Answered step by step

Verified Expert Solution

Question

1 Approved Answer

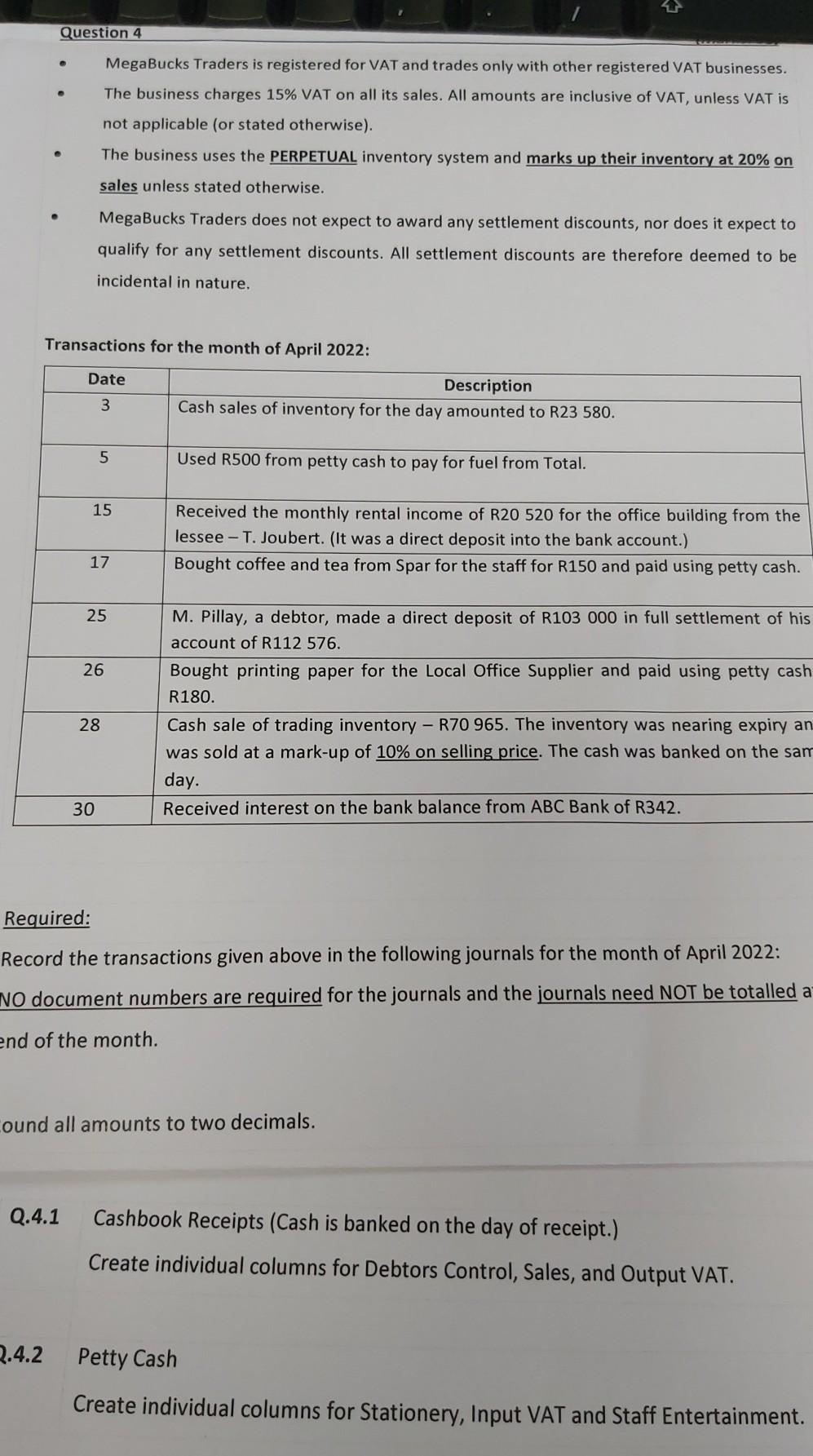

Question 4 MegaBucks Traders is registered for VAT and trades only with other registered VAT businesses. The business charges 15% VAT on all its sales.

Question 4 MegaBucks Traders is registered for VAT and trades only with other registered VAT businesses. The business charges 15% VAT on all its sales. All amounts are inclusive of VAT, unless VAT is not applicable (or stated otherwise). The business uses the PERPETUAL inventory system and marks up their inventory at 20% on . sales unless stated otherwise. MegaBucks Traders does not expect to award any settlement discounts, nor does it expect to qualify for any settlement discounts. All settlement discounts are therefore deemed to be incidental in nature. Transactions for the month of April 2022: Date 3 Description Cash sales of inventory for the day amounted to R23 580. 5 Used R500 from petty cash to pay for fuel from Total. 15 Received the monthly rental income of R20 520 for the office building from the lessee - T. Joubert. (It was a direct deposit into the bank account.) Bought coffee and tea from Spar for the staff for R150 and paid using petty cash. 17 25 26 M. Pillay, a debtor, made a direct deposit of R103 000 in full settlement of his account of R112 576. Bought printing paper for the Local Office Supplier and paid using petty cash R180. Cash sale of trading inventory - R70 965. The inventory was nearing expiry an was sold at a mark-up of 10% on selling price. The cash was banked on the sam day. Received interest on the bank balance from ABC Bank of R342. 28 30 Required: Record the transactions given above in the following journals for the month of April 2022: NO document numbers are required for the journals and the journals need NOT be totalled a end of the month. Cound all amounts to two decimals. Q.4.1 Cashbook Receipts (Cash is banked on the day of receipt.) Create individual columns for Debtors Control, Sales, and Output VAT. 2.4.2 Petty Cash Create individual columns for Stationery, Input VAT and Staff Entertainment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started