Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 On October 20, a portfolio manager is concerned about the volatility in the stock market over the next four months. Her portfolio has

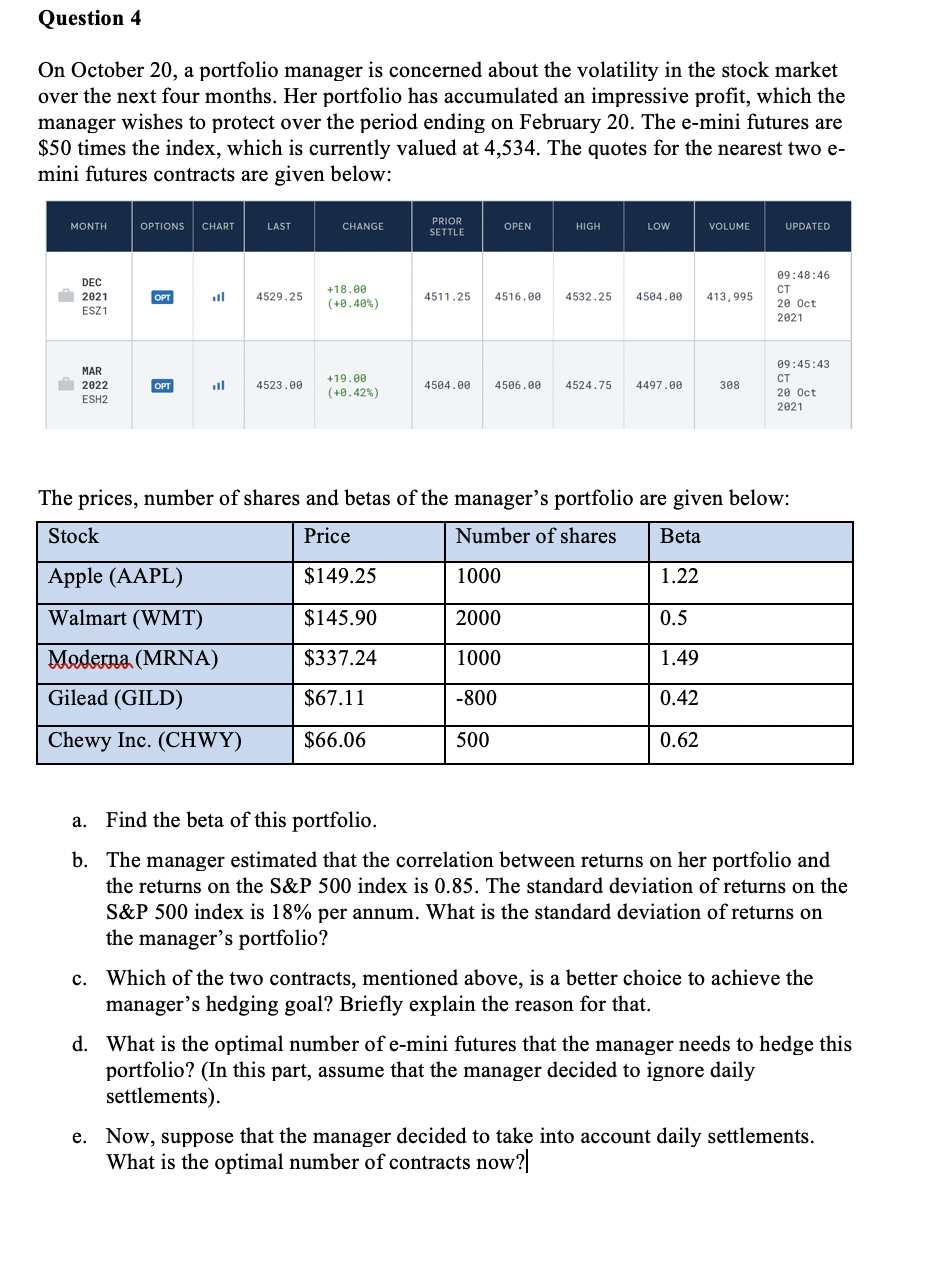

Question 4 On October 20, a portfolio manager is concerned about the volatility in the stock market over the next four months. Her portfolio has accumulated an impressive profit, which the manager wishes to protect over the period ending on February 20. The e-mini futures are $50 times the index, which is currently valued at 4,534. The quotes for the nearest two e- mini futures contracts are given below: MONTH OPTIONS PRIOR CHART LAST CHANGE OPEN SETTLE HIGH LOW VOLUME UPDATED DEC 2021 OPT 4529.25 +18.00 (+0.40%) 4511.25 4516.00 4532.25 4504.00 413,995 09:48:46 20 Oct 2021 ESZ1 MAR 2022 ESH2 OPT 11 4523.00 +19.00 (+0.42%) 4504.00 4506.00 4524.75 4497.00 308 09:45:43 CT 20 Oct 2021 The prices, number of shares and betas of the manager's portfolio are given below: Stock Price Number of shares Beta Apple (AAPL) $149.25 1000 1.22 Walmart (WMT) $145.90 2000 0.5 Moderna (MRNA) $337.24 1000 1.49 Gilead (GILD) $67.11 -800 0.42 Chewy Inc. (CHWY) $66.06 500 0.62 c. a. Find the beta of this portfolio. b. The manager estimated that the correlation between returns on her portfolio and the returns on the S&P 500 index is 0.85. The standard deviation of returns on the S&P 500 index is 18% per annum. What is the standard deviation of returns on the manager's portfolio? Which of the two contracts, mentioned above, is a better choice to achieve the manager's hedging goal? Briefly explain the reason for that. d. What is the optimal number of e-mini futures that the manager needs to hedge this portfolio? (In this part, assume that the manager decided to ignore daily settlements). e. Now, suppose that the manager decided to take into account daily settlements. What is the optimal number of contracts now?|| Question 4 On October 20, a portfolio manager is concerned about the volatility in the stock market over the next four months. Her portfolio has accumulated an impressive profit, which the manager wishes to protect over the period ending on February 20. The e-mini futures are $50 times the index, which is currently valued at 4,534. The quotes for the nearest two e- mini futures contracts are given below: MONTH OPTIONS PRIOR CHART LAST CHANGE OPEN SETTLE HIGH LOW VOLUME UPDATED DEC 2021 OPT 4529.25 +18.00 (+0.40%) 4511.25 4516.00 4532.25 4504.00 413,995 09:48:46 20 Oct 2021 ESZ1 MAR 2022 ESH2 OPT 11 4523.00 +19.00 (+0.42%) 4504.00 4506.00 4524.75 4497.00 308 09:45:43 CT 20 Oct 2021 The prices, number of shares and betas of the manager's portfolio are given below: Stock Price Number of shares Beta Apple (AAPL) $149.25 1000 1.22 Walmart (WMT) $145.90 2000 0.5 Moderna (MRNA) $337.24 1000 1.49 Gilead (GILD) $67.11 -800 0.42 Chewy Inc. (CHWY) $66.06 500 0.62 c. a. Find the beta of this portfolio. b. The manager estimated that the correlation between returns on her portfolio and the returns on the S&P 500 index is 0.85. The standard deviation of returns on the S&P 500 index is 18% per annum. What is the standard deviation of returns on the manager's portfolio? Which of the two contracts, mentioned above, is a better choice to achieve the manager's hedging goal? Briefly explain the reason for that. d. What is the optimal number of e-mini futures that the manager needs to hedge this portfolio? (In this part, assume that the manager decided to ignore daily settlements). e. Now, suppose that the manager decided to take into account daily settlements. What is the optimal number of contracts now?||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started