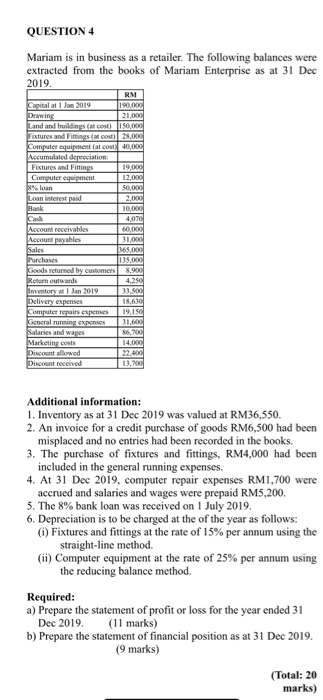

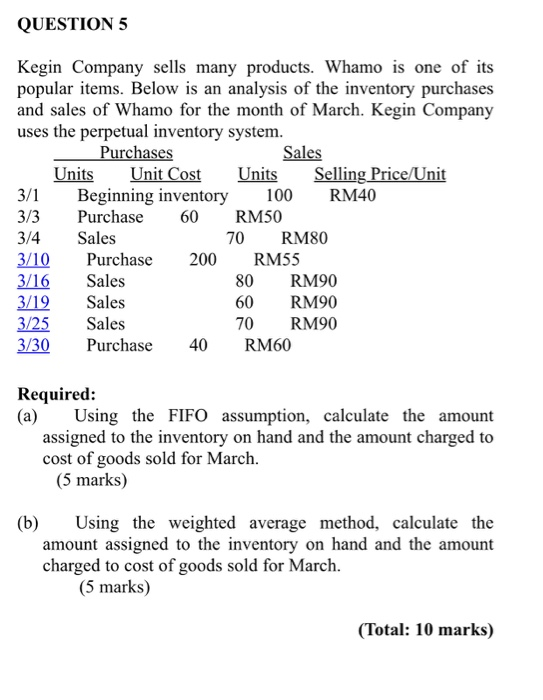

QUESTION 4 Mariam is in business as a retailer. The following balances were extracted from the books of Mariam Enterprise as at 31 Dec 2019. RM Capital at Jan 2019 190,000 Drawing 21,000 Land and buildings at cost) 150,000 Fixtures and Fittings ( M23,000 Computer equipment at cos 40,000 Accumulated depreciation Fixtures and Fillings 19,000 Computer gent 12.000 % loan 50,000 Lcan interest paid 2.000 10,000 Kash 4,070 Account receivables 0.00 ecount payables 31,000 Sales 365.000 Purchases 115,00 Goods returned by customers 8.900 Return outwards 4.250 Amatory at 1 Jan 2019 33.500 Delivery expenses 18.610 Computer repairs expenses 19.150 General running experies Salaries and wages 86,700 Marketing costs Discount allowed 22.400 Discount received 13,700 Additional information: 1. Inventory as at 31 Dec 2019 was valued at RM36,550. 2. An invoice for a credit purchase of goods RM6,500 had been misplaced and no entries had been recorded in the books. 3. The purchase of fixtures and fittings, RM4,000 had been included in the general running expenses. 4. At 31 Dec 2019, computer repair expenses RM1,700 were accrued and salaries and wages were prepaid RM5,200. 5. The 8% bank loan was received on 1 July 2019. 6. Depreciation is to be charged at the of the year as follows: Fixtures and fittings at the rate of 15% per annum using the straight-line method (ii) Computer equipment at the rate of 25% per annum using the reducing balance method. Required: a) Prepare the statement of profit or loss for the year ended 31 Dec 2019. (11 marks) b) Prepare the statement of financial position as at 31 Dec 2019. (9 marks) (Total: 20 marks) QUESTION 5 Kegin Company sells many products. Whamo is one of its popular items. Below is an analysis of the inventory purchases and sales of Whamo for the month of March. Kegin Company uses the perpetual inventory system. Purchases Sales Units Unit Cost Units Selling Price/Unit 3/1 Beginning inventory 100 RM40 3/3 Purchase 60 RM50 3/4 Sales 70 RM80 3/10 Purchase 200 RM55 3/16 Sales 80 RM90 3/19 Sales 60 RM90 3/25 Sales RM90 3/30 Purchase 40 RM60 70 Required: (a) Using the FIFO assumption, calculate the amount assigned to the inventory on hand and the amount charged to cost of goods sold for March. (5 marks) (b) Using the weighted average method, calculate the amount assigned to the inventory on hand and the amount charged to cost of goods sold for March. (5 marks) (Total: 10 marks)