Question

Question 4 of 6 < View Policies Current Attempt in Progress Accounts payable Accumulated depreciation-equipment The medical practice of Dr. W. Hall and Dr.

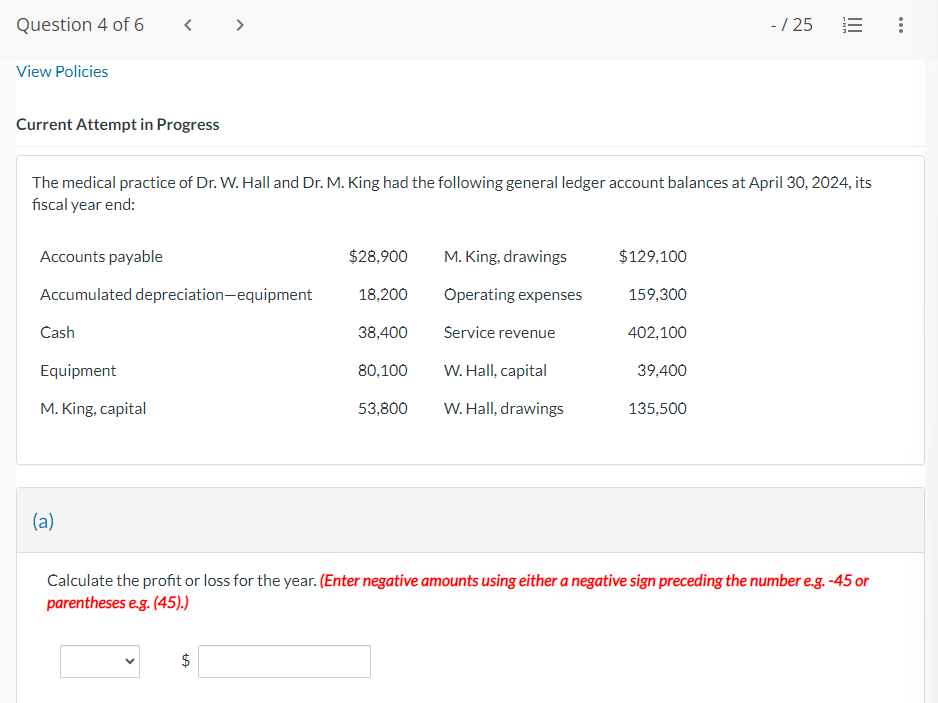

Question 4 of 6 < View Policies Current Attempt in Progress Accounts payable Accumulated depreciation-equipment The medical practice of Dr. W. Hall and Dr. M. King had the following general ledger account balances at April 30, 2024, its fiscal year end: Cash Equipment M. King, capital (a) tA $28,900 18,200 38,400 80,100 $ 53,800 M. King, drawings Operating expenses Service revenue W. Hall, capital W. Hall, drawings $129,100 159,300 402,100 39,400 - /25 135,500 ||| Calculate the profit or loss for the year. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the profit or loss for the year we need to look at the revenues and expenses as well as ...

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started