Answered step by step

Verified Expert Solution

Question

1 Approved Answer

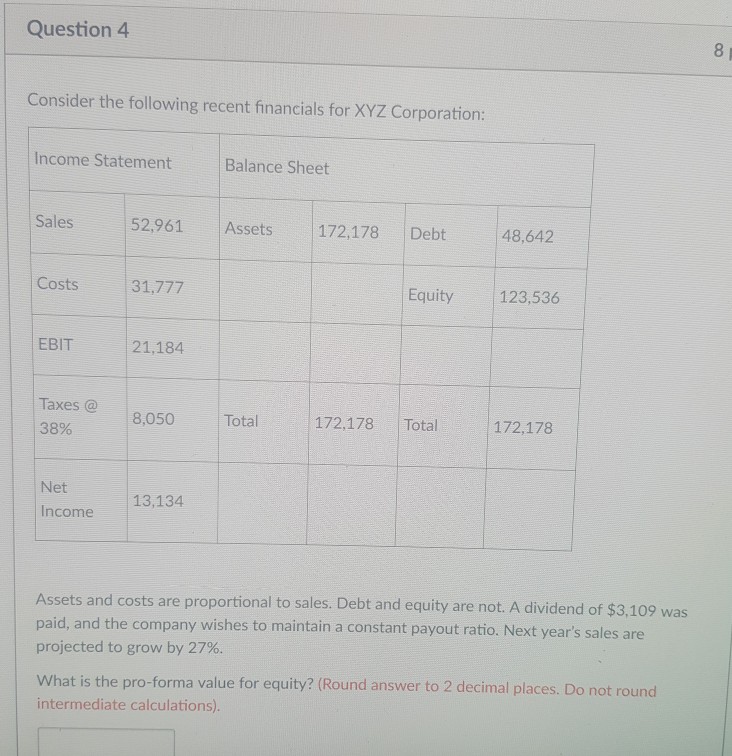

Question 4 Consider the following recent financials for XYZ Corporation: Income Statement Balance Sheet 52.961 Assets 172,178 Debt 48,642 Sales Costs 31,777 Equity 123,536 EBIT

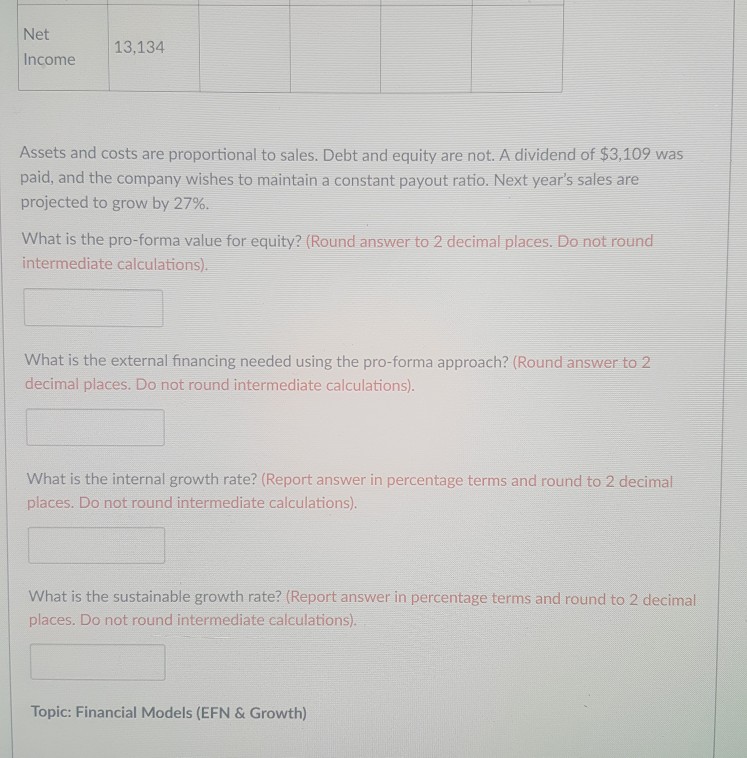

Question 4 Consider the following recent financials for XYZ Corporation: Income Statement Balance Sheet 52.961 Assets 172,178 Debt 48,642 Sales Costs 31,777 Equity 123,536 EBIT 21,184 Taxes @ 38% 8,050 Total 172,178 Total172,178 Net Income 13,134 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $3,109 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to grow by 27%. What is the pro-forma value for equity? (Round answer to 2 decimal places. Do not round intermediate calculations)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started