Answered step by step

Verified Expert Solution

Question

1 Approved Answer

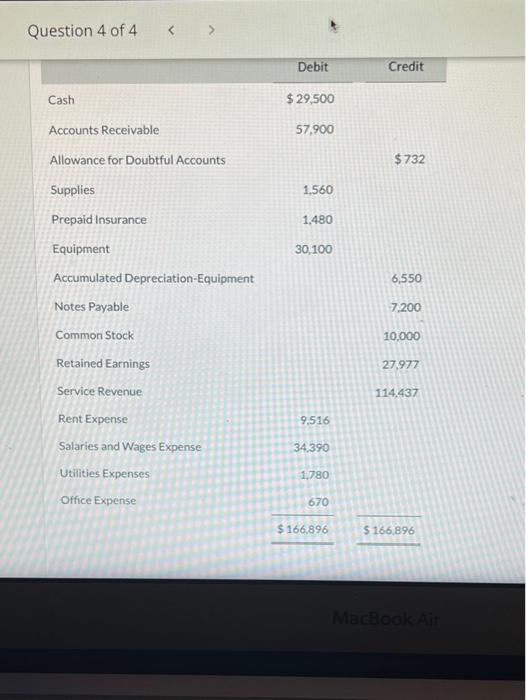

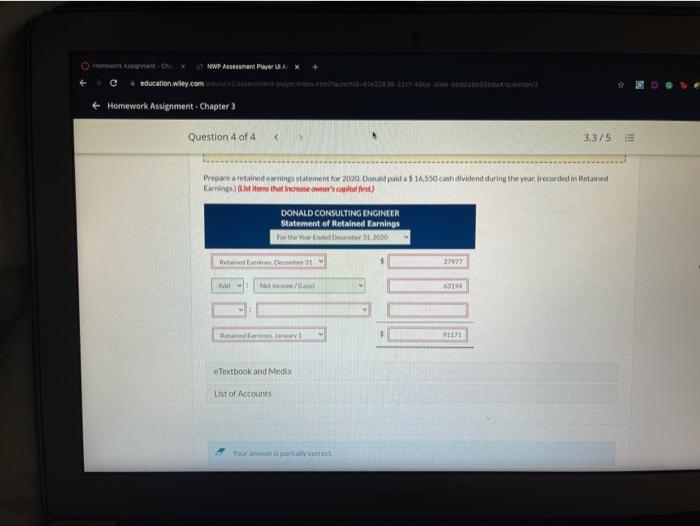

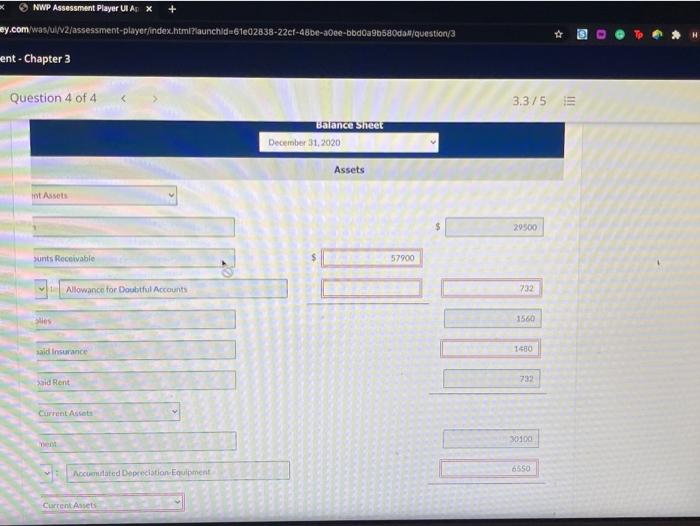

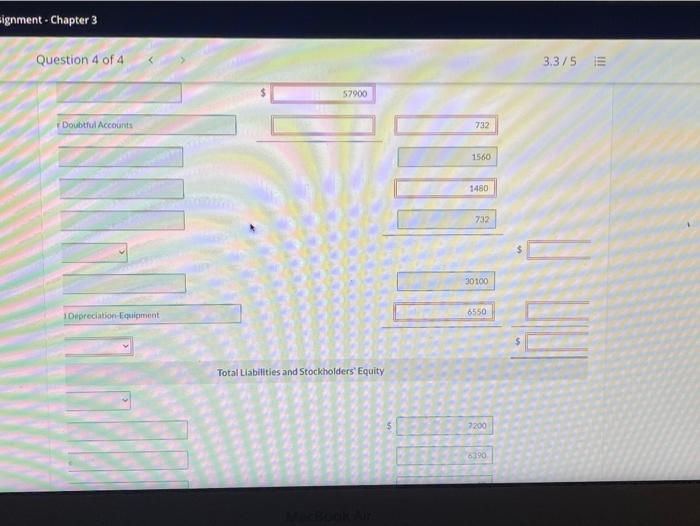

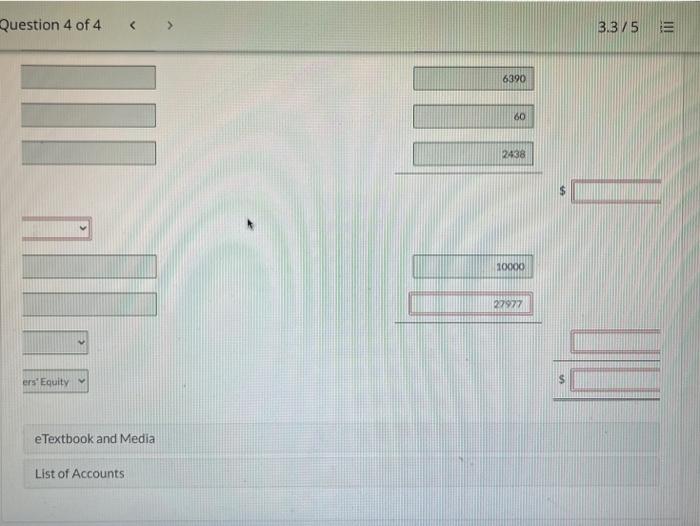

Question 4 of 4 Debit Credit Cash $ 29,500 Accounts Receivable 57,900 Allowance for Doubtful Accounts $ 732 Supplies 1.560 1.480 30,100 6,550 7,200 10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started