Answered step by step

Verified Expert Solution

Question

1 Approved Answer

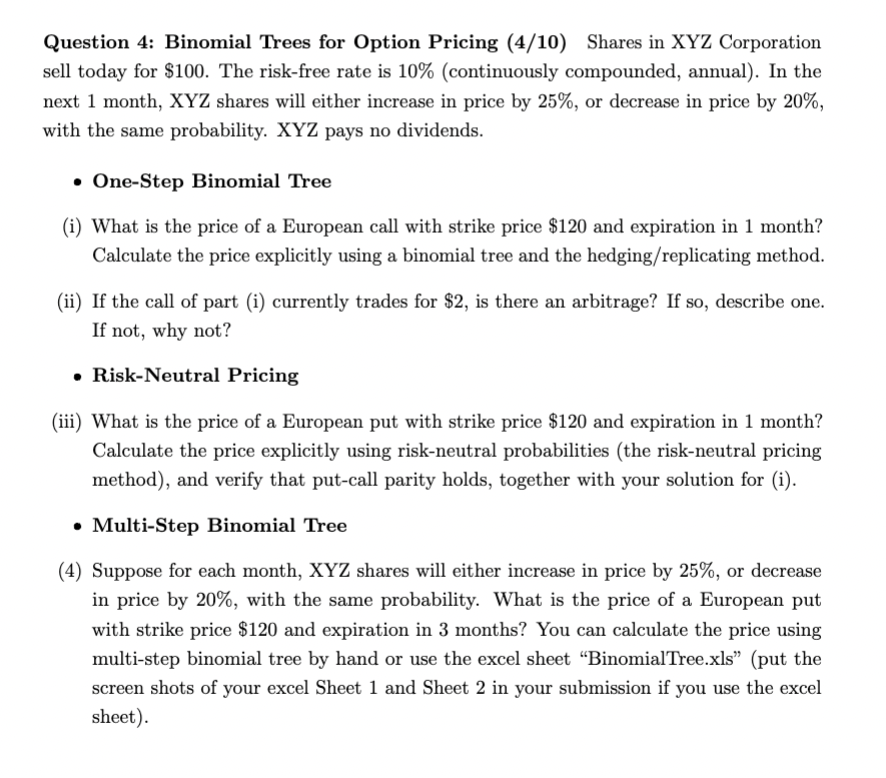

Question 4 : Binomial Trees for Option Pricing ( 4 / 1 0 ) Shares in XYZ Corporation sell today for $ 1 0 0

Question : Binomial Trees for Option Pricing Shares in XYZ Corporation

sell today for $ The riskfree rate is continuously compounded, annual In the

next month, XYZ shares will either increase in price by or decrease in price by

with the same probability. XYZ pays no dividends.

OneStep Binomial Tree

i What is the price of a European call with strike price $ and expiration in month?

Calculate the price explicitly using a binomial tree and the hedgingreplicating method.

ii If the call of part i currently trades for $ is there an arbitrage? If so describe one.

If not, why not?

RiskNeutral Pricing

iii What is the price of a European put with strike price $ and expiration in month?

Calculate the price explicitly using riskneutral probabilities the riskneutral pricing

method and verify that putcall parity holds, together with your solution for i

MultiStep Binomial Tree

Suppose for each month, XYZ shares will either increase in price by or decrease

in price by with the same probability. What is the price of a European put

with strike price $ and expiration in months? You can calculate the price using

multistep binomial tree by hand or use the excel sheet "BinomialTree.xlsput the

screen shots of your excel Sheet and Sheet in your submission if you use the excel

sheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started