Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ms. Jessica Alba is chief executive of Universal Ltd, a divisionalised company which is diversified across several lines of business. The Postage Division provides

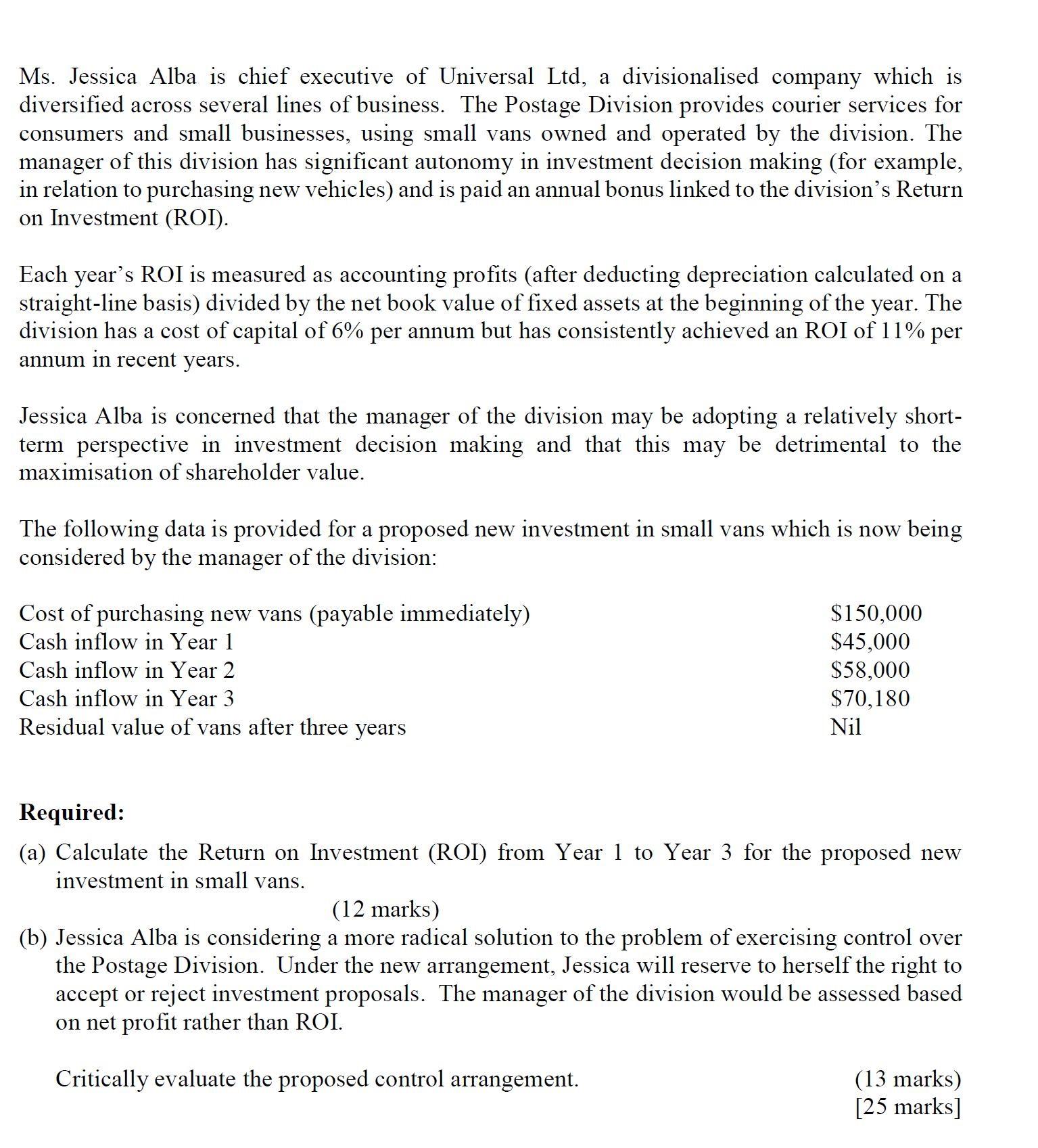

Ms. Jessica Alba is chief executive of Universal Ltd, a divisionalised company which is diversified across several lines of business. The Postage Division provides courier services for consumers and small businesses, using small vans owned and operated by the division. The manager of this division has significant autonomy in investment decision making (for example, in relation to purchasing new vehicles) and is paid an annual bonus linked to the division's Return on Investment (ROI). Each year's ROI is measured as accounting profits (after deducting depreciation calculated on a straight-line basis) divided by the net book value of fixed assets at the beginning of the year. The division has a cost of capital of 6% per annum but has consistently achieved an ROI of 11% per annum in recent years. Jessica Alba is concerned that the manager of the division may be adopting a relatively short- term perspective in investment decision making and that this may be detrimental to the maximisation of shareholder value. The following data is provided for a proposed new investment in small vans which is now being considered by the manager of the division: $150,000 $45,000 $58,000 $70,180 Cost of purchasing new vans (payable immediately) Cash inflow in Year 1 Cash inflow in Year 2 Cash inflow in Year 3 Residual value of vans after three years Nil Required: (a) Calculate the Return on Investment (ROI) from Year 1 to Year 3 for the proposed new investment in small vans. (12 marks) (b) Jessica Alba is considering a more radical solution to the problem of exercising control over the Postage Division. Under the new arrangement, Jessica will reserve to herself the right to accept or reject investment proposals. The manager of the division would be assessed based on net profit rather than ROI. Critically evaluate the proposed control arrangement. (13 marks) [25 marks]

Step by Step Solution

★★★★★

3.50 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of Return on Investment ROI from Year 1 to Year 3 for the proposed new investment in small vans Working Notes b Facts Jessica Alba is considering a more radical solution to the problem o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started