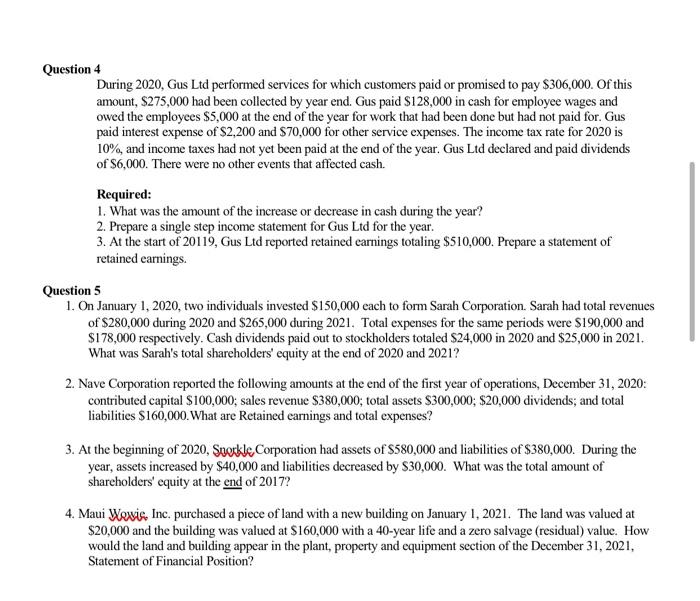

Question 4 During 2020, Gus Ltd performed services for which customers paid or promised to pay $306,000. Of this amount, $275,000 had been collected by year end. Gus paid $128,000 in cash for employee wages and owed the employees $5,000 at the end of the year for work that had been done but had not paid for. Gus paid interest expense of $2,200 and $70,000 for other service expenses. The income tax rate for 2020 is 10%, and income taxes had not yet been paid at the end of the year. Gus Ltd declared and paid dividends of $6,000. There were no other events that affected cash. Required: 1. What was the amount of the increase or decrease in cash during the year? 2. Prepare a single step income statement for Gus Ltd for the year. 3. At the start of 20119, Gus Ltd reported retained earnings totaling $510,000. Prepare a statement of retained earnings. Question 5 1. On January 1, 2020, two individuals invested $150,000 each to form Sarah Corporation. Sarah had total revenues of $280,000 during 2020 and $265,000 during 2021. Total expenses for the same periods were $190,000 and $178,000 respectively. Cash dividends paid out to stockholders totaled S24,000 in 2020 and $25,000 in 2021. What was Sarah's total shareholders' equity at the end of 2020 and 2021? 2. Nave Corporation reported the following amounts at the end of the first year of operations, December 31, 2020: contributed capital S100,000; sales revenue $380,000; total assets $300,000; $20,000 dividends; and total liabilities $160,000. What are Retained earnings and total expenses? 3. At the beginning of 2020, Snorkle Corporation had assets of S580,000 and liabilities of $380,000. During the year, assets increased by $40,000 and liabilities decreased by $30,000. What was the total amount of shareholders' equity at the end of 2017? 4. Maui Wowis, Inc. purchased a piece of land with a new building on January 1, 2021. The land was valued at $20,000 and the building was valued at $160,000 with a 40-year life and a zero salvage (residual) value. How would the land and building appear in the plant, property and equipment section of the December 31, 2021, Statement of Financial Position