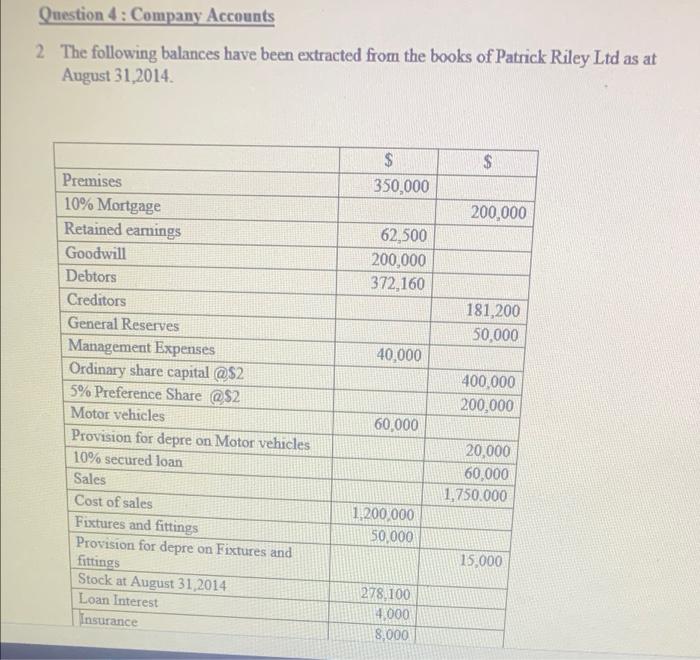

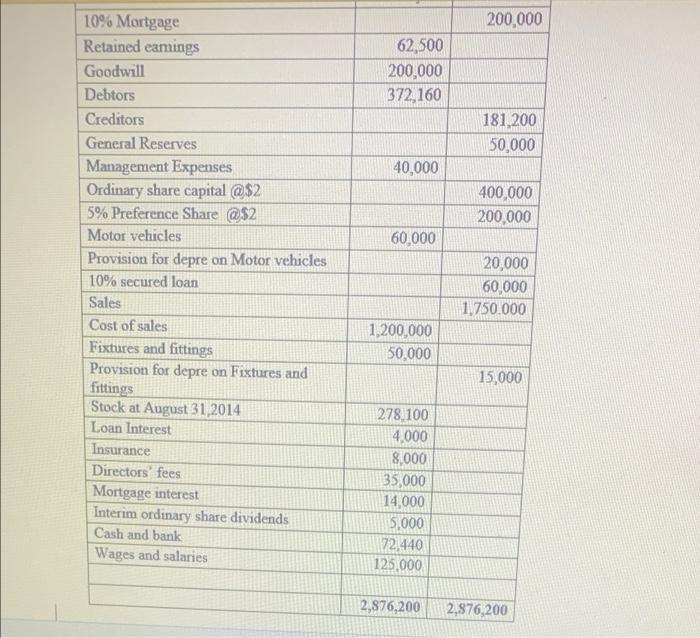

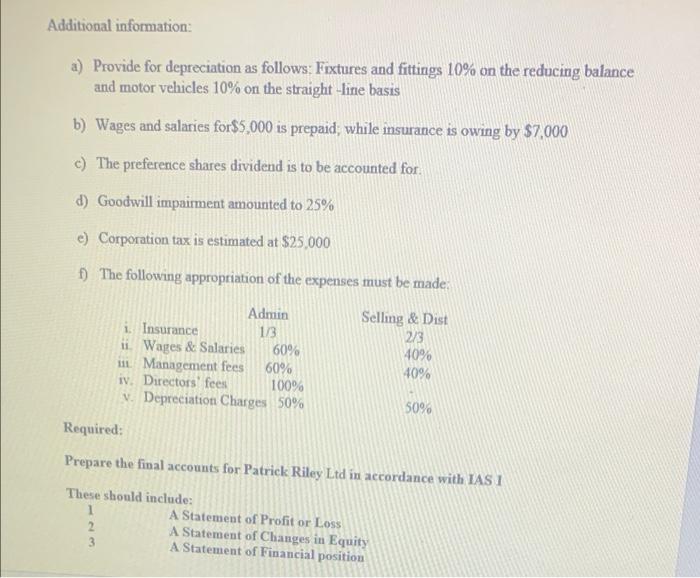

Question 4: Company Accounts 2. The following balances have been extracted from the books of Patrick Riley Ltd as at August 31,2014 $ $ 350,000 200,000 62,500 200,000 372,160 181,200 50,000 40,000 Premises 10% Mortgage Retained earings Goodwill Debtors Creditors General Reserves Management Expenses Ordinary share capital @$2 5% Preference Share @$2 Motor vehicles Provision for depre on Motor vehicles 10% secured loan Sales Cost of sales Fixtures and fittings Provision for depre on Fixtures and fittings Stock at August 31,2014 Loan Interest Insurance 400,000 200,000 60,000 20,000 60,000 1,750.000 1.200.000 50.000 15.000 278.100 4,000 8,000 200,000 62,500 200.000 372,160 181,200 50,000 40,000 400,000 200,000 60,000 10% Mortgage Retained eamings Goodwill Debtors Creditors General Reserves Management Expenses Ordinary share capital @$2 5% Preference Share @$2 Motor vehicles Provision for depre on Motor vehicles 10% secured loan Sales Cost of sales Fixtures and fittings Provision for depre on Fixtures and fittings Stock at August 31,2014 Loan Interest Insurance Directors fees Mortgage interest Interim ordinary share dividends Cash and bank Wages and salaries 20,000 60,000 1,750.000 1,200,000 50,000 15,000 278.100 4,000 8,000 35,000 14,000 5.000 172.440 125.000 2,876,200 2,876,200 Additional information: a) Provide for depreciation as follows: Fixtures and fittings 10% on the reducing balance and motor vehicles 10% on the straight line basis b) Wages and salaries for$5,000 is prepaid; while insurance is owing by $7,000 c) The preference shares dividend is to be accounted for. d) Goodwill impairment amounted to 25% e) Corporation tax is estimated at $25,000 f) The following appropriation of the expenses must be made: Admin i. Insurance 1/3 ii. Wages & Salaries 60% 1. Management fees 60% iv. Directors' fees 100% V Depreciation Charges 50% Required: Selling & Dist 2/3 40% 40% 50% Prepare the final accounts for Patrick Riley Ltd in accordance with IASI These should include: 1 A Statement of Profit or Loss 2 A Statement of Changes in Equity A Statement of Financial position 3