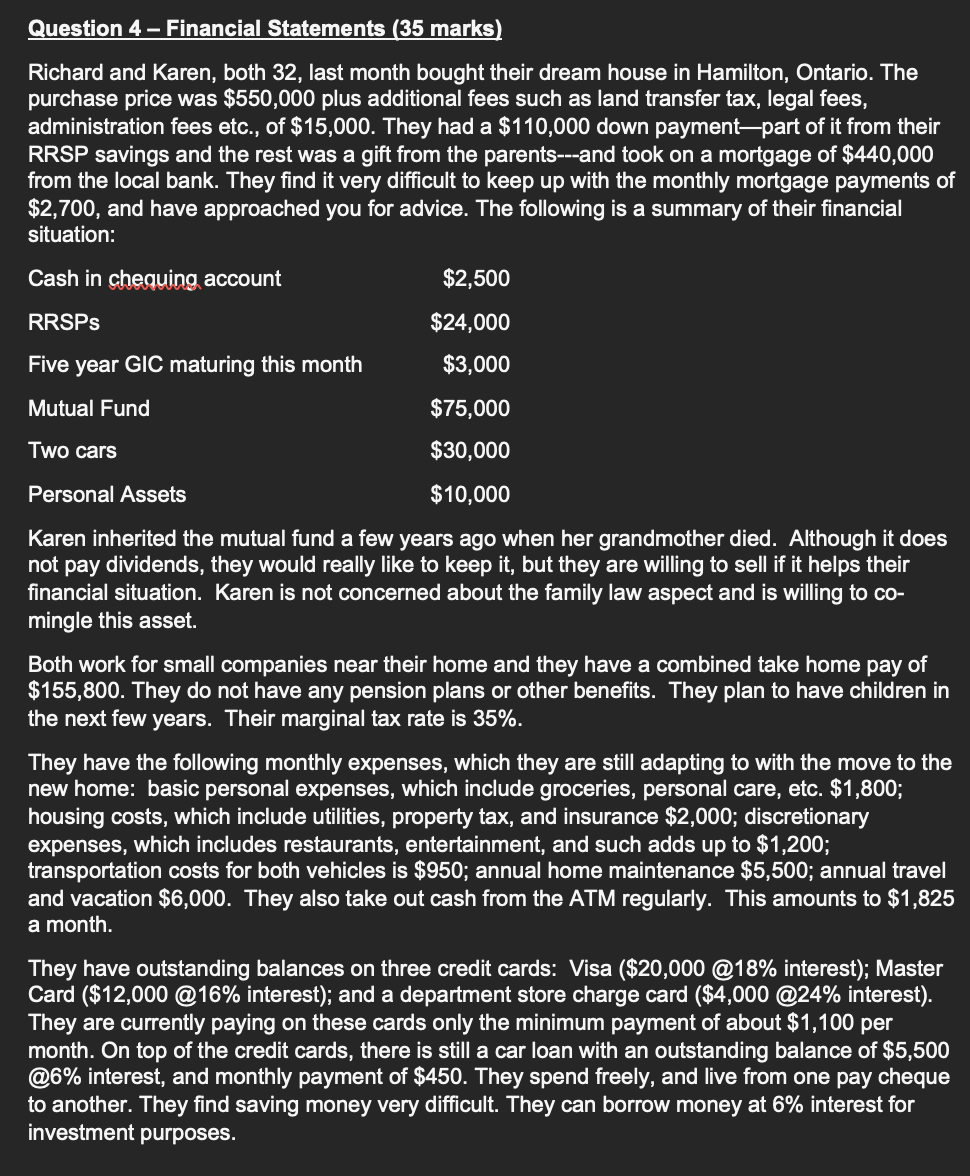

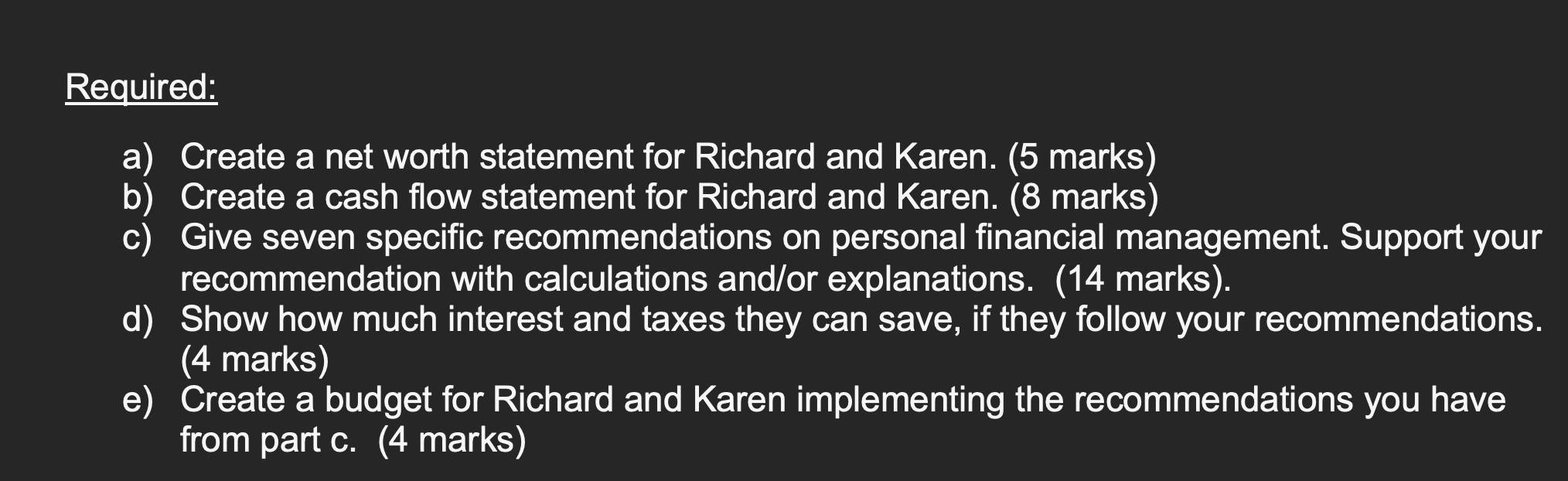

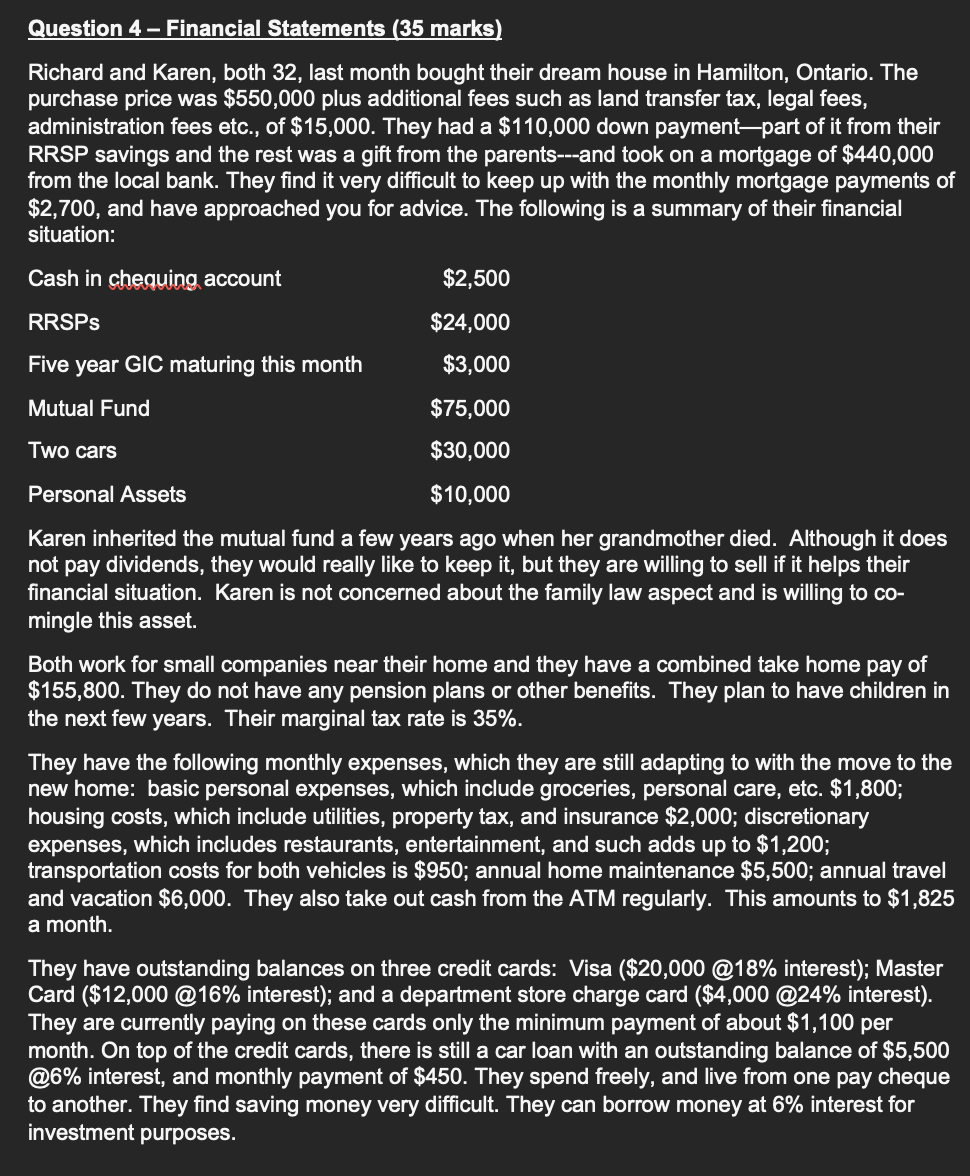

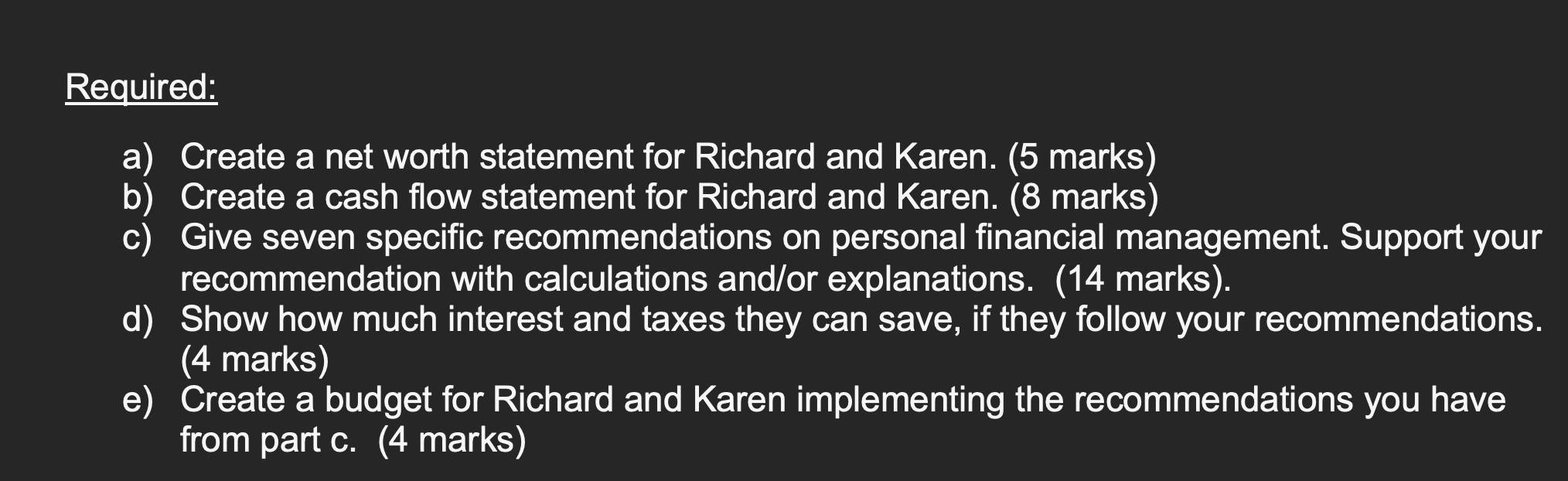

Question 4 - Financial Statements (35 marks) Richard and Karen, both 32 , last month bought their dream house in Hamilton, Ontario. The purchase price was $550,000 plus additional fees such as land transfer tax, legal fees, administration fees etc., of $15,000. They had a $110,000 down payment-part of it from their RRSP savings and the rest was a gift from the parents---and took on a mortgage of $440,000 from the local bank. They find it very difficult to keep up with the monthly mortgage payments of $2,700, and have approached you for advice. The following is a summary of their financial situation: Karen inherited the mutual fund a few years ago when her grandmother died. Although it does not pay dividends, they would really like to keep it, but they are willing to sell if it helps their financial situation. Karen is not concerned about the family law aspect and is willing to comingle this asset. Both work for small companies near their home and they have a combined take home pay of $155,800. They do not have any pension plans or other benefits. They plan to have children in the next few years. Their marginal tax rate is 35%. They have the following monthly expenses, which they are still adapting to with the move to the new home: basic personal expenses, which include groceries, personal care, etc. $1,800; housing costs, which include utilities, property tax, and insurance $2,000; discretionary expenses, which includes restaurants, entertainment, and such adds up to $1,200; transportation costs for both vehicles is $950; annual home maintenance $5,500; annual travel and vacation $6,000. They also take out cash from the ATM regularly. This amounts to $1,825 a month. They have outstanding balances on three credit cards: Visa ( $20,000@18% interest); Master Card (\$12,000@16\% interest); and a department store charge card (\$4,000@24\% interest). They are currently paying on these cards only the minimum payment of about $1,100 per month. On top of the credit cards, there is still a car loan with an outstanding balance of $5,500 @6\% interest, and monthly payment of $450. They spend freely, and live from one pay cheque to another. They find saving money very difficult. They can borrow money at 6% interest for investment purposes. Required: a) Create a net worth statement for Richard and Karen. (5 marks) b) Create a cash flow statement for Richard and Karen. (8 marks) c) Give seven specific recommendations on personal financial management. Support your recommendation with calculations and/or explanations. (14 marks). d) Show how much interest and taxes they can save, if they follow your recommendations. (4 marks) e) Create a budget for Richard and Karen implementing the recommendations you have from part c. (4 marks)