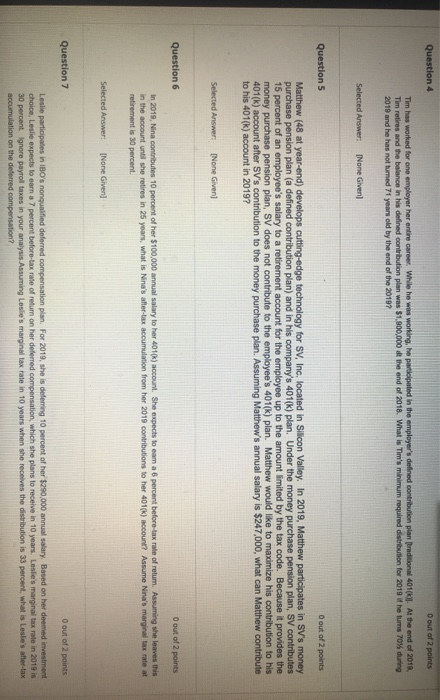

Question 4 O out of 2 points Tim has worked for one employer her entire career. While he was working, he participated in the employer's defined contribution plan (traditional 401(k). At the end of 2019, Tim retires and the balance in his defined contribution plan was $1,900,000 at the end of 2018. What is Tim's minimum required distribution for 2019 if he tums 70% during 2019 and he has not turned 71 years old by the end of the 2019? Selected Answer: None Given Question 5 O out of 2 points Matthew (48 at year-end) develops cutting-edge technology for SV, Inc. located in Silicon Valley. In 2019, Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's contribution to the money purchase plan. Assuming Matthew's annual salary is $247,000, what can Matthew contribute to his 401(k) account in 2019? Selected Answer: [None Given) Question 6 O out of 2 points In 2019, Nina contributes 10 percent of her $100.000 annual salary to her 4010) account. She expects to eam a 6 percent before tax rate of return. Assuming she leaves this in the account until she retires in 25 years, what is Nina's after-tax accumulation from her 2019 contributions to her 401(K) account? Assume Nina's marginal tax rate at retirement is 30 percent. Selected Answer: [None Given] Question 7 O out of 2 points Leslie participates in BO's nonqualified deferred compensation plan. For 2019, she is deferring 10 percent of her $200,000 annual salary. Based on her deemed investment choice, Leslie expects to earn a 7 percent before tax rate of return on her deferred compensation, which she plans to receive in 10 years. Leslie's marginal tax rate in 2019 is 30 percent gnore payroll taxes in your analysis. Assuming Leslie's marginal tax rate in 10 years when she receives the distribution is 33 percent, what is Leslie's after-tax accumulation on the deferred compensation? Question 4 O out of 2 points Tim has worked for one employer her entire career. While he was working, he participated in the employer's defined contribution plan (traditional 401(k). At the end of 2019, Tim retires and the balance in his defined contribution plan was $1,900,000 at the end of 2018. What is Tim's minimum required distribution for 2019 if he tums 70% during 2019 and he has not turned 71 years old by the end of the 2019? Selected Answer: None Given Question 5 O out of 2 points Matthew (48 at year-end) develops cutting-edge technology for SV, Inc. located in Silicon Valley. In 2019, Matthew participates in SV's money purchase pension plan (a defined contribution plan) and in his company's 401(k) plan. Under the money purchase pension plan, SV contributes 15 percent of an employee's salary to a retirement account for the employee up to the amount limited by the tax code. Because it provides the money purchase pension plan, SV does not contribute to the employee's 401(k) plan. Matthew would like to maximize his contribution to his 401(k) account after SV's contribution to the money purchase plan. Assuming Matthew's annual salary is $247,000, what can Matthew contribute to his 401(k) account in 2019? Selected Answer: [None Given) Question 6 O out of 2 points In 2019, Nina contributes 10 percent of her $100.000 annual salary to her 4010) account. She expects to eam a 6 percent before tax rate of return. Assuming she leaves this in the account until she retires in 25 years, what is Nina's after-tax accumulation from her 2019 contributions to her 401(K) account? Assume Nina's marginal tax rate at retirement is 30 percent. Selected Answer: [None Given] Question 7 O out of 2 points Leslie participates in BO's nonqualified deferred compensation plan. For 2019, she is deferring 10 percent of her $200,000 annual salary. Based on her deemed investment choice, Leslie expects to earn a 7 percent before tax rate of return on her deferred compensation, which she plans to receive in 10 years. Leslie's marginal tax rate in 2019 is 30 percent gnore payroll taxes in your analysis. Assuming Leslie's marginal tax rate in 10 years when she receives the distribution is 33 percent, what is Leslie's after-tax accumulation on the deferred compensation