000 4,000 Required: (a) Prepare comparative profit statements for each month using: (i) Absorption costing (ii) Marginal costing (12 arks) (b) Explain two justifications each for using both variable and absorption costing. (8 marks) 60 15

Step by Step Solution

3.52 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Accounting

Authors: Lew Edwards, John Medlin, Keryn Chalmers, Andreas Hellmann, Claire Beattie, Jodie Maxfield, John Hoggett

9th edition

1118608224, 1118608227, 730323994, 9780730323990, 730319172, 9780730319177, 978-1118608227

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App