Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 Nutrient Foods Ltd. is considering a project of new product line that requires the initial cost of Rs. 18 million. The company is

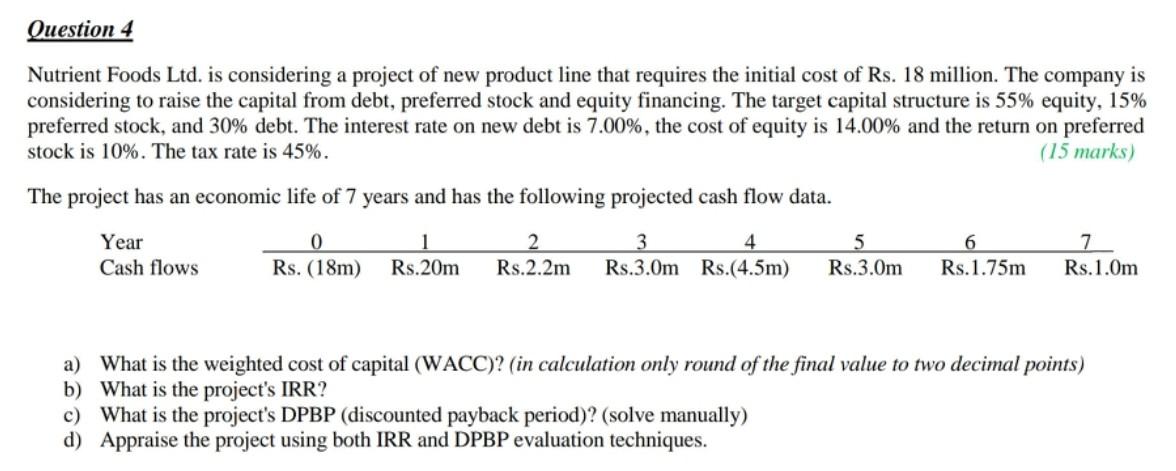

Question 4 Nutrient Foods Ltd. is considering a project of new product line that requires the initial cost of Rs. 18 million. The company is considering to raise the capital from debt, preferred stock and equity financing. The target capital structure is 55% equity, 15% preferred stock, and 30% debt. The interest rate on new debt is 7.00%, the cost of equity is 14.00% and the return on preferred stock is 10%. The tax rate is 45%. (15 marks) The project has an economic life of 7 years and has the following projected cash flow data. Year Cash flows 0 Rs. (18m) 2 Rs.2.2m 3 4 Rs.3.Om Rs.(4.5m) 5 Rs.3.0m 6 Rs.1.75m 7 Rs.1.Om Rs.20m a) What is the weighted cost of capital (WACC)? (in calculation only round of the final value to two decimal points) b) What is the project's IRR? c) What is the project's DPBP (discounted payback period)? (solve manually) d) Appraise the project using both IRR and DPBP evaluation techniques

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started