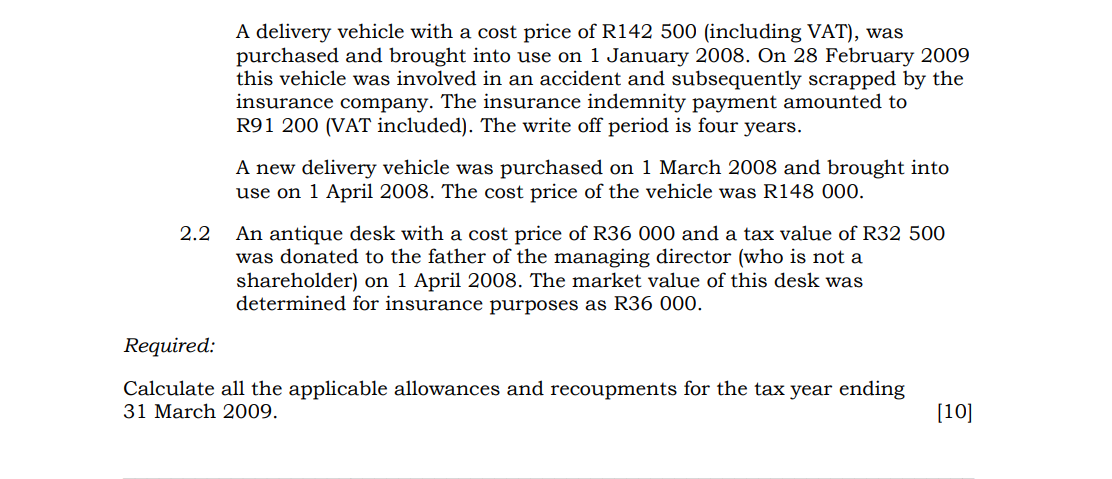

Question 4 Dash Trading (Pty) Ltd is an importer of goods into the Republic, which are then distributes locally. The following information relates to the year of assessment ended 31 March 2009: 1. Dash Trading leases office and store room space from Leasecor CC. This agreement was concluded during March 2008. According to the agreement, Dash Trading will lease office and store room space from 1 May 2008 until 30 April 2009 (a 5 year period). A monthly rental of R2 000 is payable. A lease premium of R480 000 was paid on 1 May 2008. 2. Fixed assets: 2.1 A luxury passenger vehicle was leased by Dash Trading from 1 June 2008 and the use of the vehicle was granted as a fringe benefit to the managing director. The cost price of the vehicle was R438 900 (including VAT). The monthly lease payments amounted to R95 350 in total for the period 1 June 2008 to 31 March 2009. A delivery vehicle with a cost price of R142 500 (including VAT), was purchased and brought into use on 1 January 2008. On 28 February 2009 this vehicle was involved in an accident and subsequently scrapped by the insurance company. The insurance indemnity payment amounted to R91 200 (VAT included). The write off period is four years. A new delivery vehicle was purchased on 1 March 2008 and brought into use on 1 April 2008. The cost price of the vehicle was R148 000. An antique desk with a cost price of R36 000 and a tax value of R32 500 was donated to the father of the managing director (who is not a shareholder) on 1 April 2008. The market value of this desk was determined for insurance purposes as R36 000. 2.2 Required: Calculate all the applicable allowances and recoupments for the tax year ending 31 March 2009. [10] Question 4 Dash Trading (Pty) Ltd is an importer of goods into the Republic, which are then distributes locally. The following information relates to the year of assessment ended 31 March 2009: 1. Dash Trading leases office and store room space from Leasecor CC. This agreement was concluded during March 2008. According to the agreement, Dash Trading will lease office and store room space from 1 May 2008 until 30 April 2009 (a 5 year period). A monthly rental of R2 000 is payable. A lease premium of R480 000 was paid on 1 May 2008. 2. Fixed assets: 2.1 A luxury passenger vehicle was leased by Dash Trading from 1 June 2008 and the use of the vehicle was granted as a fringe benefit to the managing director. The cost price of the vehicle was R438 900 (including VAT). The monthly lease payments amounted to R95 350 in total for the period 1 June 2008 to 31 March 2009. A delivery vehicle with a cost price of R142 500 (including VAT), was purchased and brought into use on 1 January 2008. On 28 February 2009 this vehicle was involved in an accident and subsequently scrapped by the insurance company. The insurance indemnity payment amounted to R91 200 (VAT included). The write off period is four years. A new delivery vehicle was purchased on 1 March 2008 and brought into use on 1 April 2008. The cost price of the vehicle was R148 000. An antique desk with a cost price of R36 000 and a tax value of R32 500 was donated to the father of the managing director (who is not a shareholder) on 1 April 2008. The market value of this desk was determined for insurance purposes as R36 000. 2.2 Required: Calculate all the applicable allowances and recoupments for the tax year ending 31 March 2009. [10]