Answered step by step

Verified Expert Solution

Question

1 Approved Answer

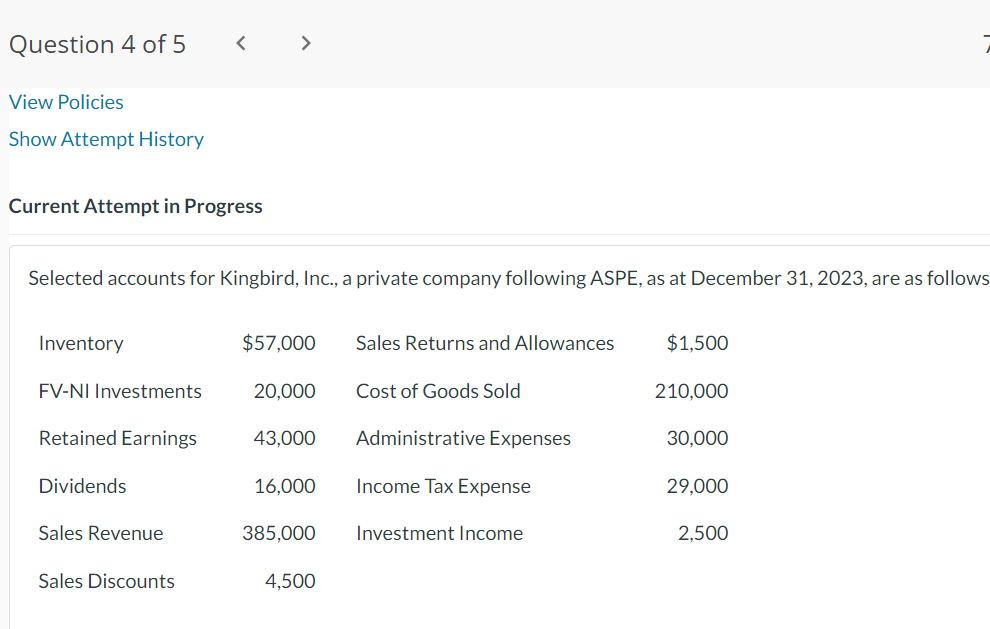

Question 4 of 5 View Policies Show Attempt History Current Attempt in Progress Selected accounts for Kingbird, Inc., a private company following ASPE, as

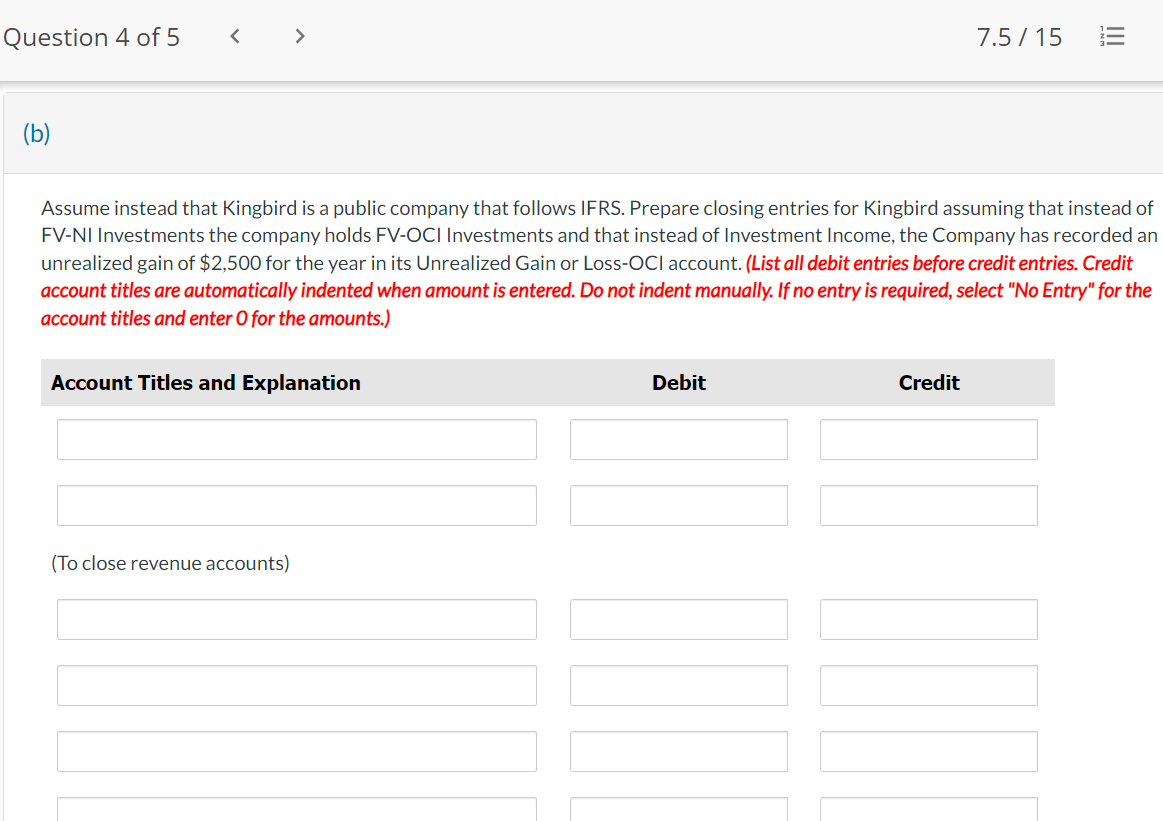

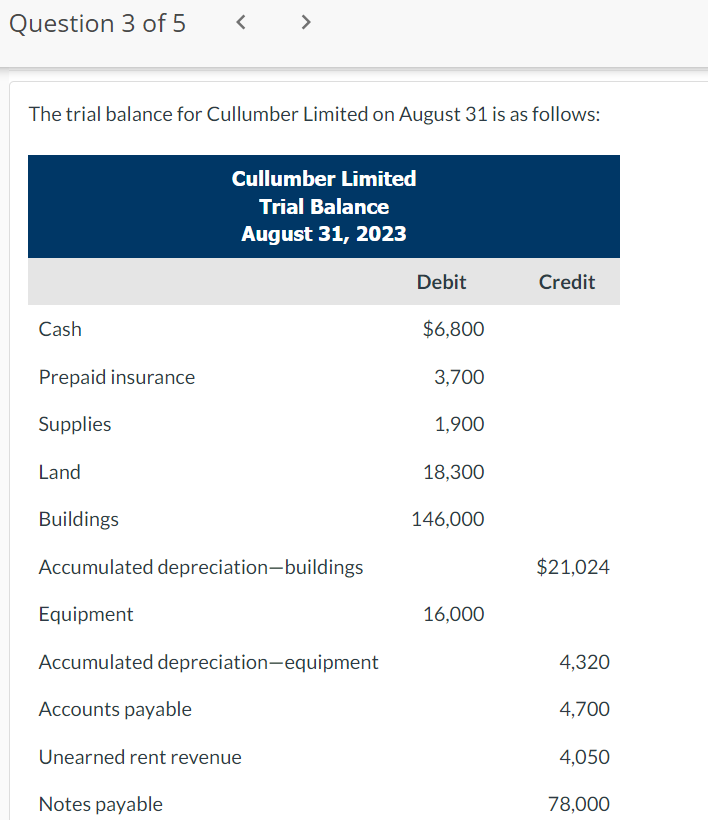

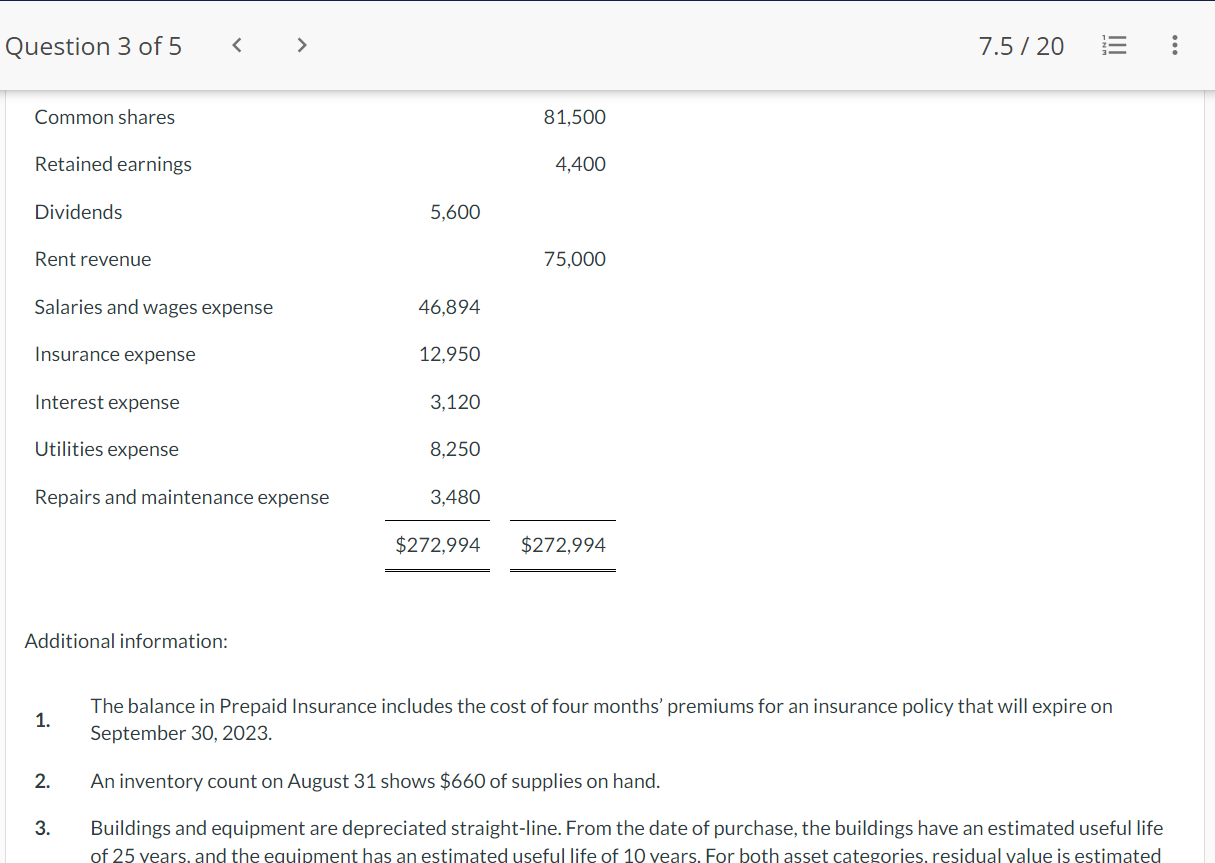

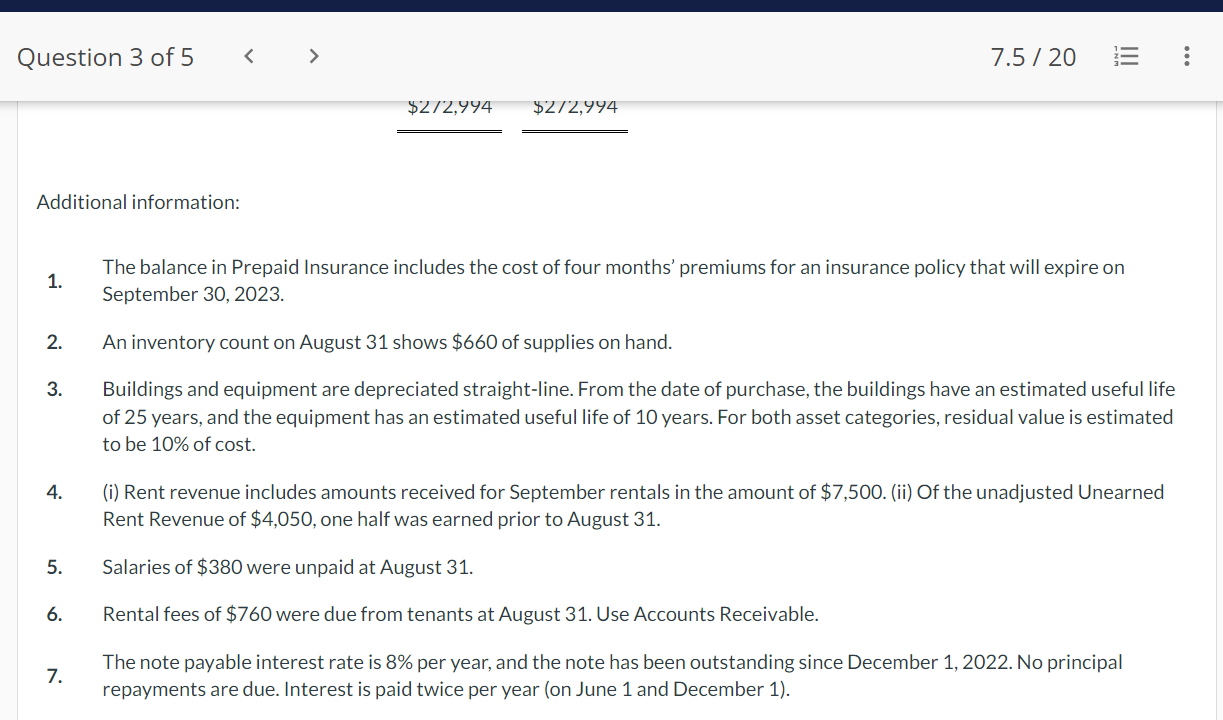

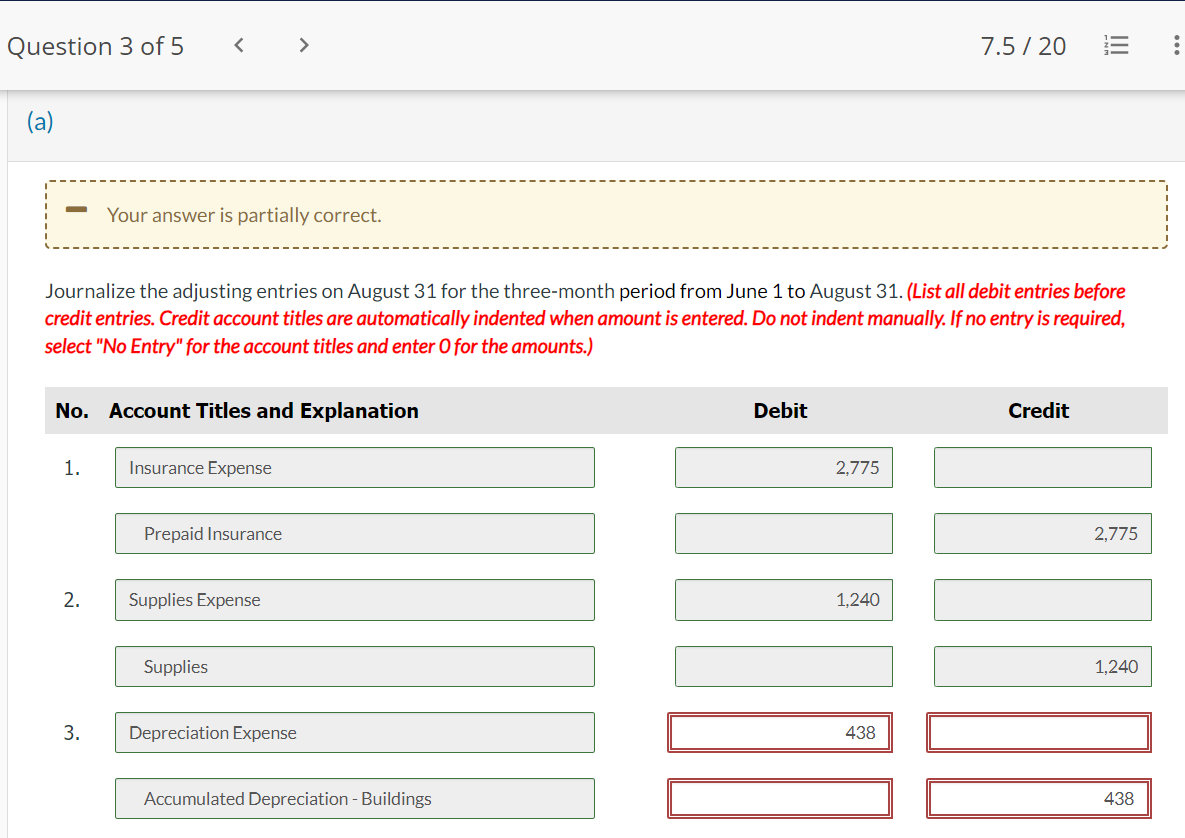

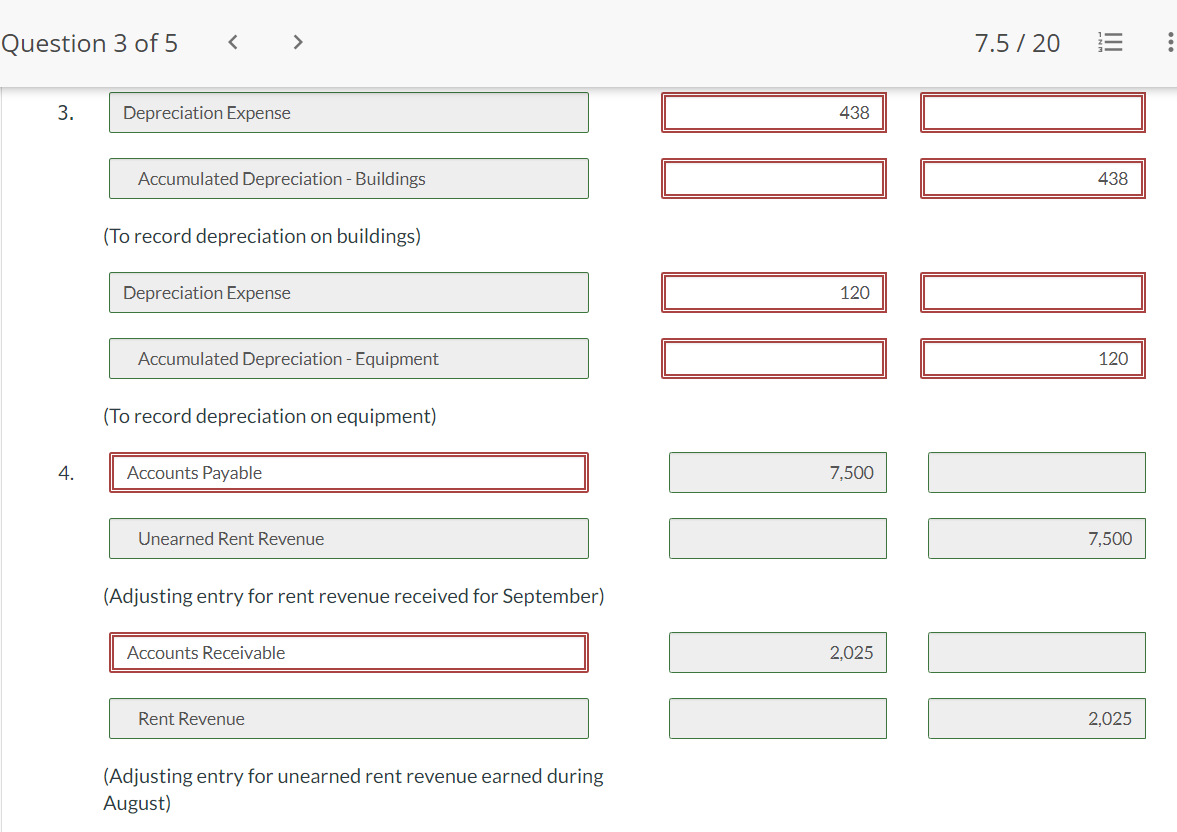

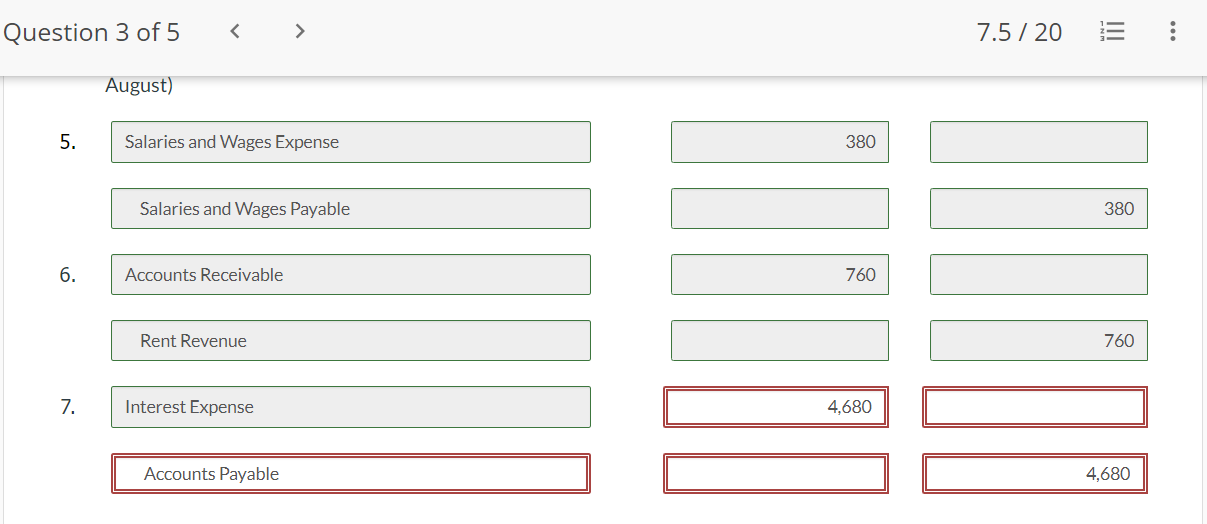

Question 4 of 5 View Policies Show Attempt History Current Attempt in Progress Selected accounts for Kingbird, Inc., a private company following ASPE, as at December 31, 2023, are as follows Inventory FV-NI Investments Retained Earnings Dividends < Sales Revenue Sales Discounts $57,000 20,000 Sales Returns and Allowances 4,500 Cost of Goods Sold 43,000 Administrative Expenses 16,000 Income Tax Expense 385,000 Investment Income $1,500 210,000 30,000 29,000 2,500 Question 4 of 5 (b) Assume instead that Kingbird is a public company that follows IFRS. Prepare closing entries for Kingbird assuming that instead of FV-NI Investments the company holds FV-OCI Investments and that instead of Investment Income, the Company has recorded an unrealized gain of $2,500 for the year in its Unrealized Gain or Loss-OCI account. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation (To close revenue accounts) Debit 7.5/15 Credit Question 3 of 5 Cash The trial balance for Cullumber Limited on August 31 is as follows: Prepaid insurance Supplies Land < > Notes payable Cullumber Limited Trial Balance August 31, 2023 Buildings Accumulated depreciation-buildings Equipment Accumulated depreciation-equipment Accounts payable Unearned rent revenue Debit $6,800 3,700 1,900 18,300 146,000 16,000 Credit $21,024 4,320 4,700 4,050 78,000 Question 3 of 5 Common shares Retained earnings Dividends Rent revenue Salaries and wages expense Insurance expense Interest expense Additional information: Utilities expense Repairs and maintenance expense 1. < 2. 3. > 5,600 46,894 12,950 3,120 8,250 3,480 $272,994 81,500 4,400 75,000 $272,994 7.5 / 20 ||| The balance in Prepaid Insurance includes the cost of four months' premiums for an insurance policy that will expire on September 30, 2023. An inventory count on August 31 shows $660 of supplies on hand. Buildings and equipment are depreciated straight-line. From the date of purchase, the buildings have an estimated useful life of 25 years, and the equipment has an estimated useful life of 10 years. For both asset categories, residual value is estimated : Question 3 of 5 Additional information: 1. 2. 3. 4. 5. 6. 7. < $272,994 $272,994 7.5 / 20 ||| The balance in Prepaid Insurance includes the cost of four months' premiums for an insurance policy that will expire on September 30, 2023. An inventory count on August 31 shows $660 of supplies on hand. Buildings and equipment are depreciated straight-line. From the date of purchase, the buildings have an estimated useful life of 25 years, and the equipment has an estimated useful life of 10 years. For both asset categories, residual value is estimated to be 10% of cost. (i) Rent revenue includes amounts received for September rentals in the amount of $7,500. (ii) Of the unadjusted Unearned Rent Revenue of $4,050, one half was earned prior to August 31. Salaries of $380 were unpaid at August 31. Rental fees of $760 were due from tenants at August 31. Use Accounts Receivable. The note payable interest rate is 8% per year, and the note has been outstanding since December 1, 2022. No principal repayments are due. Interest is paid twice per year (on June 1 and December 1). Question 3 of 5 (a) 1. 2. < No. Account Titles and Explanation 3. Your answer is partially correct. Journalize the adjusting entries on August 31 for the three-month period from June 1 to August 31. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Insurance Expense Prepaid Insurance > Supplies Expense Supplies Depreciation Expense Accumulated Depreciation - Buildings Debit 2,775 1.240 7.5 / 20 438 E Credit 2,775 1,240 438 Question 3 of 5 3. 4. < Depreciation Expense Accumulated Depreciation - Buildings (To record depreciation on buildings) Depreciation Expense Accumulated Depreciation - Equipment (To record depreciation on equipment) Accounts Payable Unearned Rent Revenue (Adjusting entry for rent revenue received for September) Accounts Receivable Rent Revenue (Adjusting entry for unearned rent revenue earned during August) 438 14 04 00 120 7,500 2,025 7.5 / 20 438 120 7,500 2,025 Question 3 of 5 August) 5. 6. 7. < Salaries and Wages Expense Salaries and Wages Payable Accounts Receivable Rent Revenue > Interest Expense Accounts Payable 380 760 4,680 7.5 / 20 ||| 380 760 4,680 :

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Here are the steps to adjust the trial balance and prepare the financial statements for Cullumber Li...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started