Question 4 is top priority

Question 4 is top priority

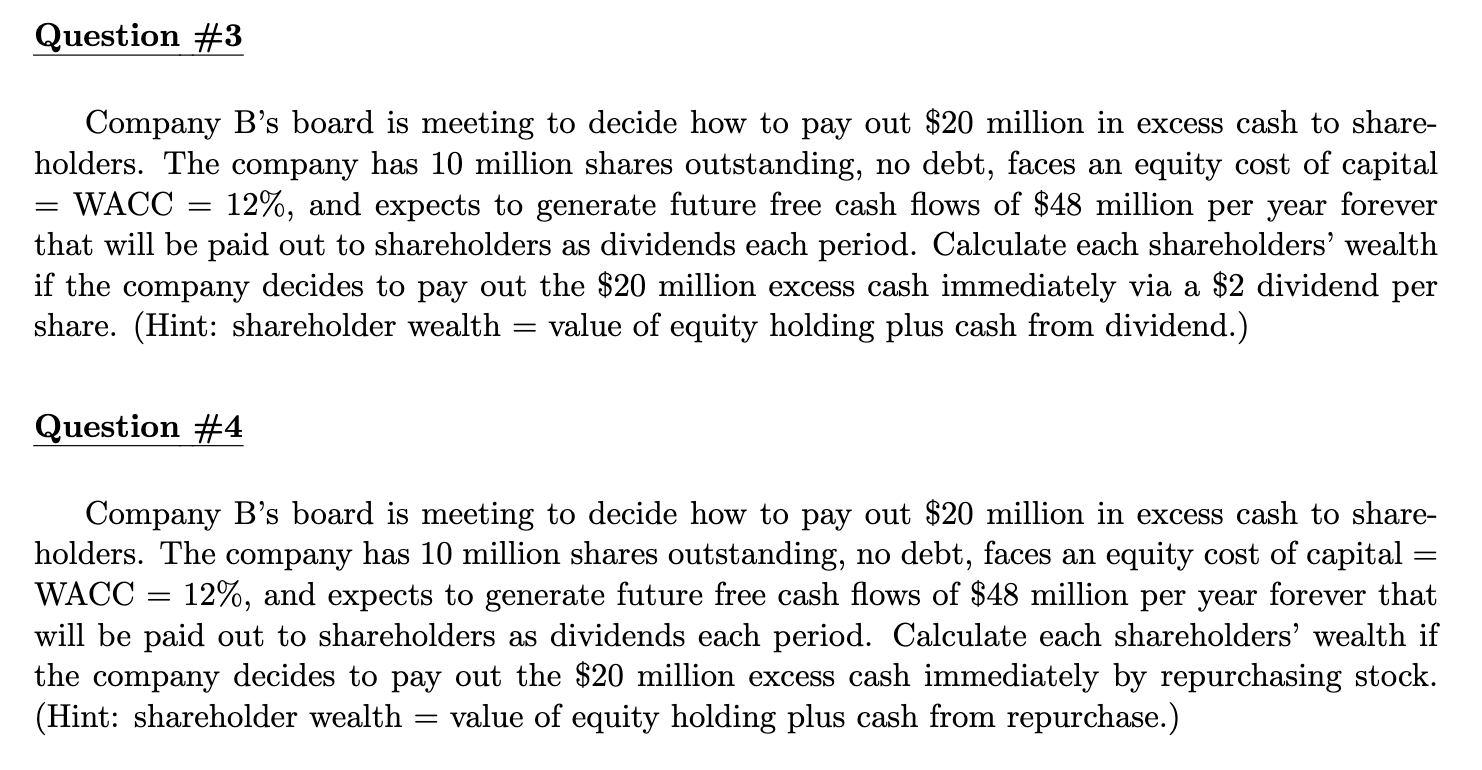

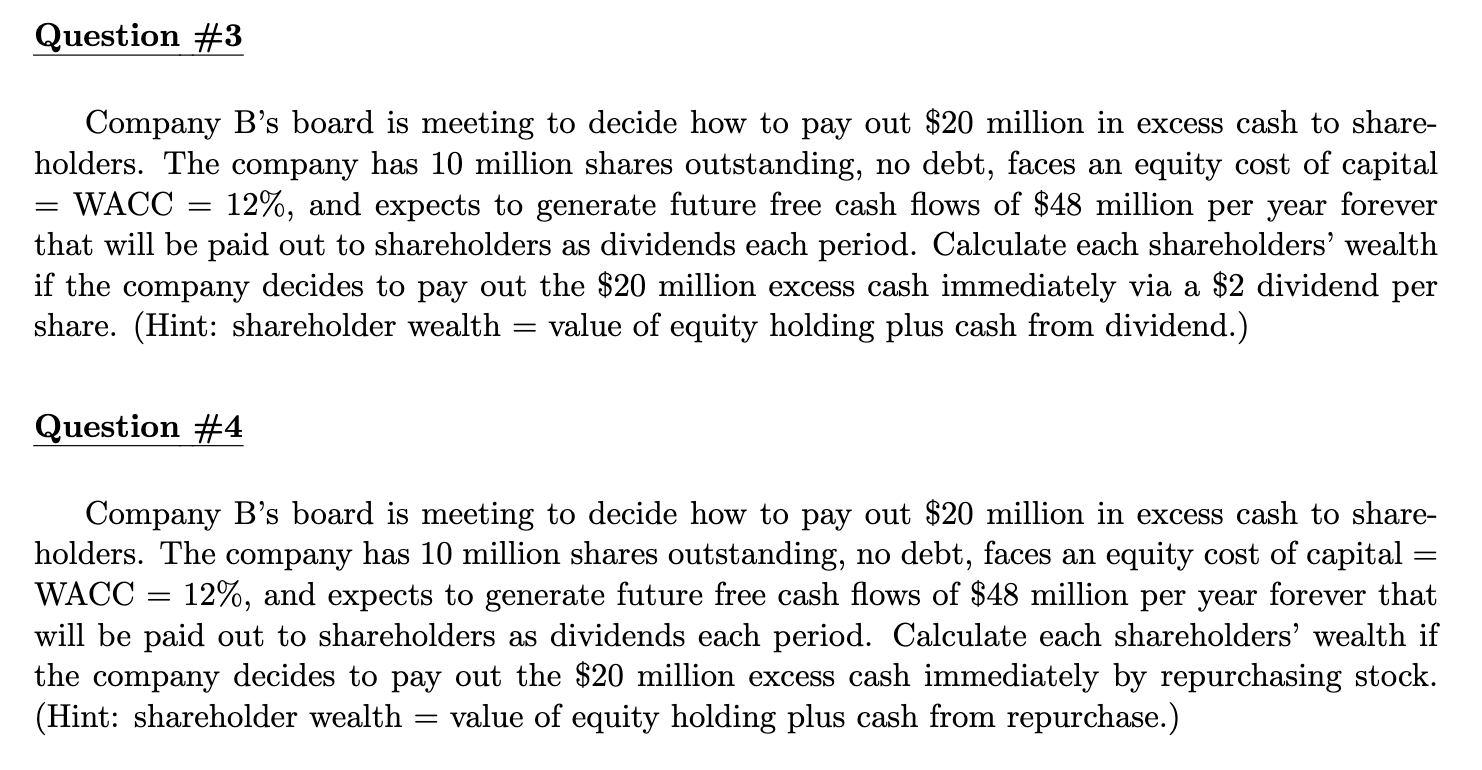

Company B's board is meeting to decide how to pay out $20 million in excess cash to shareholders. The company has 10 million shares outstanding, no debt, faces an equity cost of capital = WACC =12%, and expects to generate future free cash flows of $48 million per year forever that will be paid out to shareholders as dividends each period. Calculate each shareholders' wealth if the company decides to pay out the $20 million excess cash immediately via a $2 dividend per share. (Hint: shareholder wealth = value of equity holding plus cash from dividend.) Question \#4 Company B's board is meeting to decide how to pay out $20 million in excess cash to shareholders. The company has 10 million shares outstanding, no debt, faces an equity cost of capital = WACC =12%, and expects to generate future free cash flows of $48 million per year forever that will be paid out to shareholders as dividends each period. Calculate each shareholders' wealth if the company decides to pay out the $20 million excess cash immediately by repurchasing stock. (Hint: shareholder wealth = value of equity holding plus cash from repurchase.) Company B's board is meeting to decide how to pay out $20 million in excess cash to shareholders. The company has 10 million shares outstanding, no debt, faces an equity cost of capital = WACC =12%, and expects to generate future free cash flows of $48 million per year forever that will be paid out to shareholders as dividends each period. Calculate each shareholders' wealth if the company decides to pay out the $20 million excess cash immediately via a $2 dividend per share. (Hint: shareholder wealth = value of equity holding plus cash from dividend.) Question \#4 Company B's board is meeting to decide how to pay out $20 million in excess cash to shareholders. The company has 10 million shares outstanding, no debt, faces an equity cost of capital = WACC =12%, and expects to generate future free cash flows of $48 million per year forever that will be paid out to shareholders as dividends each period. Calculate each shareholders' wealth if the company decides to pay out the $20 million excess cash immediately by repurchasing stock. (Hint: shareholder wealth = value of equity holding plus cash from repurchase.)

Question 4 is top priority

Question 4 is top priority