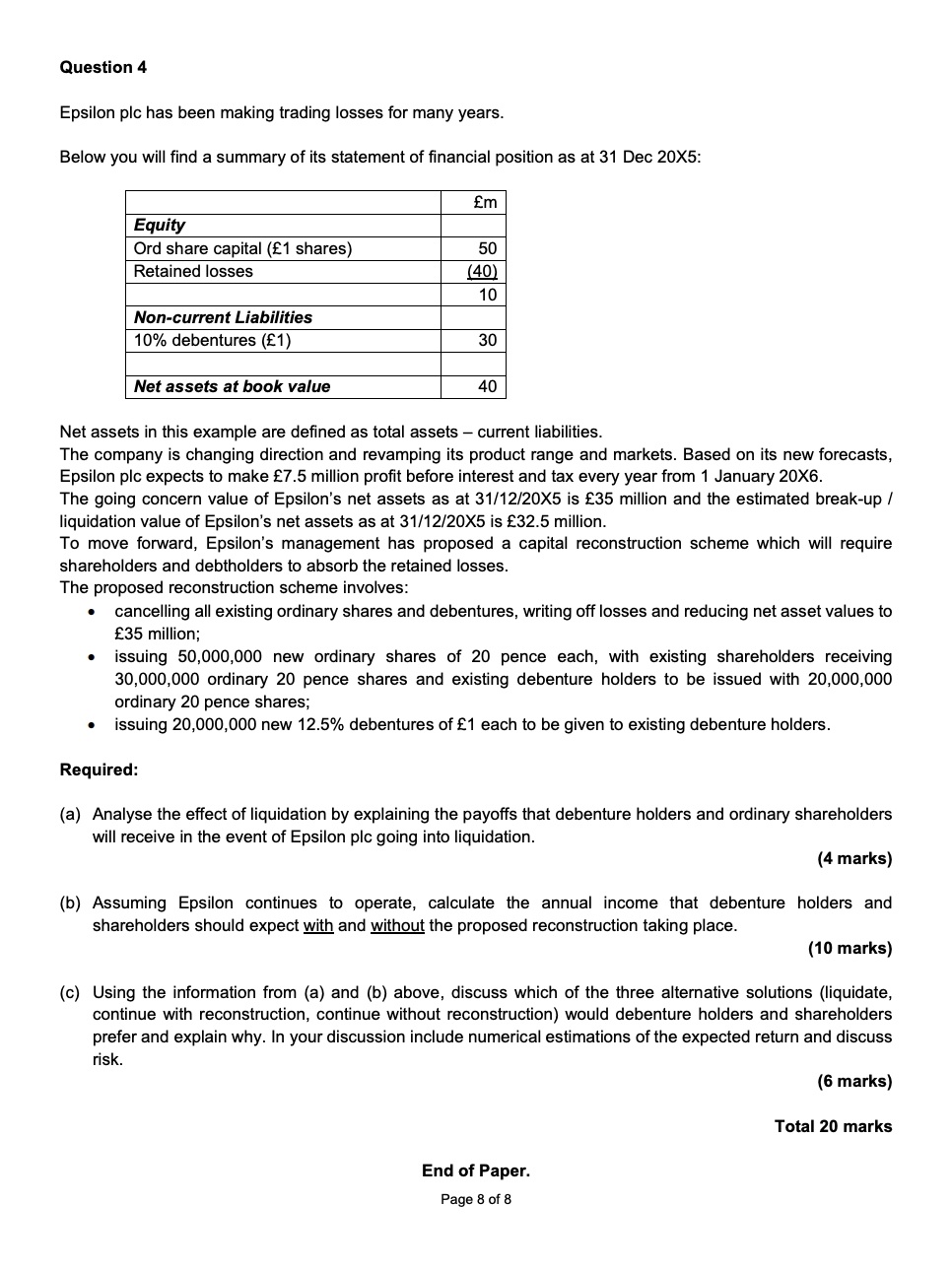

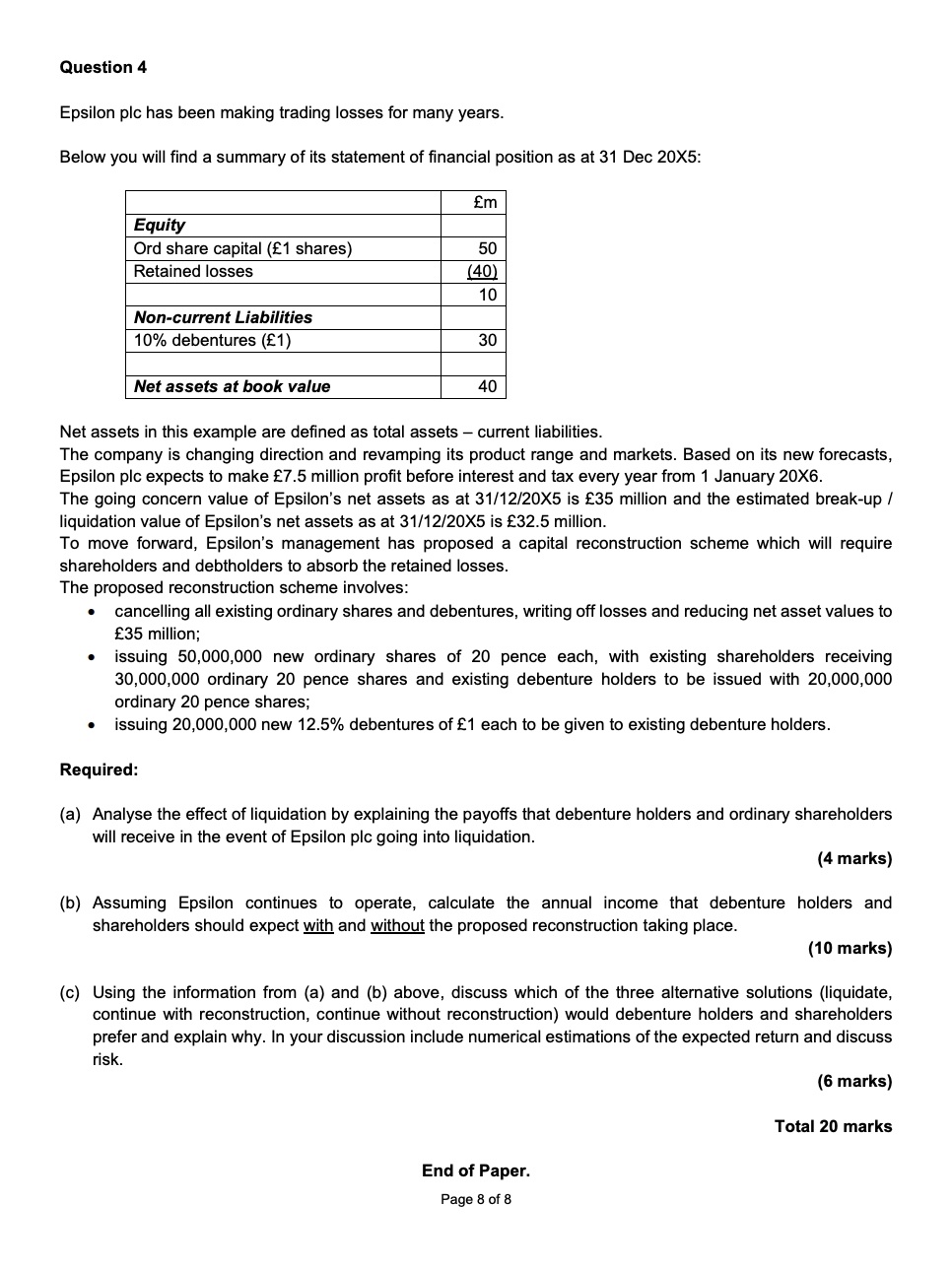

Question 4 Epsilon plc has been making trading losses for many years. Below you will find a summary of its statement of financial position as at 31 Dec 20X5: m Equity Ord share capital (1 shares) Retained losses 50 (40) 10 Non-current Liabilities 10% debentures (1) 30 Net assets at book value 40 Net assets in this example are defined as total assets - current liabilities. The company is changing direction and re its prod range and markets. Based on its new forecasts, Epsilon plc expects to make 7.5 million profit before interest and tax every year from 1 January 20X6. The going concern value of Epsilon's net assets as at 31/12/20X5 is 35 million and the estimated break-up / liquidation value of Epsilon's net assets as at 31/12/20X5 is 32.5 million. To move forward, Epsilon's management has proposed a capital reconstruction scheme which will require shareholders and debtholders to absorb the retained losses. The proposed reconstruction scheme involves: cancelling all existing ordinary shares and debentures, writing off losses and reducing net asset values to 35 million; issuing 50,000,000 new ordinary shares of 20 pence each, with existing shareholders receiving 30,000,000 ordinary 20 pence shares and existing debenture holders to be issued with 20,000,000 ordinary 20 pence shares; issuing 20,000,000 new 12.5% debentures of 1 each to be given to existing debenture holders. . Required: (a) Analyse the effect of liquidation by explaining the payoffs that debenture holders and ordinary shareholders will receive in the event of Epsilon plc going into liquidation. (4 marks) (b) Assuming Epsilon continues to operate, calculate the annual income that debenture holders and shareholders should expect with and without the proposed reconstruction taking place. (10 marks) (c) Using the information from (a) and (b) above, discuss which of the three alternative solutions (liquidate, continue with reconstruction, continue without reconstruction) would debenture holders and shareholders prefer and explain why. In your discussion include numerical estimations of the expected return and discuss risk. (6 marks) Total 20 marks End of Paper. Page 8 of 8 Question 4 Epsilon plc has been making trading losses for many years. Below you will find a summary of its statement of financial position as at 31 Dec 20X5: m Equity Ord share capital (1 shares) Retained losses 50 (40) 10 Non-current Liabilities 10% debentures (1) 30 Net assets at book value 40 Net assets in this example are defined as total assets - current liabilities. The company is changing direction and re its prod range and markets. Based on its new forecasts, Epsilon plc expects to make 7.5 million profit before interest and tax every year from 1 January 20X6. The going concern value of Epsilon's net assets as at 31/12/20X5 is 35 million and the estimated break-up / liquidation value of Epsilon's net assets as at 31/12/20X5 is 32.5 million. To move forward, Epsilon's management has proposed a capital reconstruction scheme which will require shareholders and debtholders to absorb the retained losses. The proposed reconstruction scheme involves: cancelling all existing ordinary shares and debentures, writing off losses and reducing net asset values to 35 million; issuing 50,000,000 new ordinary shares of 20 pence each, with existing shareholders receiving 30,000,000 ordinary 20 pence shares and existing debenture holders to be issued with 20,000,000 ordinary 20 pence shares; issuing 20,000,000 new 12.5% debentures of 1 each to be given to existing debenture holders. . Required: (a) Analyse the effect of liquidation by explaining the payoffs that debenture holders and ordinary shareholders will receive in the event of Epsilon plc going into liquidation. (4 marks) (b) Assuming Epsilon continues to operate, calculate the annual income that debenture holders and shareholders should expect with and without the proposed reconstruction taking place. (10 marks) (c) Using the information from (a) and (b) above, discuss which of the three alternative solutions (liquidate, continue with reconstruction, continue without reconstruction) would debenture holders and shareholders prefer and explain why. In your discussion include numerical estimations of the expected return and discuss risk. (6 marks) Total 20 marks End of Paper. Page 8 of 8