Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Langanga Auto Springs Company requires a total of 20,000 bars of steel (10 meters each) of inventory for a production run. Assume that

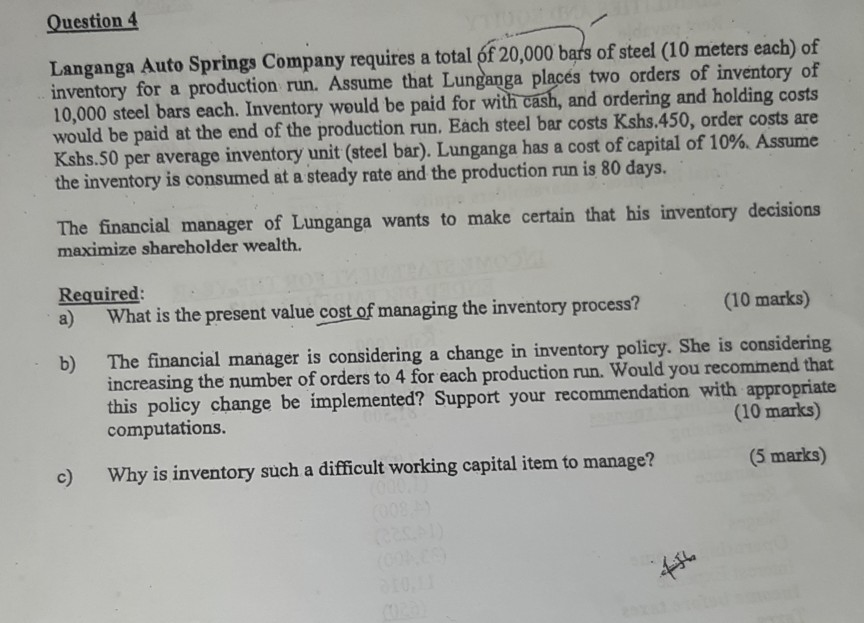

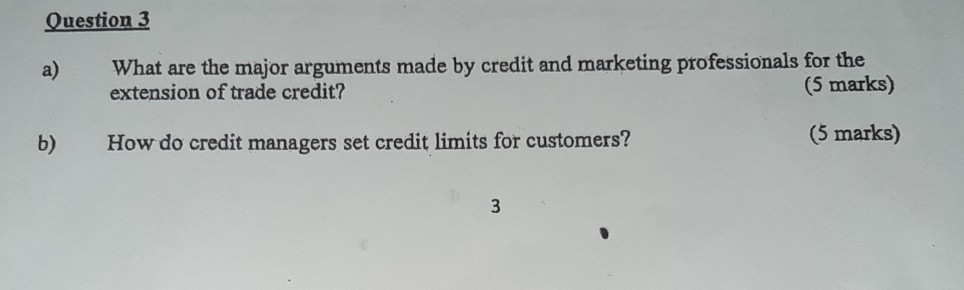

Question 4 Langanga Auto Springs Company requires a total of 20,000 bars of steel (10 meters each) of inventory for a production run. Assume that Lunganga places two orders of inventory of 10,000 steel bars each. Inventory would be paid for with cash, and ordering and holding costs would be paid at the end of the production run. Each steel bar costs Kshs.450, order costs are Kshs.50 per average inventory unit (steel bar). Lunganga has a cost of capital of 10% Assume the inventory is consumed at a steady rate and the production run is 80 days. The financial manager of Lunganga wants to make certain that his inventory decisions maximize shareholder wealth. Required: What is the present value cost of managing the inventory process? a) (10 marks) The financial manager is considering a change in inventory policy. She is considering b) increasing the number of orders to 4 for each production run. Would you recommend that this policy change be implemented? Support your recommendation with appropriate computations. (10 marks) c) Why is inventory such a difficult working capital item to manage? 00 (5 marks) Question 3 What are the major arguments made by credit and marketing professionals for the extension of trade credit? a) (5 marks) (5 marks) How do credit managers set credit limits for customers? b) 3 Question 4 Langanga Auto Springs Company requires a total of 20,000 bars of steel (10 meters each) of inventory for a production run. Assume that Lunganga places two orders of inventory of 10,000 steel bars each. Inventory would be paid for with cash, and ordering and holding costs would be paid at the end of the production run. Each steel bar costs Kshs.450, order costs are Kshs.50 per average inventory unit (steel bar). Lunganga has a cost of capital of 10% Assume the inventory is consumed at a steady rate and the production run is 80 days. The financial manager of Lunganga wants to make certain that his inventory decisions maximize shareholder wealth. Required: What is the present value cost of managing the inventory process? a) (10 marks) The financial manager is considering a change in inventory policy. She is considering b) increasing the number of orders to 4 for each production run. Would you recommend that this policy change be implemented? Support your recommendation with appropriate computations. (10 marks) c) Why is inventory such a difficult working capital item to manage? 00 (5 marks) Question 3 What are the major arguments made by credit and marketing professionals for the extension of trade credit? a) (5 marks) (5 marks) How do credit managers set credit limits for customers? b) 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started