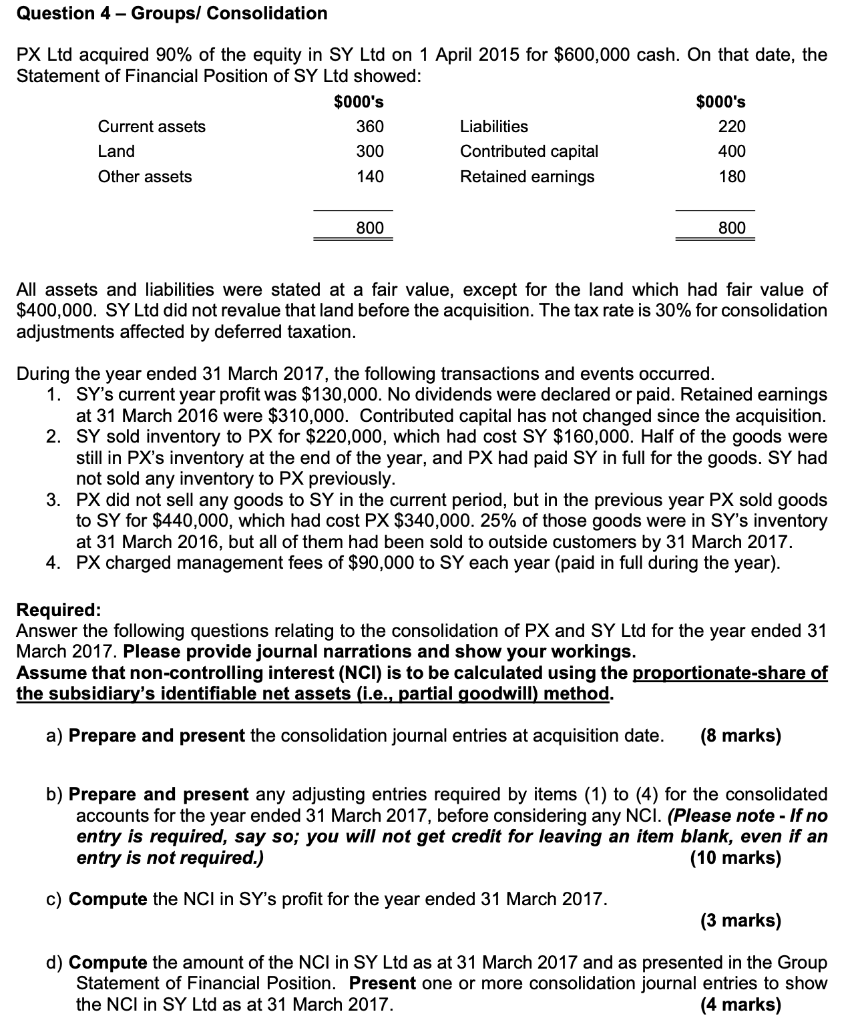

Question 4 - Groups/ Consolidation PX Ltd acquired 90% of the equity in SY Ltd on 1 April 2015 for $600,000 cash. On that date, the Statement of Financial Position of SY Ltd showed: $000's $000's Current assets 360 Liabilities 220 Land 300 Contributed capital 400 Other assets Retained earnings 180 140 800 800 All assets and liabilities were stated at a fair value, except for the land which had fair value of $400,000. SY Ltd did not revalue that land before the acquisition. The tax rate is 30% for consolidation adjustments affected by deferred taxation. During the year ended 31 March 2017, the following transactions and events occurred. 1. SY's current year profit was $130,000. No dividends were declared or paid. Retained earnings at 31 March 2016 were $310,000. Contributed capital has not changed since the acquisition. 2. SY sold inventory to PX for $220,000, which had cost SY $160,000. Half of the goods were still in PX's inventory at the end of the year, and PX had paid SY in full for the goods. SY had not sold any inventory to PX previously. 3. PX did not sell any goods to SY in the current period, but in the previous year PX sold goods to SY for $440,000, which had cost PX $340,000. 25% of those goods were in SY's inventory at 31 March 2016, but all of them had been sold to outside customers by 31 March 2017. 4. PX charged management fees of $90,000 to SY each year (paid in full during the year). Required: Answer the following questions relating to the consolidation of PX and SY Ltd for the year ended 31 March 2017. Please provide journal narrations and show your workings. Assume that non-controlling interest (NCI) is to be calculated using the proportionate-share of the subsidiary's identifiable net assets (i.e., partial goodwill) method. a) Prepare and present the consolidation journal entries at acquisition date. (8 marks) b) Prepare and present any adjusting entries required by items (1) to (4) for the consolidated accounts for the year ended 31 March 2017, before considering any NCI. (Please note - If no entry is required, say so; you will not get credit for leaving an item blank, even if an entry is not required.) (10 marks) c) Compute the NCI in SY's profit for the year ended 31 March 2017. (3 marks) d) Compute the amount of the NCI in SY Ltd as at 31 March 2017 and as presented in the Group Statement of Financial Position. Present one or more consolidation journal entries to show the NCI in SY Ltd as at 31 March 2017. (4 marks)