Answered step by step

Verified Expert Solution

Question

1 Approved Answer

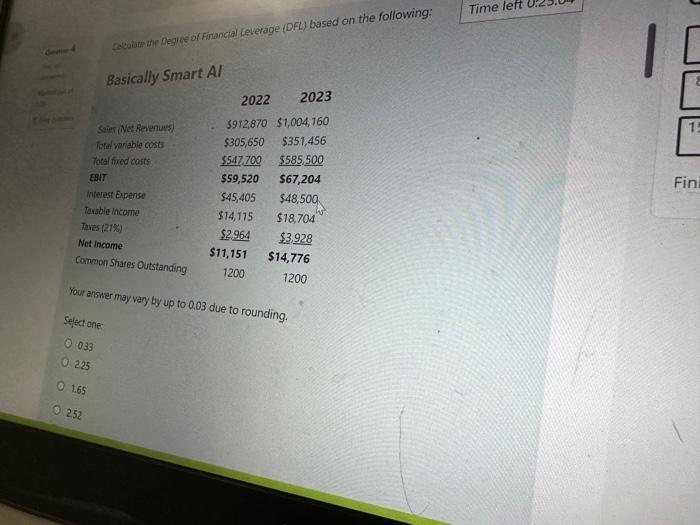

Question 4 Not ye Marked out of Flag question Calculate the Degree of Financial Leverage (DFL) based on the following: Basically Smart Al Sales (Net

Question 4 Not ye Marked out of Flag question Calculate the Degree of Financial Leverage (DFL) based on the following: Basically Smart Al Sales (Net Revenues) Total variable costs Total fixed costs EBIT Interest Expense Taxable income Taxes (21%) Net Income Common Shares Outstanding Your answer may vary by up to 0.03 due to rounding. Select one: O 0.33 O 2.25 O 1.65 O 2.52 2022 2023 $912,870 $1,004, 160 $305,650 $351,456 $547,700 $585,500 $59,520 $67,204 $45,405 $48,500 $14,115 $18,704 $2,964 $3,928 $11,151 $14,776 1200 1200 Time left 15 Fini

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started