QUESTION 4 Fantech Co. a company producing the PC gaming devices like Logitech racing wheel, gamepad, headsets, keyboards, joysticks etc. to meet the high

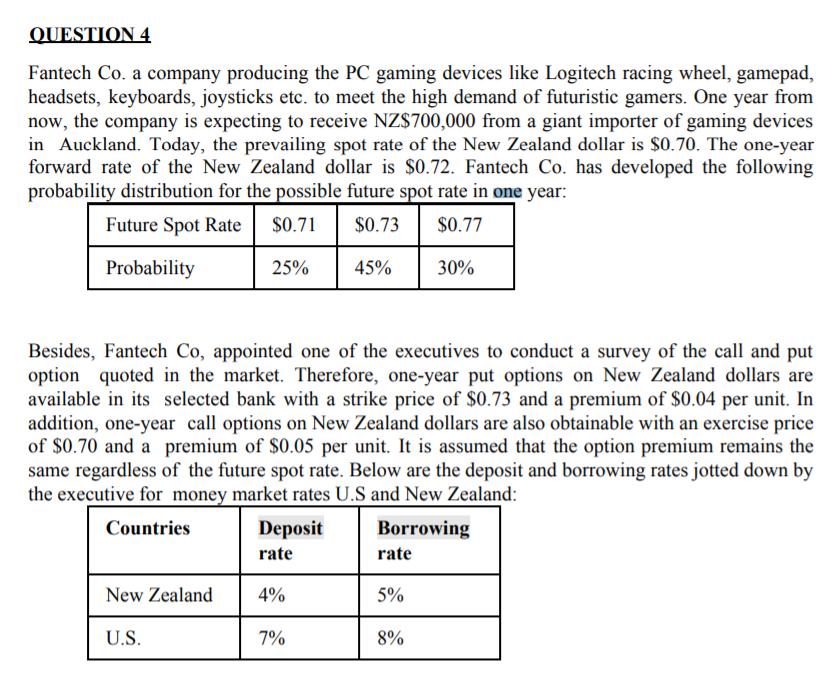

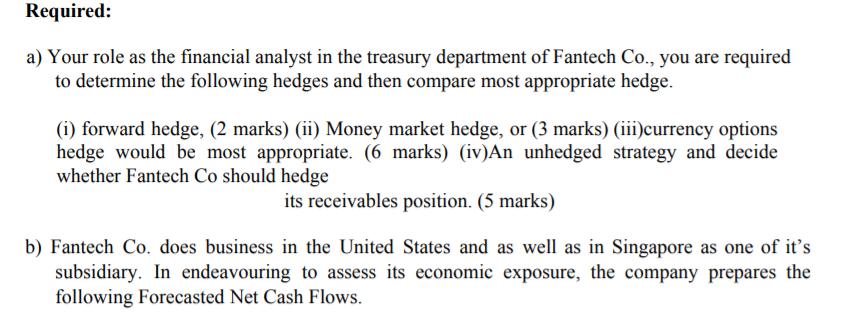

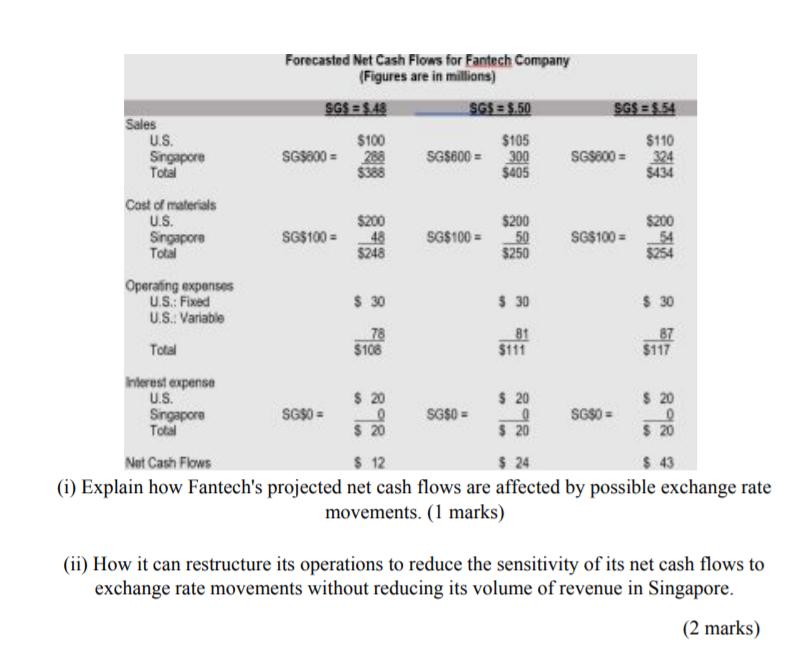

QUESTION 4 Fantech Co. a company producing the PC gaming devices like Logitech racing wheel, gamepad, headsets, keyboards, joysticks etc. to meet the high demand of futuristic gamers. One year from now, the company is expecting to receive NZ$700,000 from a giant importer of gaming devices in Auckland. Today, the prevailing spot rate of the New Zealand dollar is $0.70. The one-year forward rate of the New Zealand dollar is $0.72. Fantech Co. has developed the following probability distribution for the possible future spot rate in one year: Future Spot Rate $0.71 $0.73 $0.77 Probability 25% 45% 30% Besides, Fantech Co, appointed one of the executives to conduct a survey of the call and put option quoted in the market. Therefore, one-year put options on New Zealand dollars are available in its selected bank with a strike price of $0.73 and a premium of $0.04 per unit. In addition, one-year call options on New Zealand dollars are also obtainable with an exercise price of $0.70 and a premium of $0.05 per unit. It is assumed that the option premium remains the same regardless of the future spot rate. Below are the deposit and borrowing rates jotted down by the executive for money market rates U.S and New Zealand: Countries Deposit Borrowing rate rate New Zealand 4% 5% U.S. 7% 8% Required: a) Your role as the financial analyst in the treasury department of Fantech Co., you are required to determine the following hedges and then compare most appropriate hedge. (i) forward hedge, (2 marks) (ii) Money market hedge, or (3 marks) (iii)currency options hedge would be most appropriate. (6 marks) (iv)An unhedged strategy and decide whether Fantech Co should hedge its receivables position. (5 marks) b) Fantech Co. does business in the United States and as well as in Singapore as one of it's subsidiary. In endeavouring to assess its economic exposure, the company prepares the following Forecasted Net Cash Flows. Forecasted Net Cash Flows for Fantech Company (Figures are in millions) SGS = $48 SGS = $.50 SGS = $.54 Sales U.S. Singapore Total $100 $105 SGS600 = 300 $405 $110 SGS800 = 324 $434 SGS00 = 288 $388 Cost of materials U.S. $200 48 $248 $200 54 $254 $200 SG$100 = Singapore Total SG$100 = 50 SG$100 = $250 Operafing expenses U.S. Fixed U.S. Variable $ 30 $ 30 $ 30 78 $108 81 $111 87 $117 Total Interest expense U.S. $ 20 $ 20 $ 20 Singapore Total SGS0 = $ 20 SGS0 = SGS0 = $ 20 $ 20 $ 24 $ 12 (i) Explain how Fantech's projected net cash flows are affected by possible exchange rate movements. (1 marks) Net Cash Flows $ 43 (ii) How it can restructure its operations to reduce the sensitivity of its net cash flows to exchange rate movements without reducing its volume of revenue in Singapore. (2 marks) (iii) The Singapore dollar has weakened after their central bank announced for the currency easing if the economy weakened due to the impact of the coronavirus outbreak. Explain how can Fantech hedge its translation exposure when the company has badly affected with depreciation of Singapore Dollar? (1 marks) [Total: 20 marks]

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Your role as the financial analyst in the treasury department of Fantech Co you are required to de...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started