Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Mortgages can be taken out at a fixed interest rate over a period of time, which means that the interest rate cannot

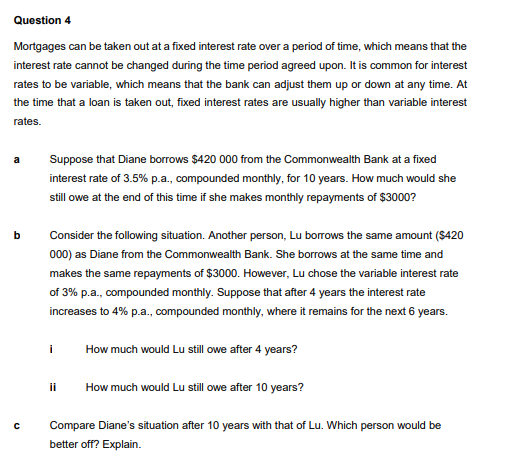

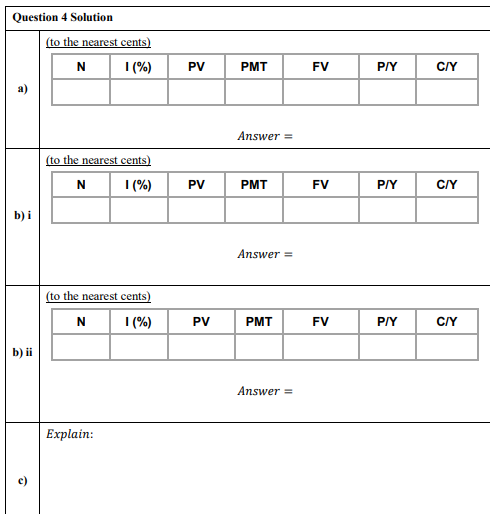

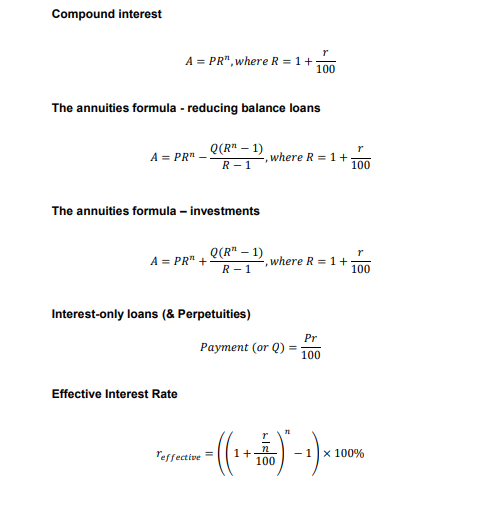

Question 4 Mortgages can be taken out at a fixed interest rate over a period of time, which means that the interest rate cannot be changed during the time period agreed upon. It is common for interest rates to be variable, which means that the bank can adjust them up or down at any time. At the time that a loan is taken out, fixed interest rates are usually higher than variable interest rates. a b C Suppose that Diane borrows $420 000 from the Commonwealth Bank at a fixed interest rate of 3.5% p.a., compounded monthly, for 10 years. How much would she still owe at the end of this time if she makes monthly repayments of $3000? Consider the following situation. Another person, Lu borrows the same amount ($420 000) as Diane from the Commonwealth Bank. She borrows at the same time and makes the same repayments of $3000. However, Lu chose the variable interest rate of 3% p.a., compounded monthly. Suppose that after 4 years the interest rate increases to 4% p.a., compounded monthly, where it remains for the next 6 years. i How much would Lu still owe after 4 years? ii How much would Lu still owe after 10 years? Compare Diane's situation after 10 years with that of Lu. Which person would be better off? Explain. Question 4 Solution (to the nearest cents) N 1(%) PV PMT FV P/Y C/Y (to the nearest cents) N b) i b) ii Answer = 1(%) PV PMT FV P/Y C/Y (to the nearest cents) N Explain: Answer = 1(%) PV PMT FV P/Y C/Y Answer = Compound interest r A = PR", where R = 1+ The annuities formula - reducing balance loans 100 A = PR" - Q(R" - 1) r where R = 1 + R-1 100 The annuities formula - investments A = PR" + Q(R" - 1) r where R=1+ R-1 100 Interest-only loans (& Perpetuities) Effective Interest Rate Payment (or Q) Pr 100 Teffective= 100 (14+)-1) = 100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started