Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Noncurrent Assets (10 marks) Part a House at Pooh Corner Limited purchased a machine on 1 July 2013 at a cost of

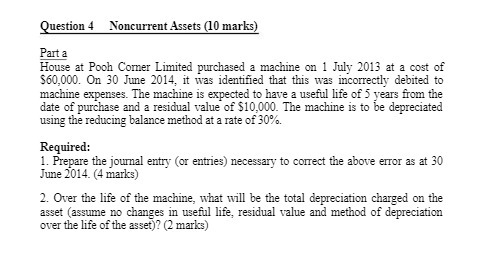

Question 4 Noncurrent Assets (10 marks) Part a House at Pooh Corner Limited purchased a machine on 1 July 2013 at a cost of $60,000. On 30 June 2014, it was identified that this was incorrectly debited to machine expenses. The machine is expected to have a useful life of 5 years from the date of purchase and a residual value of $10,000. The machine is to be depreciated using the reducing balance method at a rate of 30%. Required: 1. Prepare the journal entry (or entries) necessary to correct the above error as at 30 June 2014. (4 marks) 2. Over the life of the machine, what will be the total depreciation charged on the asset (assume no changes in useful life, residual value and method of depreciation over the life of the asset)? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

House at Pooh Corner Limited Noncurrent Assets Part a 1 Journal Entry for Correction 4 marks ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started