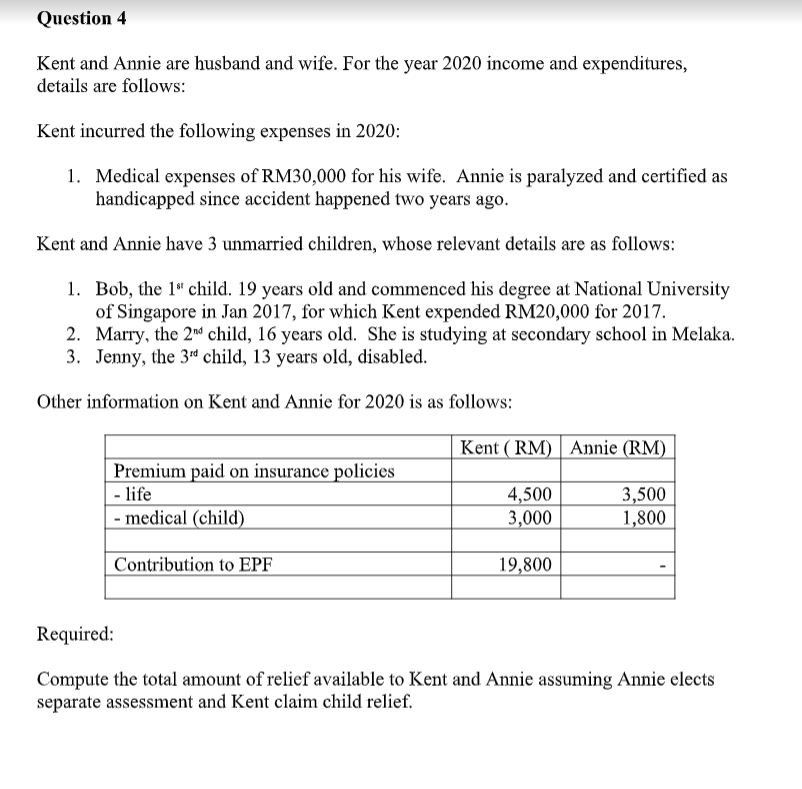

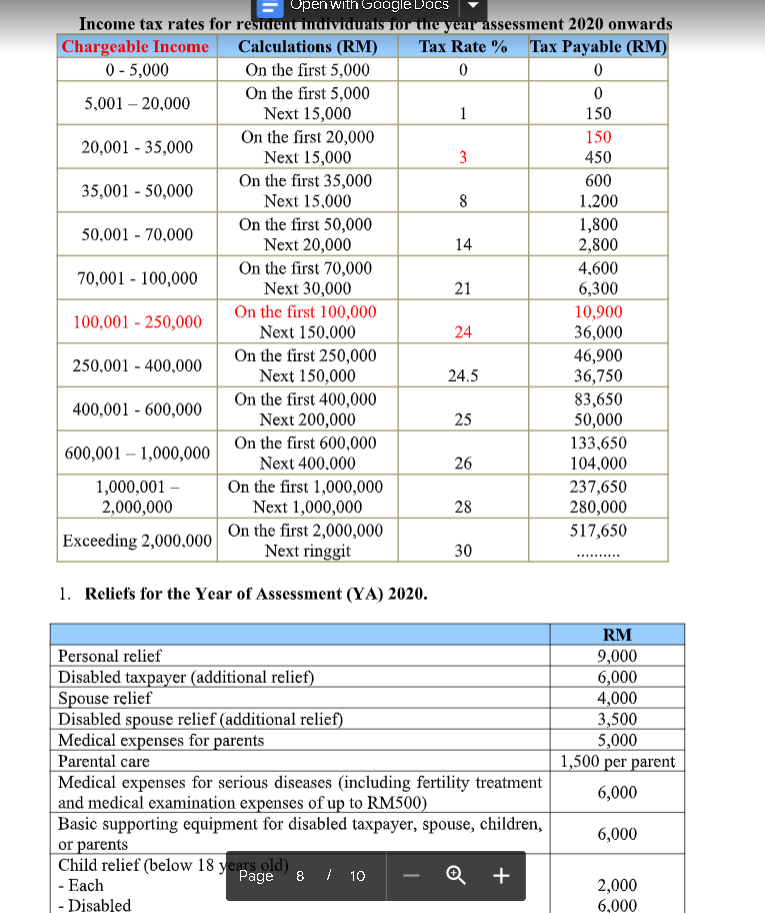

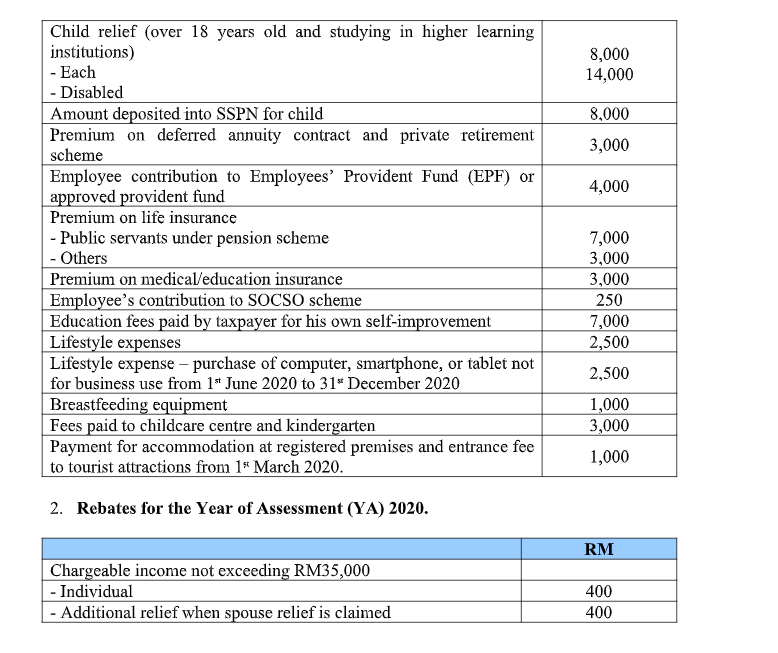

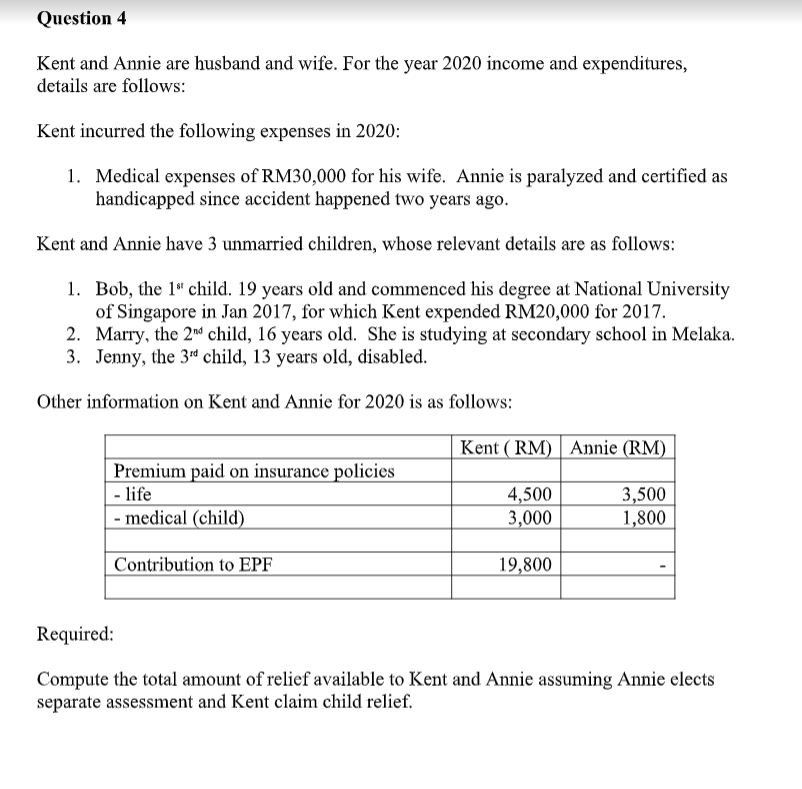

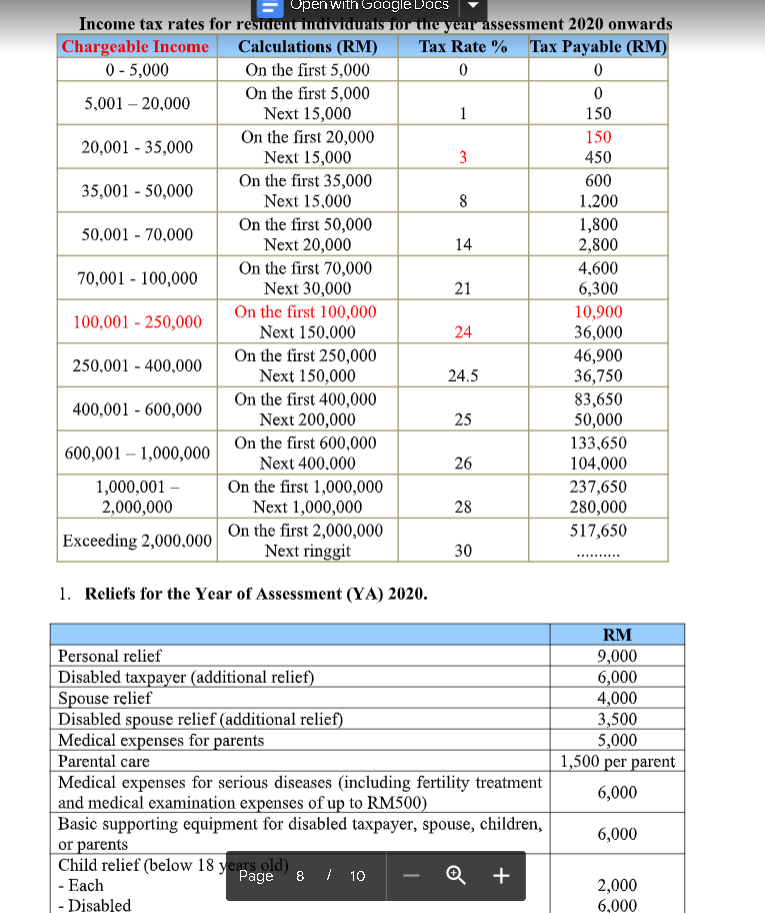

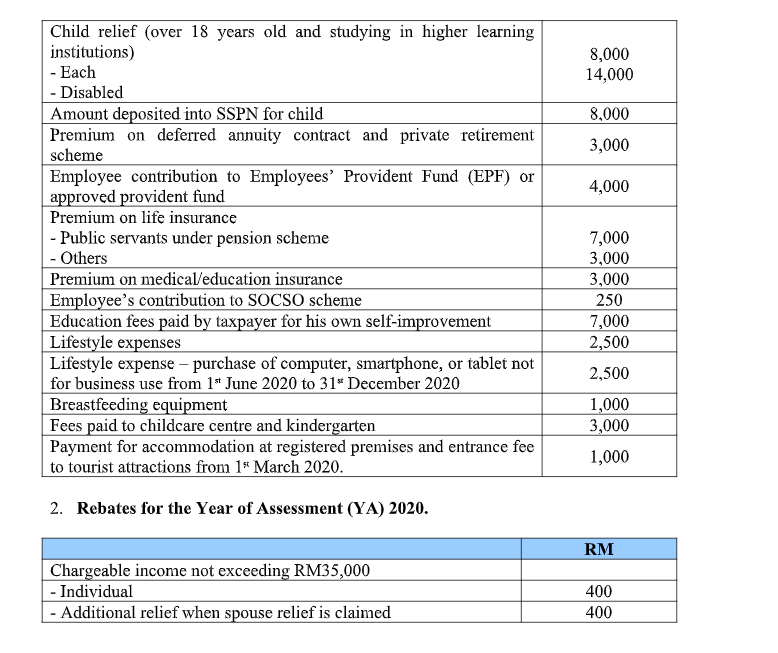

Question 4 Kent and Annie are husband and wife. For the year 2020 income and expenditures, details are follows: Kent incurred the following expenses in 2020: 1. Medical expenses of RM30,000 for his wife. Annie is paralyzed and certified as handicapped since accident happened two years ago. Kent and Annie have 3 unmarried children, whose relevant details are as follows: 1. Bob, the 1" child. 19 years old and commenced his degree at National University of Singapore in Jan 2017, for which Kent expended RM20,000 for 2017. 2. Marry, the 2nd child, 16 years old. She is studying at secondary school in Melaka. 3. Jenny, the 3rd child, 13 years old, disabled. Other information on Kent and Annie for 2020 is as follows: Kent (RM) Annie (RM) Premium paid on insurance policies - life - medical (child) 4,500 3,000 3,500 1,800 Contribution to EPF 19,800 Required: Compute the total amount of relief available to Kent and Annie assuming Annie elects separate assessment and Kent claim child relief. 3 - Open with Google Docs Income tax rates for resident Muiviuuais for the year assessment 2020 onwards Chargeable Income Calculations (RM) Tax Rate % Tax Payable (RM) 0 - 5,000 On the first 5,000 0 0 5,001 - 20,000 On the first 5,000 0 Next 15,000 1 150 On the first 20,000 150 20,001 - 35,000 Next 15,000 3 450 35,001 - 50,000 600 On the first 35,000 Next 15,000 8 1.200 On the first 50,000 1,800 50,001 - 70,000 Next 20,000 14 2,800 On the first 70,000 4,600 70,001 - 100,000 Next 30,000 21 6,300 On the first 100,000 10,900 100,001 - 250,000 Next 150.000 24 36,000 On the first 250,000 46,900 250,001 - 400,000 Next 150,000 24.5 36,750 On the first 400,000 400,001 - 600,000 83,650 Next 200,000 25 50,000 600,001 - 1,000,000 On the first 600,000 133,650 Next 400.000 26 104.000 1,000,001 - On the first 1,000,000 237,650 2,000,000 Next 1,000,000 28 280,000 On the first 2,000,000 Exceeding 2,000,000 517,650 Next ringgit 30 1. Reliefs for the Year of Assessment (YA) 2020. Personal relief Disabled taxpayer (additional relief) Spouse relief Disabled spouse relief (additional relief) Medical expenses for parents Parental care Medical expenses for serious diseases (including fertility treatment and medical examination expenses of up to RM500) Basic supporting equipment for disabled taxpayer, spouse, children, or parents Child relief (below 18 years old) Page 8 / 10 + - Each - Disabled RM 9,000 6,000 4,000 3,500 5,000 1,500 per parent 6,000 6,000 2,000 6,000 8,000 14,000 8,000 3,000 4,000 Child relief (over 18 years old and studying in higher learning institutions) - Each - Disabled Amount deposited into SSPN for child Premium on deferred annuity contract and private retirement scheme Employee contribution to Employees' Provident Fund (EPF) or approved provident fund Premium on life insurance - Public servants under pension scheme - Others Premium on medical/education insurance Employee's contribution to SOCSO scheme Education fees paid by taxpayer for his own self-improvement Lifestyle expenses Lifestyle expense - purchase of computer, smartphone, or tablet not for business use from 1* June 2020 to 31* December 2020 Breastfeeding equipment Fees paid to childcare centre and kindergarten Payment for accommodation at registered premises and entrance fee to tourist attractions from 15 March 2020. 7,000 3,000 3,000 250 7,000 2,500 2,500 1,000 3,000 1,000 2. Rebates for the Year of Assessment (YA) 2020. RM Chargeable income not exceeding RM35,000 - Individual - Additional relief when spouse relief is claimed 400 400 Question 4 Kent and Annie are husband and wife. For the year 2020 income and expenditures, details are follows: Kent incurred the following expenses in 2020: 1. Medical expenses of RM30,000 for his wife. Annie is paralyzed and certified as handicapped since accident happened two years ago. Kent and Annie have 3 unmarried children, whose relevant details are as follows: 1. Bob, the 1" child. 19 years old and commenced his degree at National University of Singapore in Jan 2017, for which Kent expended RM20,000 for 2017. 2. Marry, the 2nd child, 16 years old. She is studying at secondary school in Melaka. 3. Jenny, the 3rd child, 13 years old, disabled. Other information on Kent and Annie for 2020 is as follows: Kent (RM) Annie (RM) Premium paid on insurance policies - life - medical (child) 4,500 3,000 3,500 1,800 Contribution to EPF 19,800 Required: Compute the total amount of relief available to Kent and Annie assuming Annie elects separate assessment and Kent claim child relief. 3 - Open with Google Docs Income tax rates for resident Muiviuuais for the year assessment 2020 onwards Chargeable Income Calculations (RM) Tax Rate % Tax Payable (RM) 0 - 5,000 On the first 5,000 0 0 5,001 - 20,000 On the first 5,000 0 Next 15,000 1 150 On the first 20,000 150 20,001 - 35,000 Next 15,000 3 450 35,001 - 50,000 600 On the first 35,000 Next 15,000 8 1.200 On the first 50,000 1,800 50,001 - 70,000 Next 20,000 14 2,800 On the first 70,000 4,600 70,001 - 100,000 Next 30,000 21 6,300 On the first 100,000 10,900 100,001 - 250,000 Next 150.000 24 36,000 On the first 250,000 46,900 250,001 - 400,000 Next 150,000 24.5 36,750 On the first 400,000 400,001 - 600,000 83,650 Next 200,000 25 50,000 600,001 - 1,000,000 On the first 600,000 133,650 Next 400.000 26 104.000 1,000,001 - On the first 1,000,000 237,650 2,000,000 Next 1,000,000 28 280,000 On the first 2,000,000 Exceeding 2,000,000 517,650 Next ringgit 30 1. Reliefs for the Year of Assessment (YA) 2020. Personal relief Disabled taxpayer (additional relief) Spouse relief Disabled spouse relief (additional relief) Medical expenses for parents Parental care Medical expenses for serious diseases (including fertility treatment and medical examination expenses of up to RM500) Basic supporting equipment for disabled taxpayer, spouse, children, or parents Child relief (below 18 years old) Page 8 / 10 + - Each - Disabled RM 9,000 6,000 4,000 3,500 5,000 1,500 per parent 6,000 6,000 2,000 6,000 8,000 14,000 8,000 3,000 4,000 Child relief (over 18 years old and studying in higher learning institutions) - Each - Disabled Amount deposited into SSPN for child Premium on deferred annuity contract and private retirement scheme Employee contribution to Employees' Provident Fund (EPF) or approved provident fund Premium on life insurance - Public servants under pension scheme - Others Premium on medical/education insurance Employee's contribution to SOCSO scheme Education fees paid by taxpayer for his own self-improvement Lifestyle expenses Lifestyle expense - purchase of computer, smartphone, or tablet not for business use from 1* June 2020 to 31* December 2020 Breastfeeding equipment Fees paid to childcare centre and kindergarten Payment for accommodation at registered premises and entrance fee to tourist attractions from 15 March 2020. 7,000 3,000 3,000 250 7,000 2,500 2,500 1,000 3,000 1,000 2. Rebates for the Year of Assessment (YA) 2020. RM Chargeable income not exceeding RM35,000 - Individual - Additional relief when spouse relief is claimed 400 400