Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Chicago Plc, USA makes heavy machine tools with annual sales of over US$1 bn. It has expanded internationally, however its largest sales are

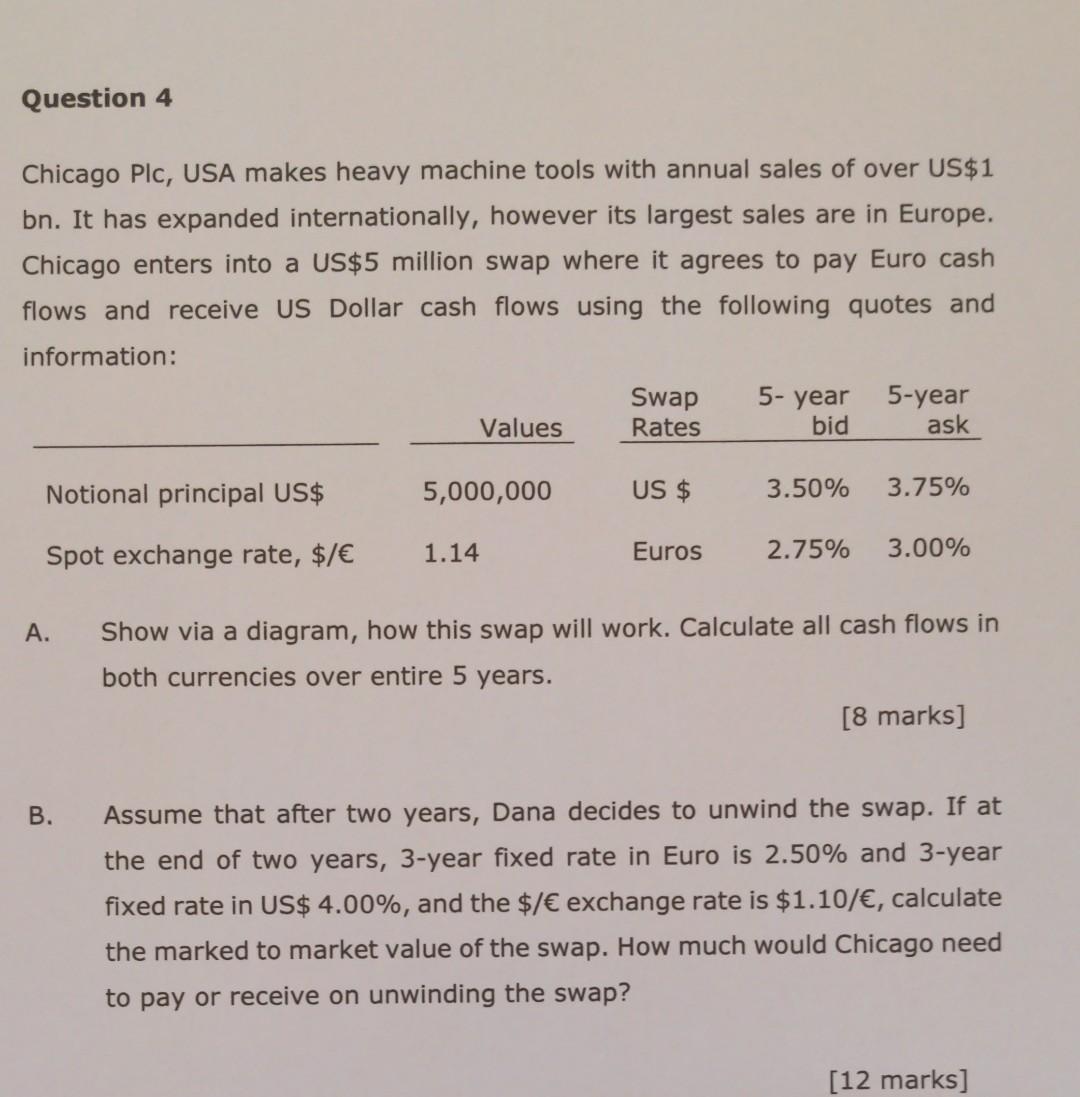

Question 4 Chicago Plc, USA makes heavy machine tools with annual sales of over US$1 bn. It has expanded internationally, however its largest sales are in Europe. Chicago enters into a US$5 million swap where it agrees to pay Euro cash flows and receive US Dollar cash flows using the following quotes and information: Swap 5-year Values Rates bid ask 5- year Notional principal US$ 5,000,000 US $ 3.50% 3.75% 1.14 Spot exchange rate, $/ Euros 2.75% 3.00% A. Show via a diagram, how this swap will work. Calculate all cash flows in both currencies over entire 5 years. [8 marks] B. Assume that after two years, Dana decides to unwind the swap. If at the end of two years, 3-year fixed rate in Euro is 2.50% and 3-year fixed rate in US$ 4.00%, and the $/ exchange rate is $1.10/, calculate the marked to market value of the swap. How much would Chicago need to pay or receive on unwinding the swap? [12 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started