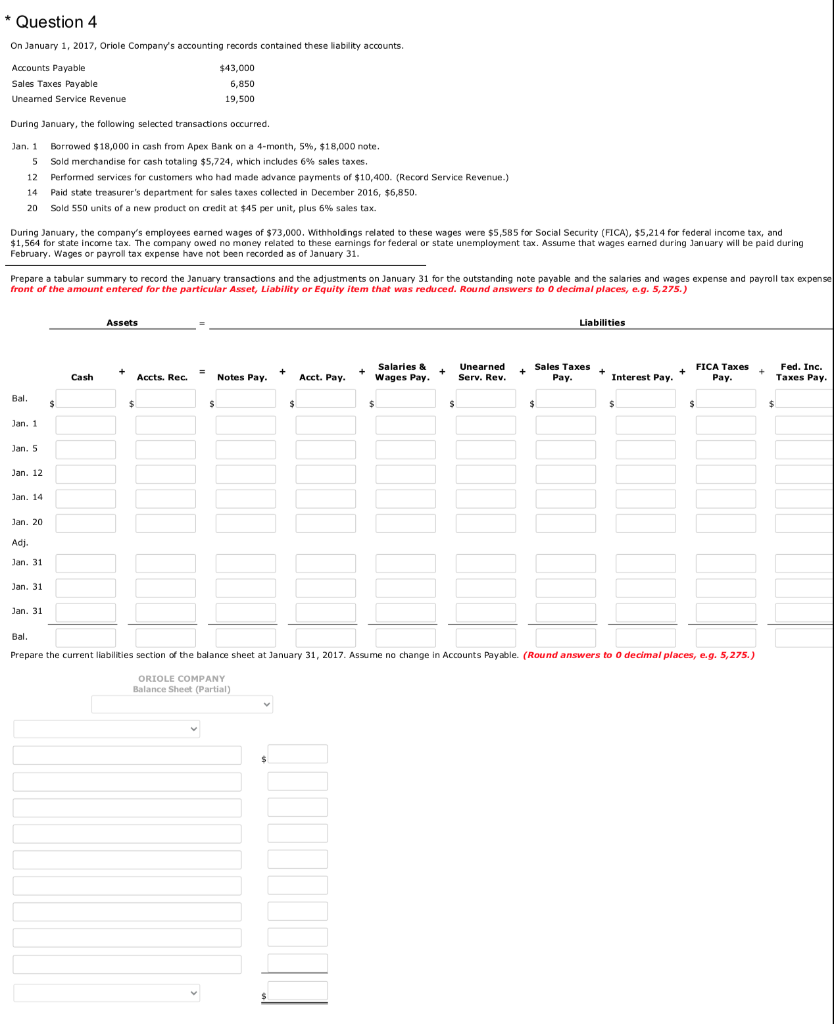

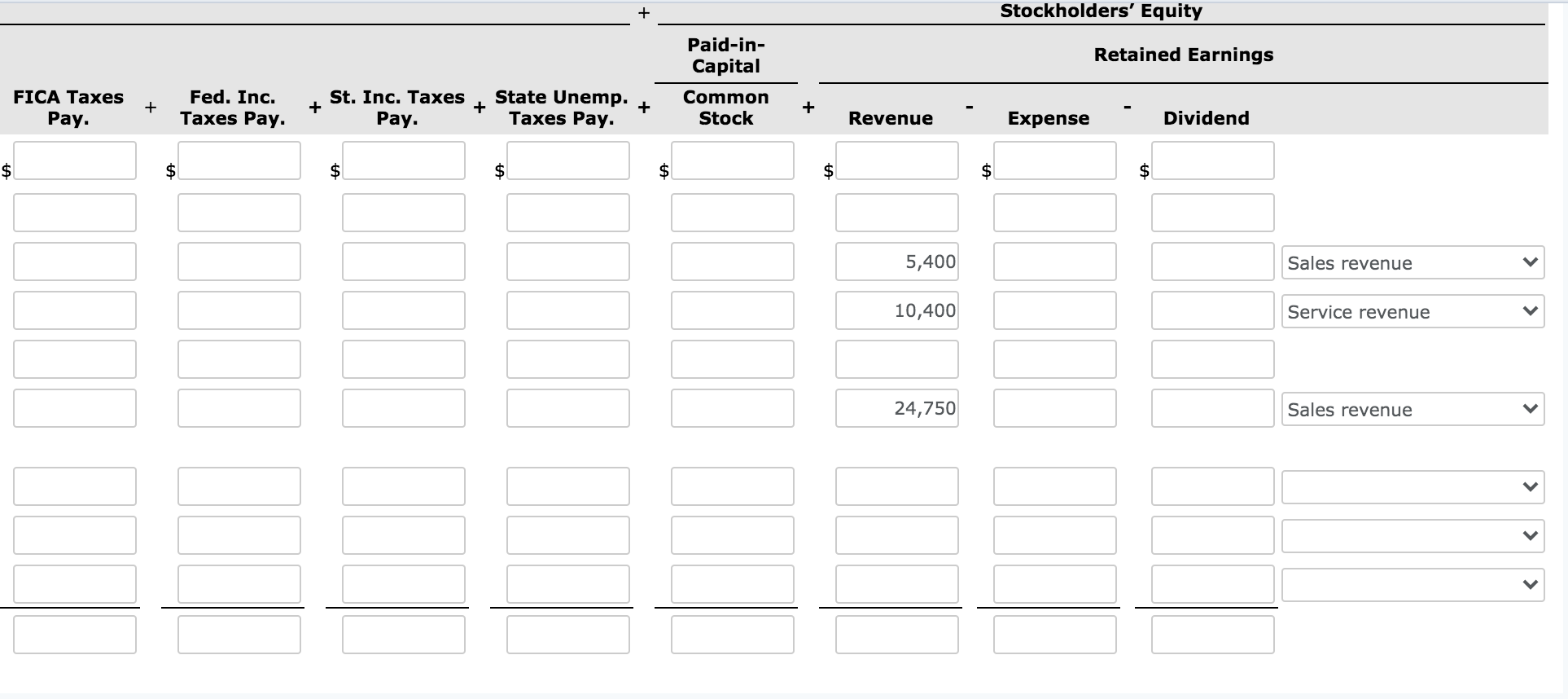

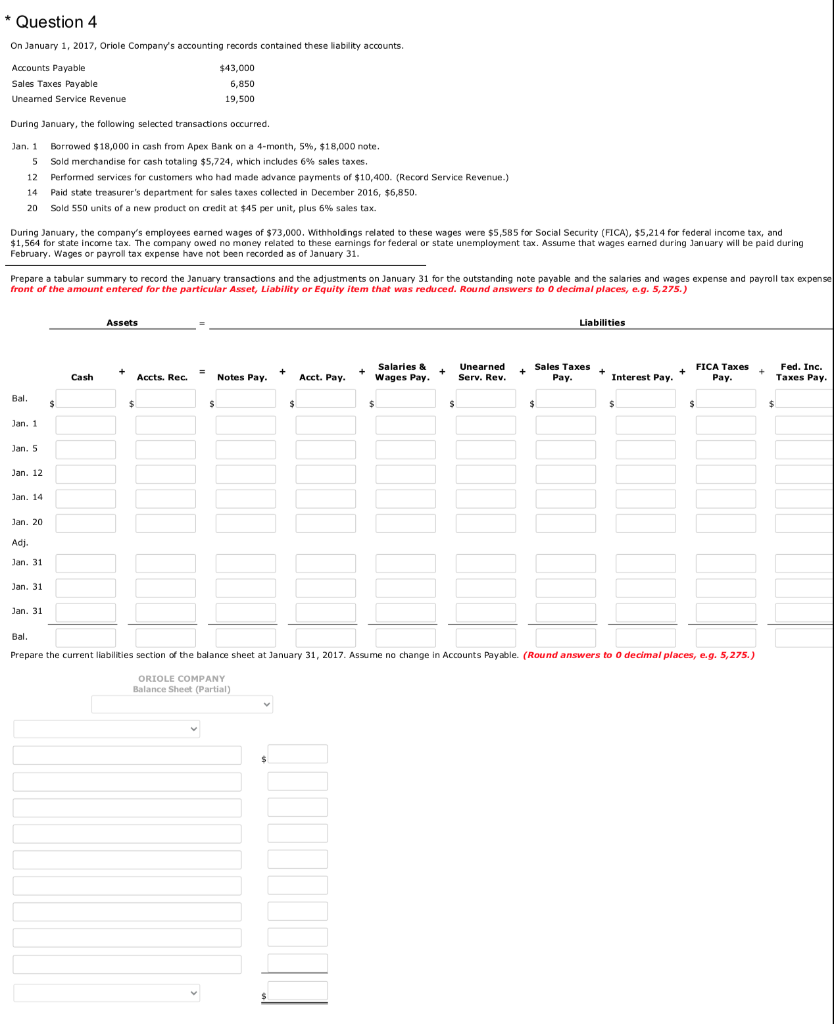

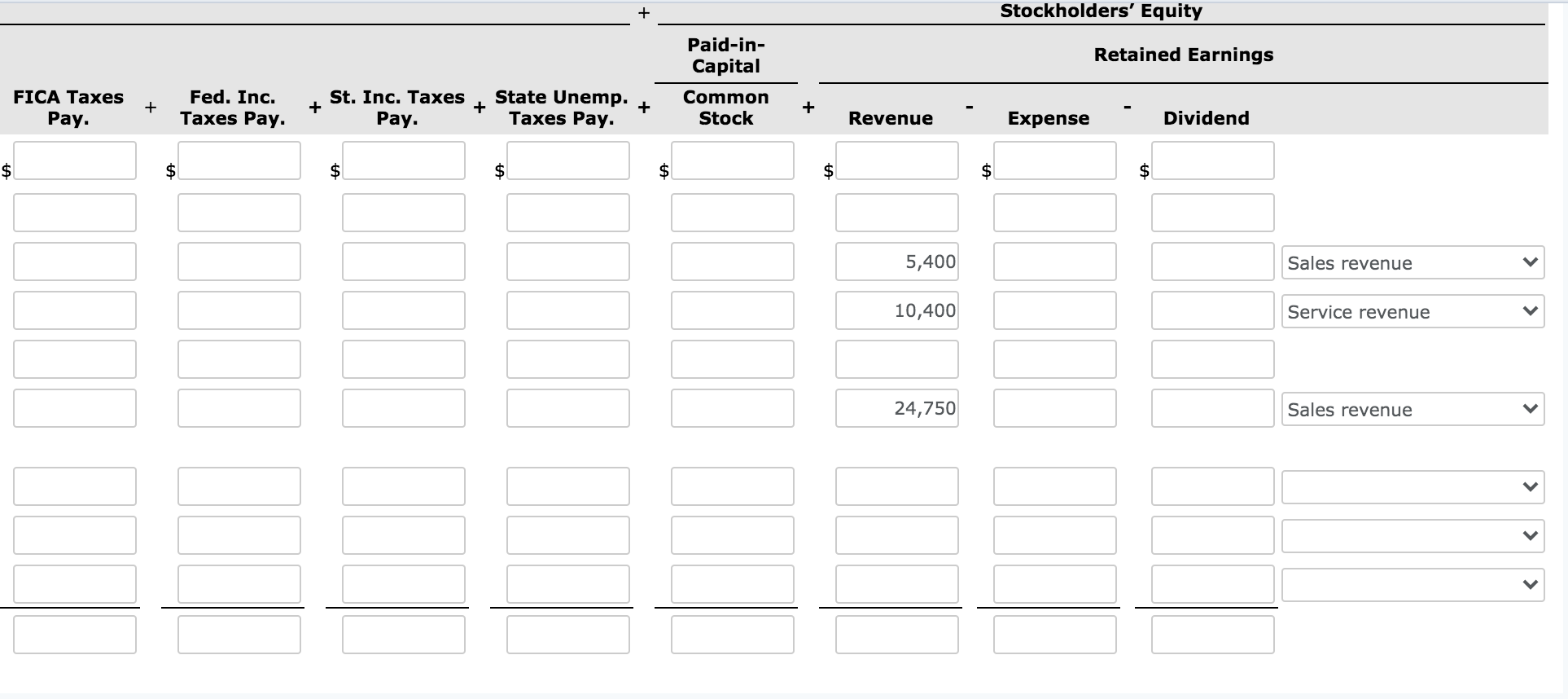

* Question 4 On January 1, 2017, Oriole Company's accounting records contained these liability accounts. Accounts Payable Sales Taxes Payable Uneamed Service Revenue $43,000 6,850 19,500 During January, the following selected transactions occurred. Jan. 1 Borrowed $18,000 in cash from Apex Bank on a 4-month, 5%, $18,000 note. 5 5 Sold merchandise for cash totaling $5,724, which includes 6% sales taxes. 12 Performed services for customers who had made advance payments of $10,400. (Record Service Revenue.) 14 Paid state treasurer's department for sales taxes collected in December 2016, $6,850. . 20 Sold 550 units of a new product on credit at $45 per unit, plus 6% sales tax. During January, the company's employees earned wages of $73,000. Withholdings related to these wages were $5,585 for Social Security (FICA), $5,214 for federal income tax, and $1,564 for state income tax. The company owed no money related to these earnings for federal or state unemployment tax. Assume that wages earned during January will be paid during February. Wages or payroll tax expense have not been recorded as of January 31. Prepare a tabular summary to record the January transactions and the adjustments on January 31 for the outstanding note payable and the salaries and wages expense and payroll tax expense front of the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to o decimal places, e.g. 5, 275.) Assets Liabilities FICA Taxes Salaries & Wages Pay. + Unearned Serv. Rev. + Notes Pay. Sales Taxes Pay. Acct. Pay. Cash Accts. Rec. Fed. Inc. Taxes Pay. Interest Pay. Pay. Bal. $ $ $ $ $ $ $ $ $ $ Jan. 1 Jan. 5 Jan. 12 Jan. 14 Jan. 20 Adj. Jan. 31 Jan. 31 Jan. 31 Bal Prepare the current liabilities section of the balance sheet at January 31, 2017. Assume no change in Accounts Payable. (Round answers to o decimal places, e.g. 5, 275.) ORIOLE COMPANY Balance Sheet (Partial) = Stockholders' Equity Retained Earnings Paid-in- Capital Common Stock FICA Taxes Pay. + Fed. Inc. Taxes Pay. + St. Inc. Taxes State Unemp. + Pay. Taxes Pay. + + Revenue Expense Dividend $ $ $ $ $ $ $ $ 5,400 Sales revenue 10,400 Service revenue 24,750 Sales revenue