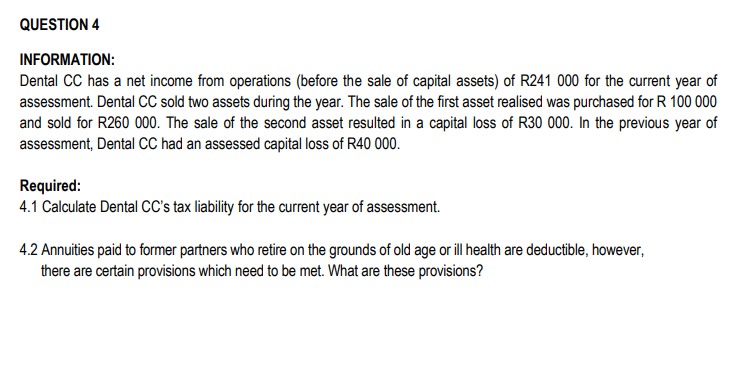

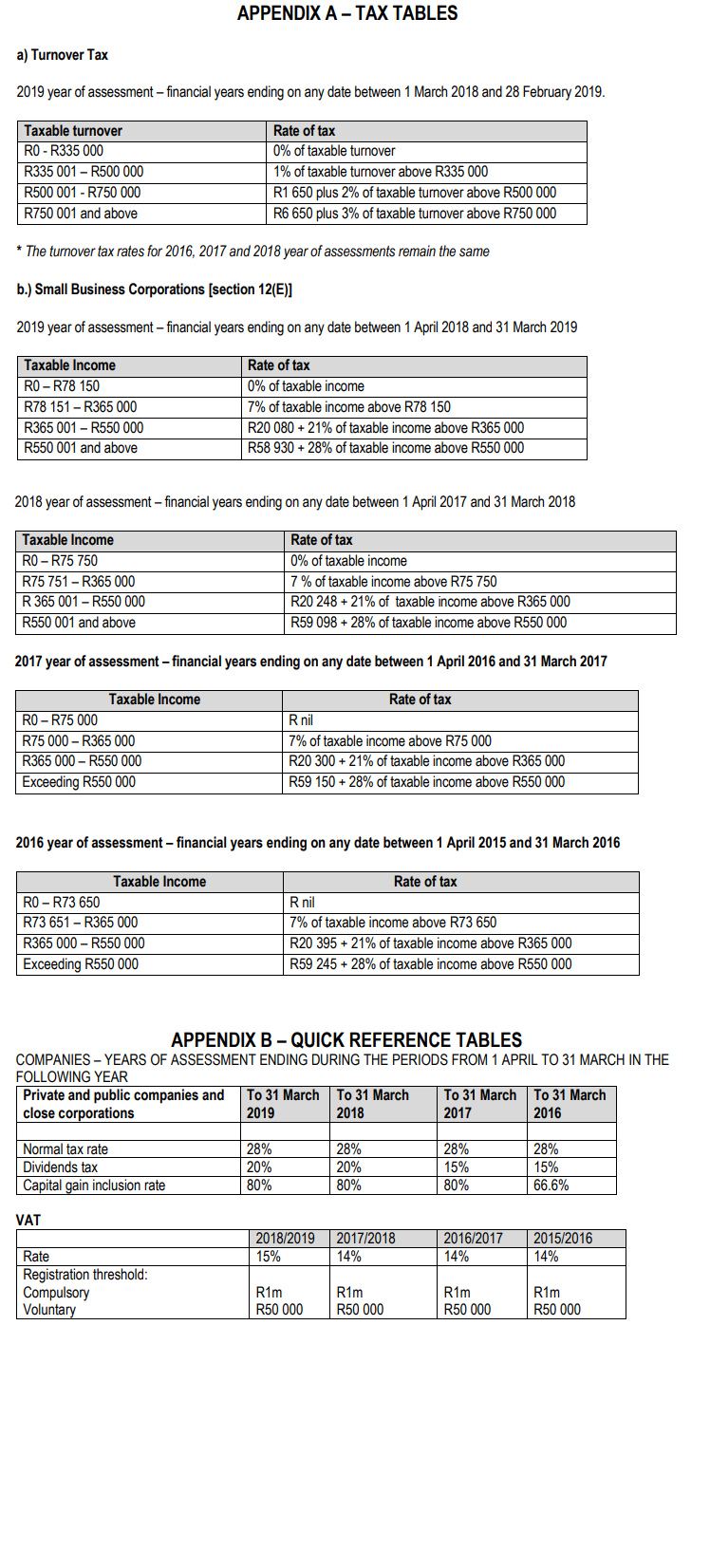

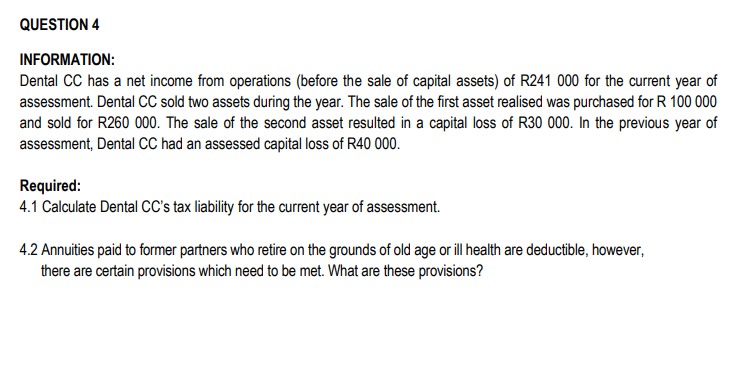

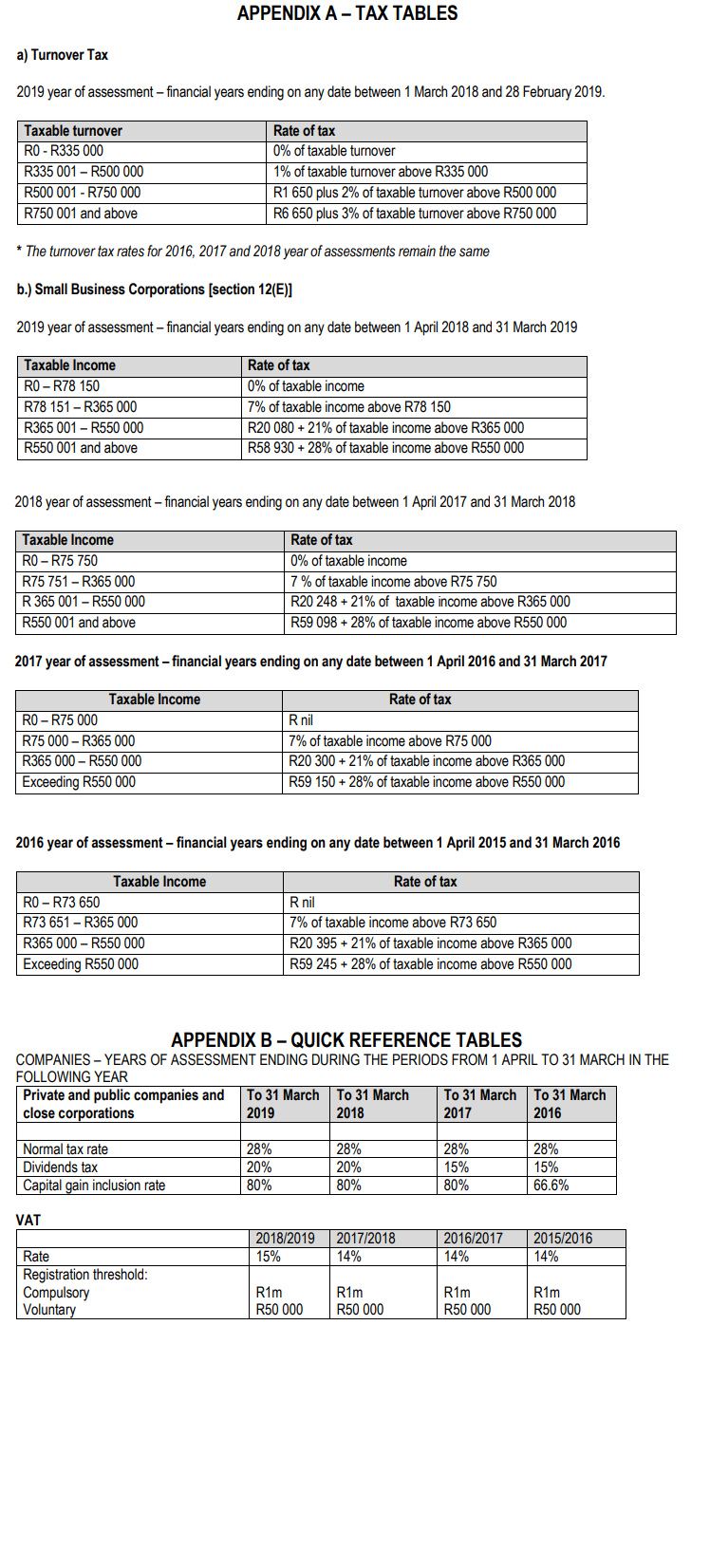

QUESTION 4 INFORMATION: Dental CC has a net income from operations (before the sale of capital assets) of R241 000 for the current year of assessment. Dental CC sold two assets during the year. The sale of the first asset realised was purchased for R 100 000 and sold for R260 000. The sale of the second asset resulted in a capital loss of R30 000. In the previous year of assessment, Dental CC had an assessed capital loss of R40 000. Required: 4.1 Calculate Dental CC's tax liability for the current year of assessment. 4.2 Annuities paid to former partners who retire on the grounds of old age or ill health are deductible, however, there are certain provisions which need to be met. What are these provisions? APPENDIX A-TAX TABLES a) Turnover Tax 2019 year of assessment - financial years ending on any date between 1 March 2018 and 28 February 2019. Taxable turnover RO - R335 000 R335 001 - R500 000 R500 001 - R750 000 R750 001 and above Rate of tax 0% of taxable turnover 1% of taxable turnover above R335 000 R1 650 plus 2% of taxable turnover above R500 000 R6 650 plus 3% of taxable turnover above R750 000 * The turnover tax rates for 2016, 2017 and 2018 year of assessments remain the same b.) Small Business Corporations (section 12(E)] 2019 year of assessment - financial years ending on any date between 1 April 2018 and 31 March 2019 Taxable income RO - R78 150 R78 151 - R365 000 R365 001 - R550 000 R550 001 and above Rate of tax 0% of taxable income 7% of taxable income above R78 150 R20 080 + 21% of taxable income above R365 000 R58 930 + 28% of taxable income above R550 000 2018 year of assessment - financial years ending on any date between 1 April 2017 and 31 March 2018 Taxable income RO-R75 750 R75 751 - R365 000 R 365 001 - R550 000 R550 001 and above Rate of tax 0% of taxable income 7% of taxable income above R75 750 R20 248 +21% of taxable income above R365 000 R59 098 + 28% of taxable income above R550 000 2017 year of assessment - financial years ending on any date between 1 April 2016 and 31 March 2017 Taxable income RO-R75 000 R75 000 - R365 000 R365 000 - R550 000 Exceeding R550 000 Rate of tax R nil 7% of taxable income above R75 000 R20 300 + 21% of taxable income above R365 000 R59 150 + 28% of taxable income above R550 000 2016 year of assessment - financial years ending on any date between 1 April 2015 and 31 March 2016 Taxable income RO - R73 650 R73 651 -R365 000 R365 000 - R550 000 Exceeding R550 000 Rate of tax R nil 7% of taxable income above R73 650 R20 395 + 21% of taxable income above R365 000 R59 245 +28% of taxable income above R550 000 APPENDIX B-QUICK REFERENCE TABLES COMPANIES - YEARS OF ASSESSMENT ENDING DURING THE PERIODS FROM 1 APRIL TO 31 MARCH IN THE FOLLOWING YEAR Private and public companies and To 31 MarchTo 31 March To 31 March To 31 March close corporations 2019 2018 2017 2016 Normal tax rate Dividends tax Capital gain inclusion rate 28% 20% 80% 28% 20% 80% 28% 15% 80% 28% 15% 66.6% VAT 2018/2019 15% 2017/2018 14% 2016/2017 14% 2015/2016 14% Rate Registration threshold: Compulsory Voluntary R1m R50 000 R1m R50 000 R1m R50 000 R1m R50 000 QUESTION 4 INFORMATION: Dental CC has a net income from operations (before the sale of capital assets) of R241 000 for the current year of assessment. Dental CC sold two assets during the year. The sale of the first asset realised was purchased for R 100 000 and sold for R260 000. The sale of the second asset resulted in a capital loss of R30 000. In the previous year of assessment, Dental CC had an assessed capital loss of R40 000. Required: 4.1 Calculate Dental CC's tax liability for the current year of assessment. 4.2 Annuities paid to former partners who retire on the grounds of old age or ill health are deductible, however, there are certain provisions which need to be met. What are these provisions? APPENDIX A-TAX TABLES a) Turnover Tax 2019 year of assessment - financial years ending on any date between 1 March 2018 and 28 February 2019. Taxable turnover RO - R335 000 R335 001 - R500 000 R500 001 - R750 000 R750 001 and above Rate of tax 0% of taxable turnover 1% of taxable turnover above R335 000 R1 650 plus 2% of taxable turnover above R500 000 R6 650 plus 3% of taxable turnover above R750 000 * The turnover tax rates for 2016, 2017 and 2018 year of assessments remain the same b.) Small Business Corporations (section 12(E)] 2019 year of assessment - financial years ending on any date between 1 April 2018 and 31 March 2019 Taxable income RO - R78 150 R78 151 - R365 000 R365 001 - R550 000 R550 001 and above Rate of tax 0% of taxable income 7% of taxable income above R78 150 R20 080 + 21% of taxable income above R365 000 R58 930 + 28% of taxable income above R550 000 2018 year of assessment - financial years ending on any date between 1 April 2017 and 31 March 2018 Taxable income RO-R75 750 R75 751 - R365 000 R 365 001 - R550 000 R550 001 and above Rate of tax 0% of taxable income 7% of taxable income above R75 750 R20 248 +21% of taxable income above R365 000 R59 098 + 28% of taxable income above R550 000 2017 year of assessment - financial years ending on any date between 1 April 2016 and 31 March 2017 Taxable income RO-R75 000 R75 000 - R365 000 R365 000 - R550 000 Exceeding R550 000 Rate of tax R nil 7% of taxable income above R75 000 R20 300 + 21% of taxable income above R365 000 R59 150 + 28% of taxable income above R550 000 2016 year of assessment - financial years ending on any date between 1 April 2015 and 31 March 2016 Taxable income RO - R73 650 R73 651 -R365 000 R365 000 - R550 000 Exceeding R550 000 Rate of tax R nil 7% of taxable income above R73 650 R20 395 + 21% of taxable income above R365 000 R59 245 +28% of taxable income above R550 000 APPENDIX B-QUICK REFERENCE TABLES COMPANIES - YEARS OF ASSESSMENT ENDING DURING THE PERIODS FROM 1 APRIL TO 31 MARCH IN THE FOLLOWING YEAR Private and public companies and To 31 MarchTo 31 March To 31 March To 31 March close corporations 2019 2018 2017 2016 Normal tax rate Dividends tax Capital gain inclusion rate 28% 20% 80% 28% 20% 80% 28% 15% 80% 28% 15% 66.6% VAT 2018/2019 15% 2017/2018 14% 2016/2017 14% 2015/2016 14% Rate Registration threshold: Compulsory Voluntary R1m R50 000 R1m R50 000 R1m R50 000 R1m R50 000